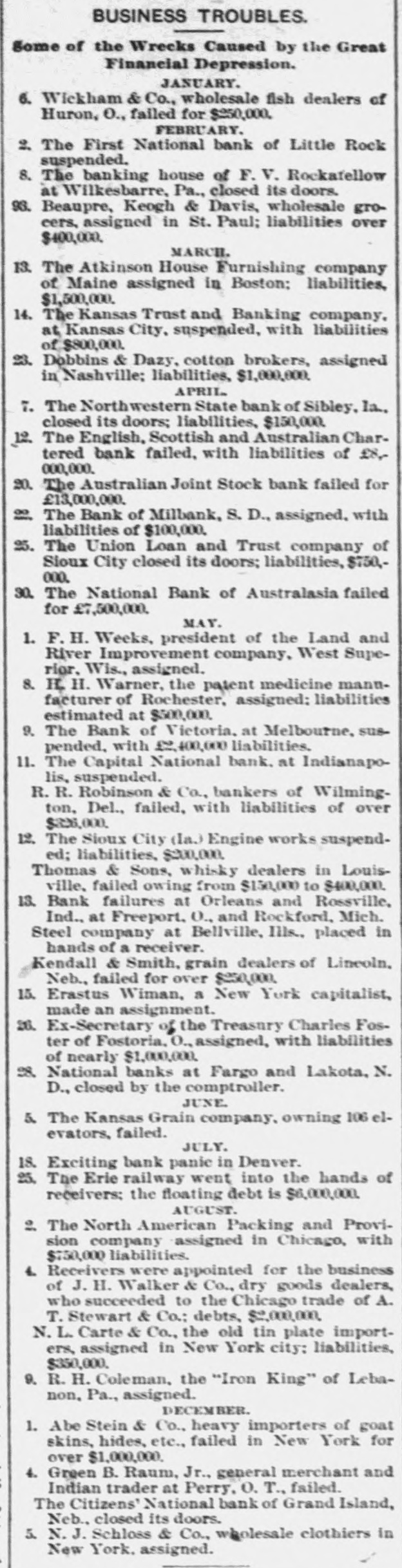

Article Text

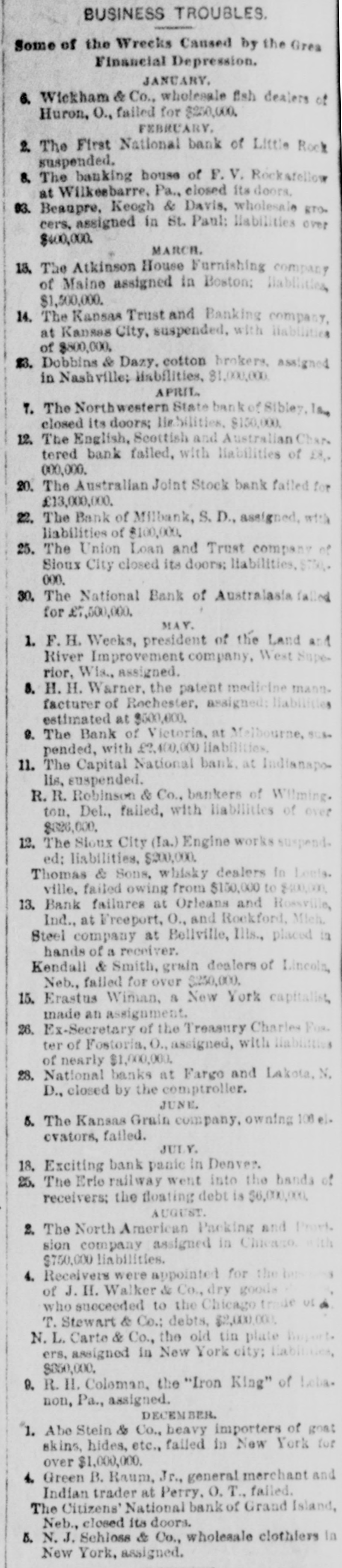

FAILURES. KANSAS CITY, April 22.-Attachments were levied this morning upon the Benjamin McLain Hide company of Kansas City, Kan., aggregating $67,000. The attachments were run by the Metropolitan National bank of this city for $50.000. The other creditors who have so far made themselves known through attachments have claims for small amounts. Yesterday afternoon Frank E. Tyler, the principal stockholder in the company and its manager, gave mortgages to his wife and sisterin-law, Mrs. Benjamin McLain, in the sum of $50,000 each. Tyler is not to be found, and no statement can be obtained concerning his enbarrassment. Benjamiu McLain, the founder of the company, died some two years ago, leaving the bulk of his estate of $1,000,000 to his wife and his interest in the hide company to his son-inlaw, Frank E. Tyler, who has since that time managed the business. This afternoon attachments were brought in Kansas City, Kan, by Swift & Co. for $1,500 and by the Santa Fe Railway company for $6,500. CHICAGO, April 22.-Frank E. Tyler, who is extensively engaged in the hide and fertilizing business, having branch houses in this city, Kansas City and New York, under the firm name of Benjamin McLain & Co., was served with attachments this morning in behalf of the Metropolitan National Bank of Kansas City for $50,000. The attachments were made in and of two assumpsit suits commenced simultaneously in the circuit court-one for $35.0 and one for $20,000. The seizure was made at the Metropolitan National Bank of Chicago, where, according to adhas $50,000 on vices, Tyler depost. The Hicks Car company, in which Tyler is said to own a one-half interest. was also levied upon. The Metropolitan National Bank at Kansas City, which precipitated the rush upon Tyler, claims in one count that he fraudulently obtained $15,000 of the amount attached for from the bank. and in another that the balance of the money which it seeks to recover, $24 300 being stipulated in the attachment. is an open book account for moneys loaned and advanced. BOSTON, April 22.-Asa P. Potter, convicted of false certification of checks drawn upon the failed Maverick National bank, of which he was president, was sentenced today to sixty days' imprisonment and to pay a fine of $1,000. MILBANK, S. D. April 22.-The Bank of Milbauk today made an assignment for the benefit of its creditors to Hon. S.R. Rold. The stringency in the money market IS understood to be the cause. The li bilities are reported to be over $100,000, with assets largely in excess of this amount. NASHVILLE, Tenu., April e-The United States grand jury today returned into court SIX indictments, based unon the tailure, some weeks since, of the Commercial National bank of this city. One indietment in the district court is against Frank Porterfield, cashier of the bank, and another is against George A. Dazey. Those indictments charge conspiracy to defraud and injure the stockholders of the bank. Of the other indictments three are against Frank Porterfield and the fourth is against Marcus A. Spurr, president of the bank. FRANKLIN, O. April 22.-An assignment to P. R. Rea was made today by the Friend & Ford Paper company. The liabilities are $200,000. The assets are not given. The failure is due to embarrass ment caused by the failure two years ago of Clark, Friend, Fox & Co. of Chicago.