Click image to open full size in new tab

Article Text

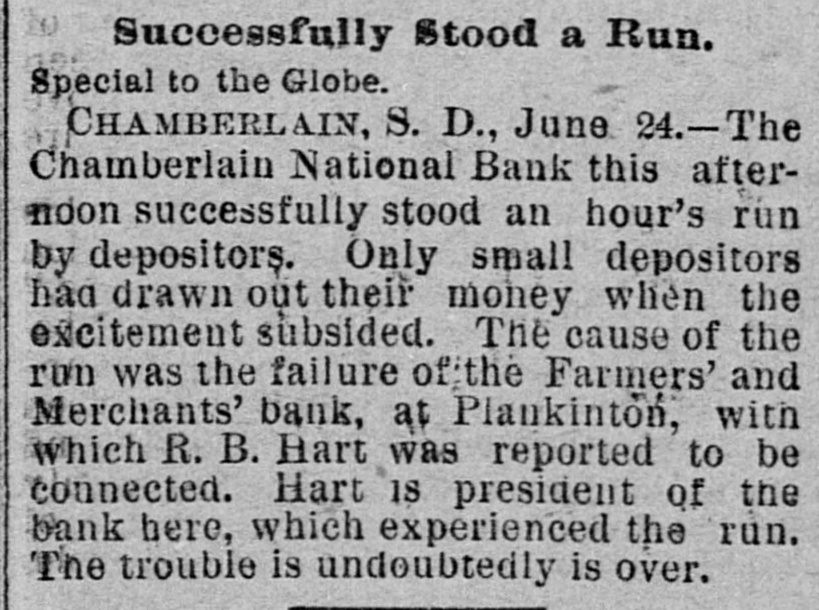

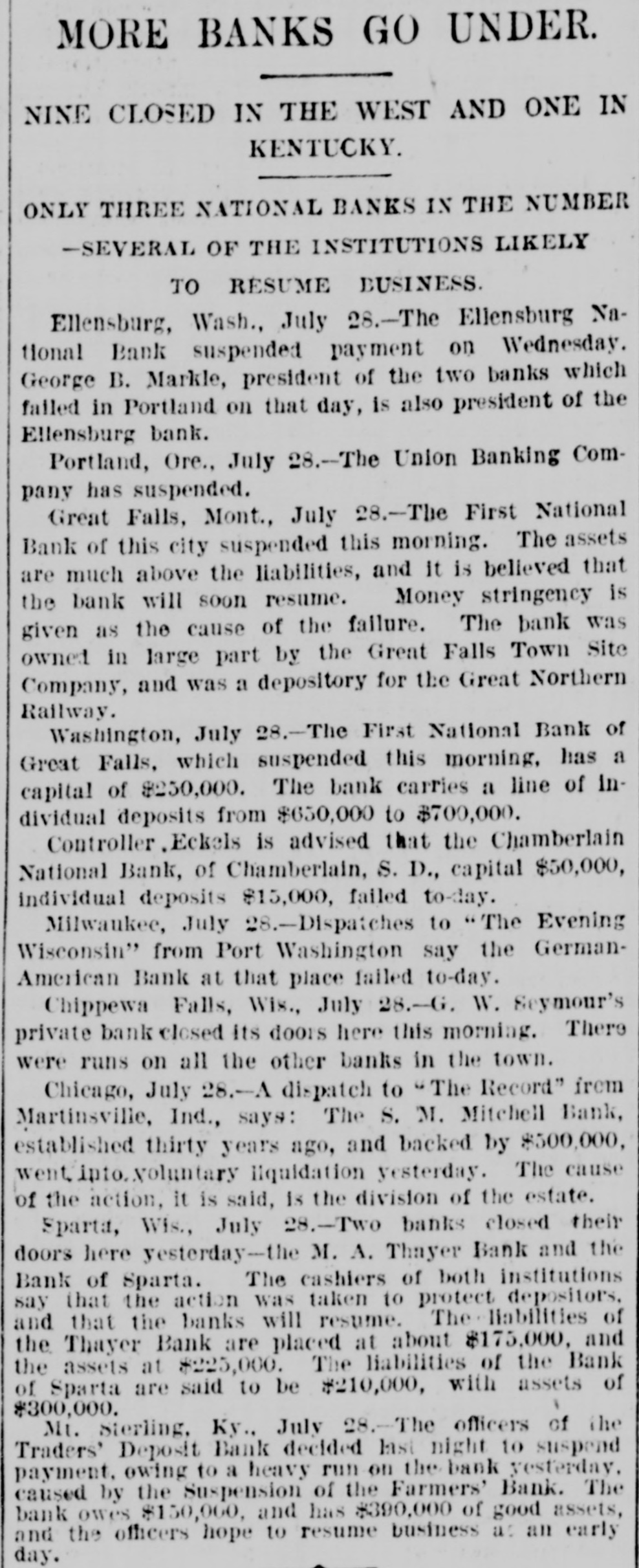

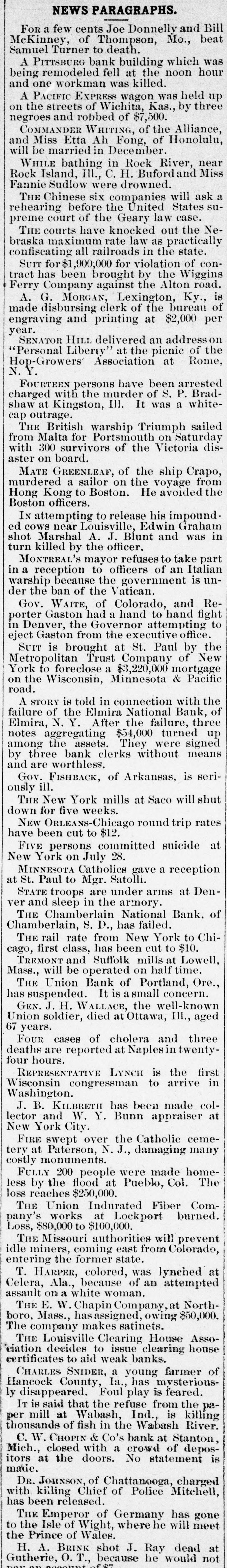

negroes and robbed of $7,500. COMMANDER WHITING, of the Alliance, and Miss Etta Ah Fong, of Honolulu, will be married in December. WHILE bathing in Rock River, near Rock Island, Ill., C. H. Bufordand Miss Fannie Sudlow were drowned. THE Chinese six companies will ask a rehearing before the United States supreme court of the Geary law case. THE courts have knocked out the Nebraska maximum rate law as practically confiscating all railroads in the state. SUIT for $1,900,000 for violation of contract has been brought by the Wiggins Ferry Company against the Alton road. A. G. MORGAN, Lexington, Ky., is made disbursing clerk of the bureau of engraving and printing at $2,000 per year. SENATOR HILL delivered an addresson "Personal Liberty" at the pienic of the Hop-Growers' Association at Rome, N.Y. FOURTEEN persons have been arrested charged with the murder of S. P. Bradshaw at Kingston, III. It was a whitecap outrage. THE British warship Triumph sailed from Malta for Portsmouth on Saturday with 300 survivors of the Victoria disaster on board. MATE GREENLEAF, of the ship Crapo, murdered a sailor on the voyage from Hong Kong to Boston. He avoided the Boston officers. IN attempting to release his impounded cows near Louisville, Edwin Graham shot Marshal A. J. Blunt and was in turn killed by the officer. MONTREAL'S mayor refuses to take part in a reception to officers of an Italian warship because the government is under the ban of the Vatican. Gov. WAITE, of Colorado, and Reporter Gaston had a hand to hand fight in Denver, the Governor attempting to eject Gaston from the executive office. SUIT is brought at St. Paul by the Metropolitan Trust Company of New York to foreclose a $3,220,000 mortgage on the Wisconsin, Minnesota & Pacific road. A STORY is told in connection with the failure of the Elmira National Bank, of Elmira, N. Y. After the failure, three notes aggregating $54,000 turned up among the assets. They were signed by three bank clerks without means and are worthless. Gov. FISHBACK, of Arkansas, is seriously ill. THE New York mills at Saco will shut down for five weeks. NEW ORLEANS-Chicago round trip rates have been cut to $12. FIVE persons committed suicide at New York on July 28. MINNESOTA Catholics gave a reception at St. Paul to Mgr. Satolli. STATE troops are under arms at Denver and sleep in the armory. THE Chamberlain National Bank. of Chamberlain, S. D., has failed. THE rail rate from New York to Chicago, first class, has been cut to $10. TREMONT and Suffolk mills at Lowell, Mass., will be operated on half time. THE Union Bank of Portland, Ore., has suspended. It is asmall concern. GEN. J. H. WALLACE, the well-known Union soldier, died at Ottawa, III., aged 67 years. FOUR cases of cholera and three deaths are reported at Naples in twentyfour hours. REPRESENTATIVE LYNCH is the first Wisconsin congressman to arrive in Washington. J. B. KILBRETH has been made collector and W. Y. Bunn appraiser at New York City. FIRE swept over the Catholic cemetery at Paterson, N. J., damaging many costly monuments. FULLY 200 people were made homeless by the flood at Pueblo, Col. The loss reaches $250,000. THE Union Indurated Fiber Company's works at Lockport burned. Loss, $80,000 to $100,000. THE Missouri authorities will prevent idle miners, coming east from Colorado, entering the former state. T. HARPER, colored, was lynched at Celera, Ala., because of an attempted assault on a white woman. THE E. W. Chapin Company, at Northboro, Mass., has assigned, owing $50,000. The company makes satinets. THE Louisville Clearing House Association decides to issue clearing house certificates to aid weak banks. CHARLES SNIDER, a young farmer of Hancock County, Ia., has mysteriously disappeared. Foul play is feared. IT is said that the refuse from the paper mill at Wabash, Ind., is killing thousands of fish in the Wabash River. C. W. CHOPIN & Co's bank at Stanton, Mich., closed with a crowd of depositors at the doors. No statement is made. DR. JOHNSON, of Chattanooga, charged with killing Chief of Police Mitchell, has been released. THE Emperor of Germany has gone to the Isle of Wight, where he will meet the Prince of Wales. H. A. BRINK shot J. Ray dead at Gutherie, O.T., because he would not