Click image to open full size in new tab

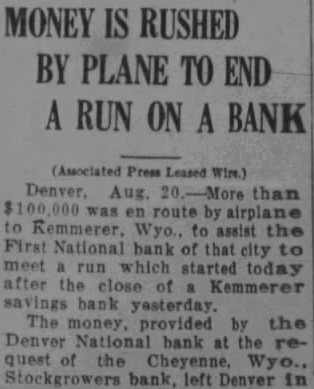

Article Text

KEMMERER BANK TO BLUE CHIPS HAVE OUT IN FULL DAY ON

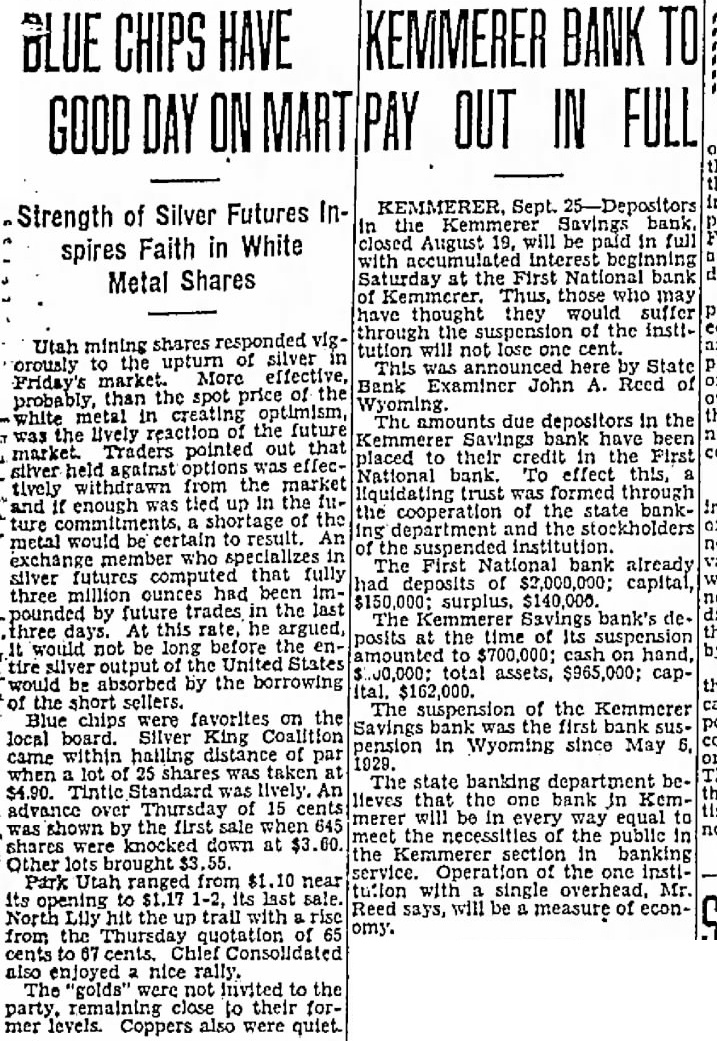

Strength of Silver Futures Inspires Faith in White Metal Shares

Utah mining shares responded vig'orously the upturn of silver effective, market. More Friday's probably, than the spot price of the white metal in creating optimism, was the lively reaction of the future market. Traders pointed out that silver held against options was effectively withdrawn from the market and If enough was tied up in the future commitments. a shortage of the metal would be certain to result. An exchange member who specializes in silver futures computed that fully three million ounces had been impounded by future trades in the three days. At this rate, he argued, would not be long before the entire silver output the States would be absorbed by the borrowing of the short sellers. Blue chips were favorites on the local board. Silver King came within hailing distance of par when of 25 shares was taken at $4.90. Tintic Standard was lively. An advance Thursday of 15 cents shown by the first sale when 645 shares knocked down at $3.60. Other lots brought Park Utah ranged from near its opening to $1.17 its last sale. the up trail with from the Thursday of 65 cents to 67 cents. Chief Consolidated also enjoyed nice rally. "golds" were not Invited to the party. remaining close to their former levels. Coppers also were quiet

KEMMERER, Sept. 25-Depositors the Savings closed August 19, will be paid in full with beginning Saturday at the First bank of Kemmerer. Thus, those may have thought they would suffer through the suspension of the instltution will not lose one This here by State Bank Examiner John A. Reed of The amounts due depositors in the have been placed to their in the First National bank. To effect this, liquidating trust was formed through the cooperation of the state banking department and the stockholders the suspended institution. The First bank already of $2,000,000; capital, surplus, $140,000. The Kemmerer Savings bank's deposits at the time of Its suspension amounted to $700,000; cash on hand, by 00,000: total assets, $965,000; cap$162,000. The suspension of the Kemmerer Savings bank the first bank suspension in Wyoming since May 6, The state banking department believes that the one bank in Kemmerer will be in every way equal the of the public in the section in banking service. Operation of the one institu:lon with single overhead, Mr. Reed says, will be a measure of economy.