Article Text

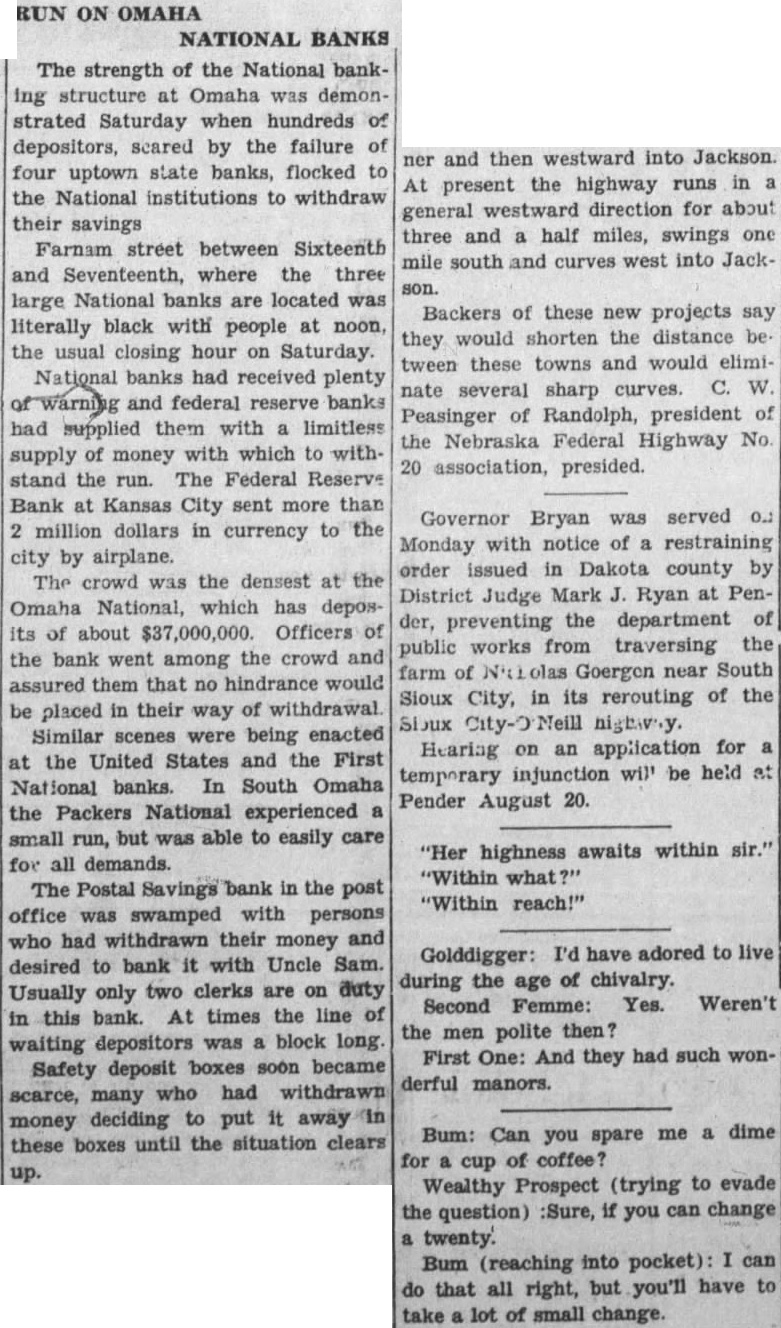

RUN ON OMAHA NATIONAL BANKS The strength of the National banking structure at Omaha was demonstrated Saturday when hundreds of depositors, scared by the failure of four uptown state banks, flocked to the National institutions to withdraw their savings Farnam street between Sixteenth and Seventeenth, where the three large National banks are located was literally black with people at noon, the usual closing hour on Saturday. National banks had received plenty of warning and federal reserve banks had supplied them with a limitless supply of money with which to withstand the run. The Federal Reserve Bank at Kansas City sent more than 2 million dollars in currency to the city by airplane. The crowd was the densest at the Omaha National, which has deposits of about $37,000,000. Officers of the bank went among the crowd and assured them that no hindrance would be placed in their way of withdrawal. Similar scenes were being enacted at the United States and the First National banks. In South Omaha the Packers National experienced a small run, but was able to easily care for all demands. The Postal Savings bank in the post office was swamped with persons who had withdrawn their money and desired to bank it with Uncle Sam. Usually only two clerks are on duty in this bank. At times the line of waiting depositors was a block long Safety deposit boxes soon became scarce, many who had withdrawn money deciding to put it away in these boxes until the situation clears up. ner and then westward into Jackson. At present the highway runs in a general westward direction for about three and a half miles, swings one mile south and curves west into Jackson. Backers of these new projects say they would shorten the distance be tween these towns and would eliminate several sharp curves. C. W. Peasinger of Randolph, president of the Nebraska Federal Highway No. 20 association, presided. Governor Bryan was served O.: Monday with notice of a restraining order issued in Dakota county by District Judge Mark J. Ryan at Pender, preventing the department of public works from traversing the farm of Nid olas Goergen near South Sioux City, in its rerouting of the Hearing on an application for a temporary injunction will be held at Pender August 20. "Her highness awaits within sir." "Within what "Within reach!" Golddigger: I'd have adored to live during the age of chivalry. Second Femme: Yes. Weren't the men polite then? First One: And they had such wonderful manors. Bum: Can you spare me a dime for a cup of coffee? Wealthy Prospect (trying to evade the question) :Sure, if you can change a twenty. Bum (reaching into pocket) I can do that all right, but you'll have to take a lot of small change.