Click image to open full size in new tab

Article Text

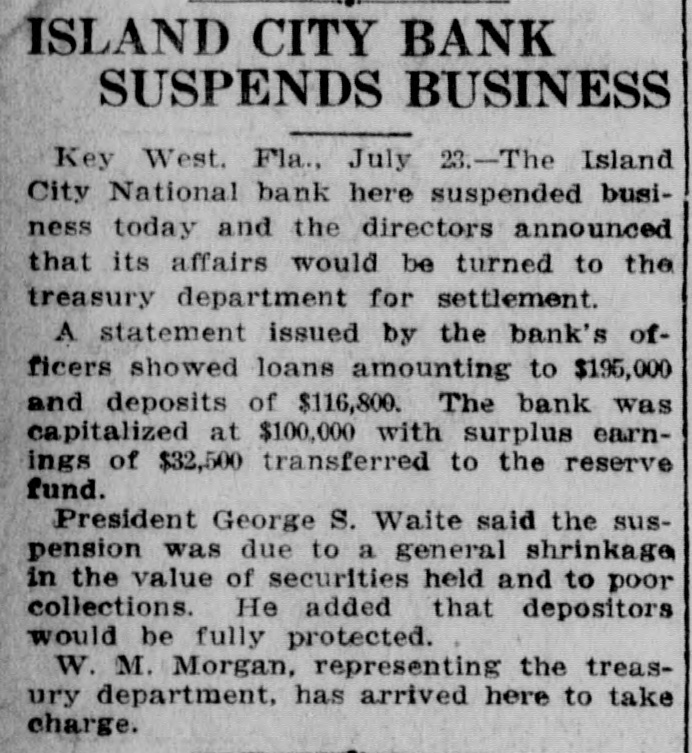

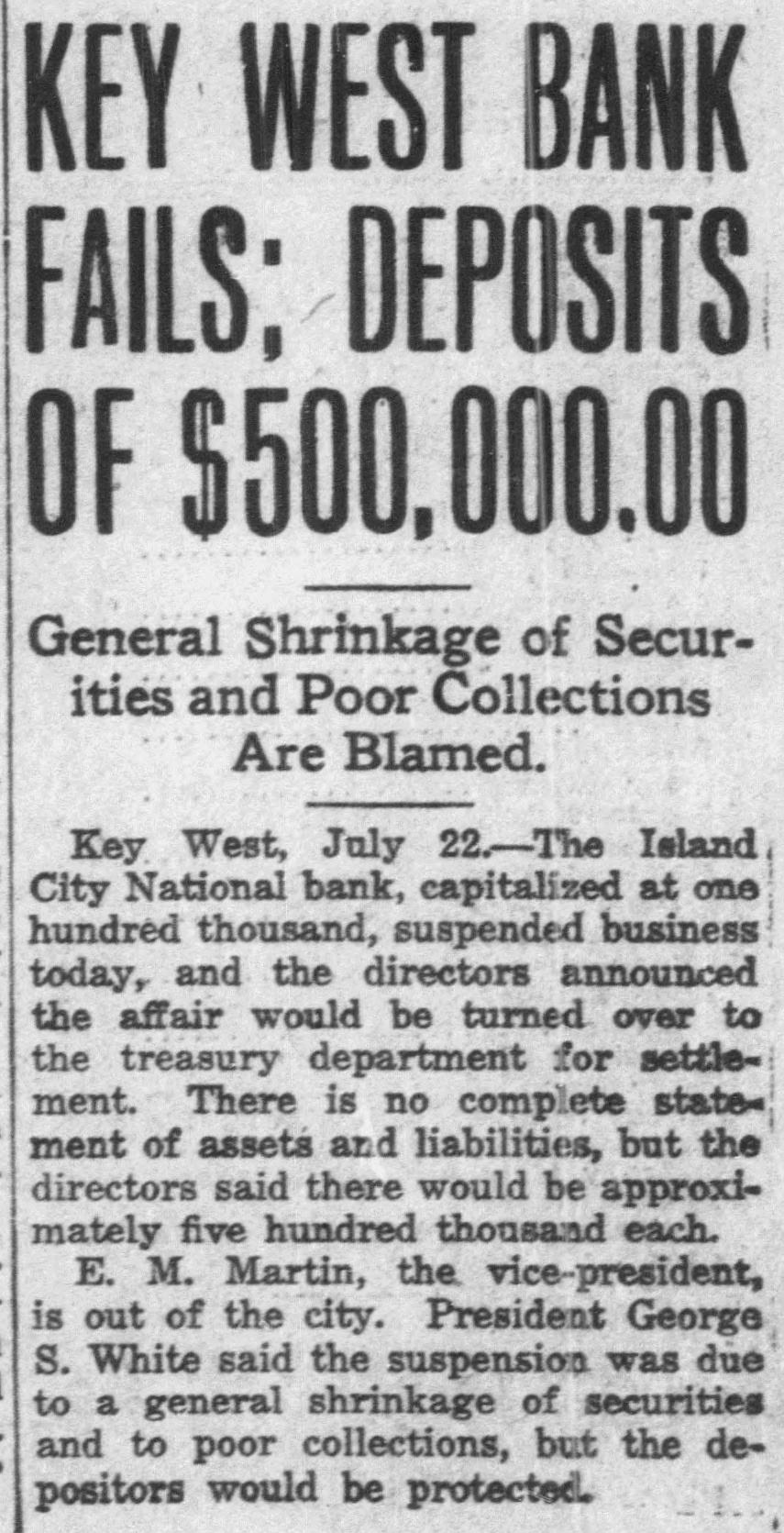

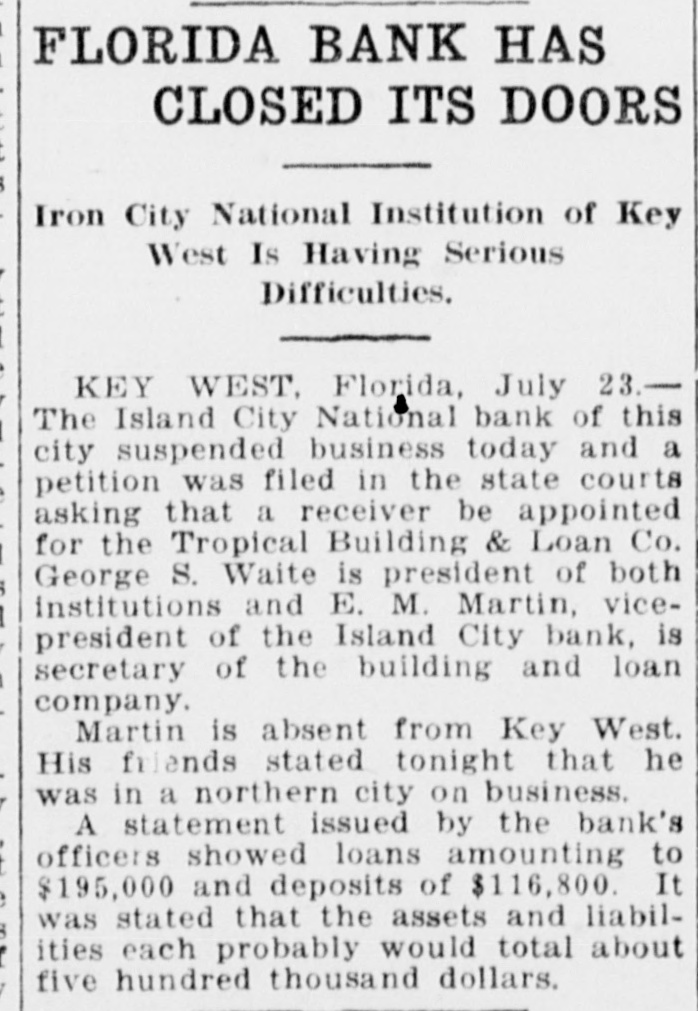

U. S. Treasury Holding Unclaimed Monies Of Old Island City Bank Sixteen Hundred Dollars Selection Made Of Guard In Dividends Belongs To Heirs Of DeposiMembers For Ceremonies tors By PAUL MAY On Sunday At Matecumbe (Special Washington Correspondent of The Citizen) WASHINGTON, D. C., Nov. 8. W. of Roberts, Kirk Albury, Louis RichHarris, Curry Captain ardson, George Saunders, Jack Company "E", Florida National -The United States Treasury, Saunders, Manuel Cervantes, Guard, today announced the comstill is trying to get rid of $1,Charles Martinez, Neal Mojica, pany members who will go next Julian Lucignani, Joe Henriquez, Sunday to Matecumbe to take 689.04 that belongs to the heirs of Harry Bravo. part in the Keys Memorial Dedi710 Key West depositors in the The detail will be in command cation. of Lieutenant Wm. E. P. RobThose selected to represent the closed Island City National Bank erts and Major Wm. V. Albury, company are: Joseph W. Baker, of Key West. in command of the Second BatJack Porter, Oscar E. Ward, Lutalion of the 265th Regiment cio Barrosa, Arnold Byre, Joseph The Treasury did not make pubC. A. C., will accompany the deSoldano, Mathew Zacal, Joseph lic the names of the depositors, Cates, George del Pino, Everett tail. but explained they or their heirs have that amount coming to them Interest In Election Now in unclaimed dividends from the bank's assets. Centers Mainly On Mayor, The bank failed and its receivership was terminated in 1923. Chief And Police Captain At that time the receivers turned offices for which they are conHighly interesting from several in to the Treasury such funds as tending: angles will be the election of city they were unable to find claimants For Mayor: Willard M. Albury officials to be held in Key West for, and the Government has been and Frank Delaney. tomorrow with opposition for For City Clerk: Wallace Pinholding the $1,689.04 ever since. every office except that of city der. What's more, officials say, it clerk, city treasurer and tax colFor Chief of Police: Ivan Ellector-assessor. looks as though the Treasury will wood and Everett R. Rivas. hold the ottes forever: It 'While there are 21 candidates For Captain Night Police: Alberto Camero, Vernie Griffin, spent, they said, and rests with for the seven seats on the city Robert J. Lewis, Bienvenido $717,591 of such funds from other council, interest appears to be Perez, Thomas F. Russell (Bustclosed banks in trusts in Washingmore greatly centered on the er). election of mayor, chief of poton banks, drawing no interest. For Tax Collector-Assessor: "Every once in a while some lice and captain of night police, Samuel B. Pinder. one goes through Grandpa's old for which there are two, two and For Police Justice: Thomas S. papers and find documents to five candidates for the respecCaro and Abelardo Lopez, Jr. make a claim for some of these tive offices. For Councilmen: Benj. N. old funds and we get rid of them," Speculation is rampant, naturAdams, Earl Adams (Jewfish), a spokesman for the controller of ally, on the probable winners in W. P. Archer, E. M. Carbonell currency's office said, adding: each event, but a survey of the (Toots), John Carbonell, Jr., Wm. "Claims are very infrequent in centers of speculation today, T. Doughtry, Jr., William A. such old cases as the Key West brought to light the fact that Freeman, Roy Fulford, Earl Inbank, and we really haven't much the race for chief, captain and graham (Rinkley Bill), Charles S. hope of ever finding the owners mayor, are the most discussed, Lowe, Roy L. McKillip, Wm. H. of this cash." and have thus caused more specMonsalvatge, P. Adrian O'Swee-