Click image to open full size in new tab

Article Text

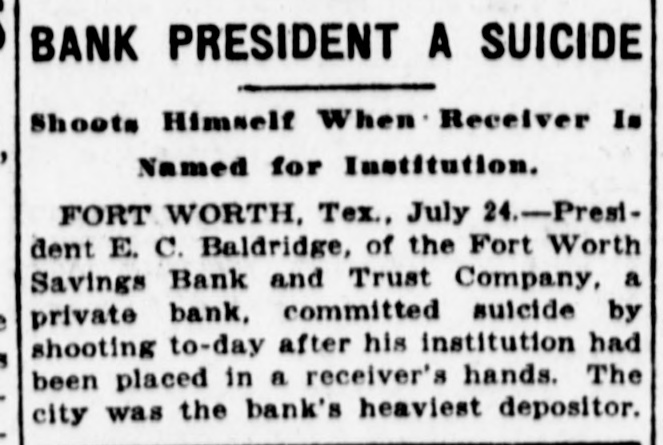

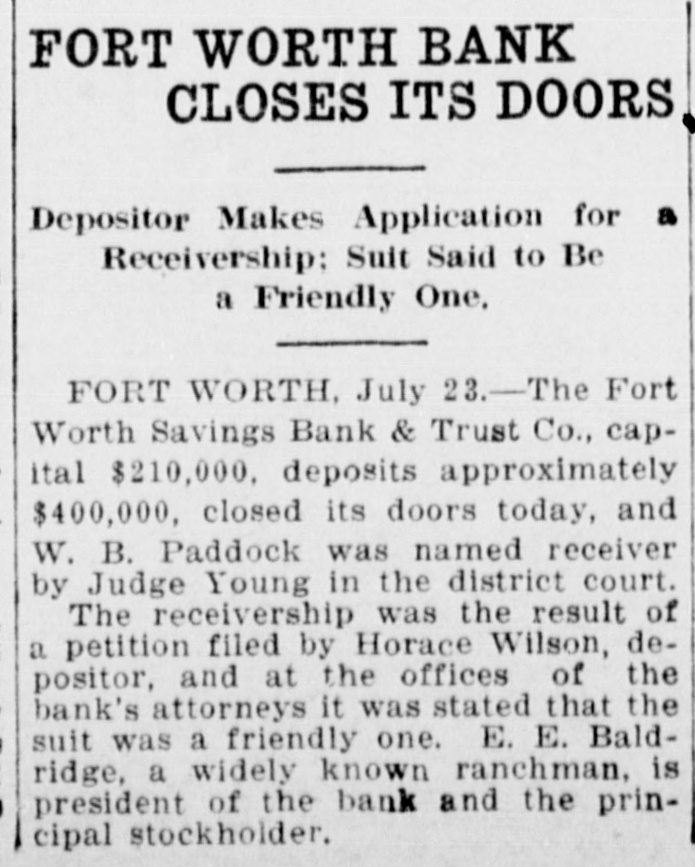

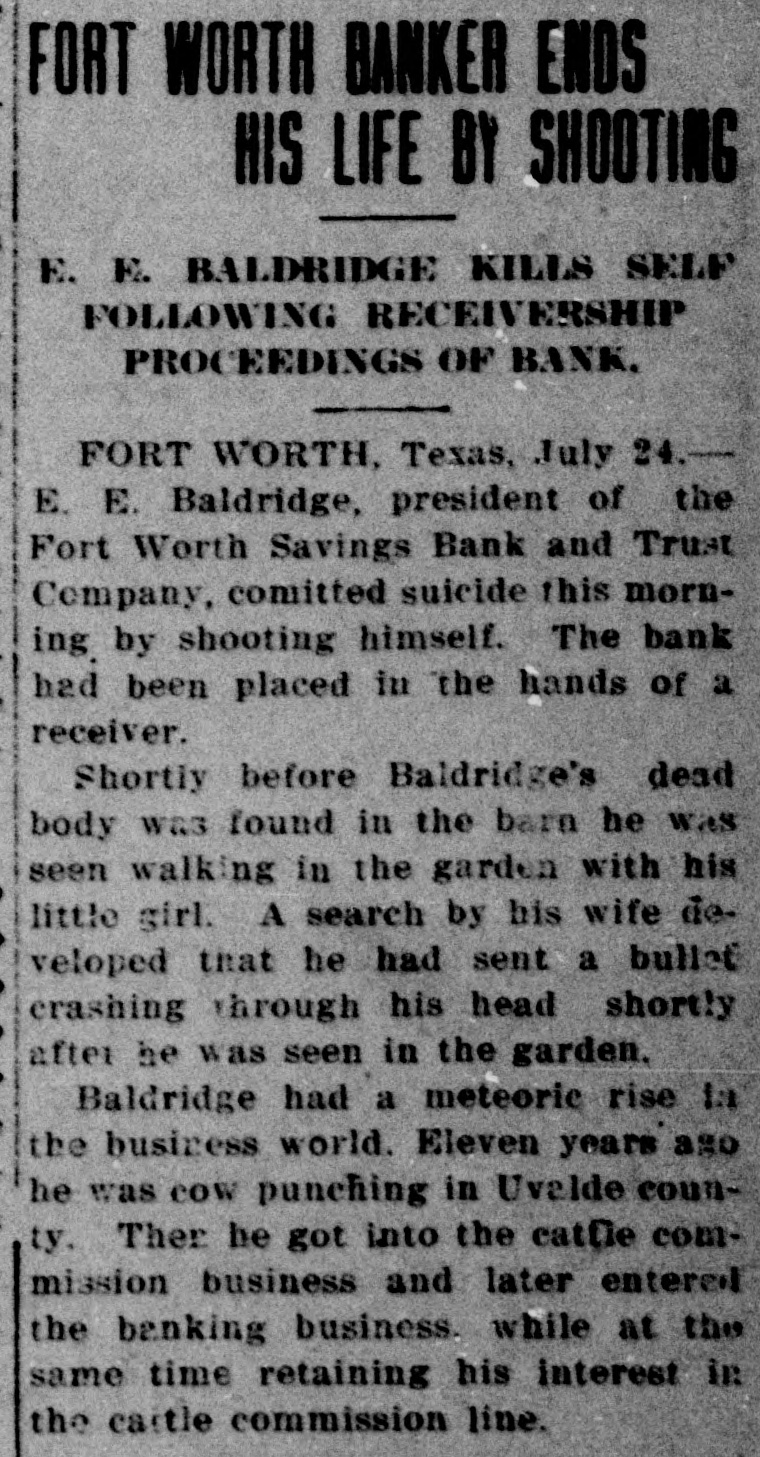

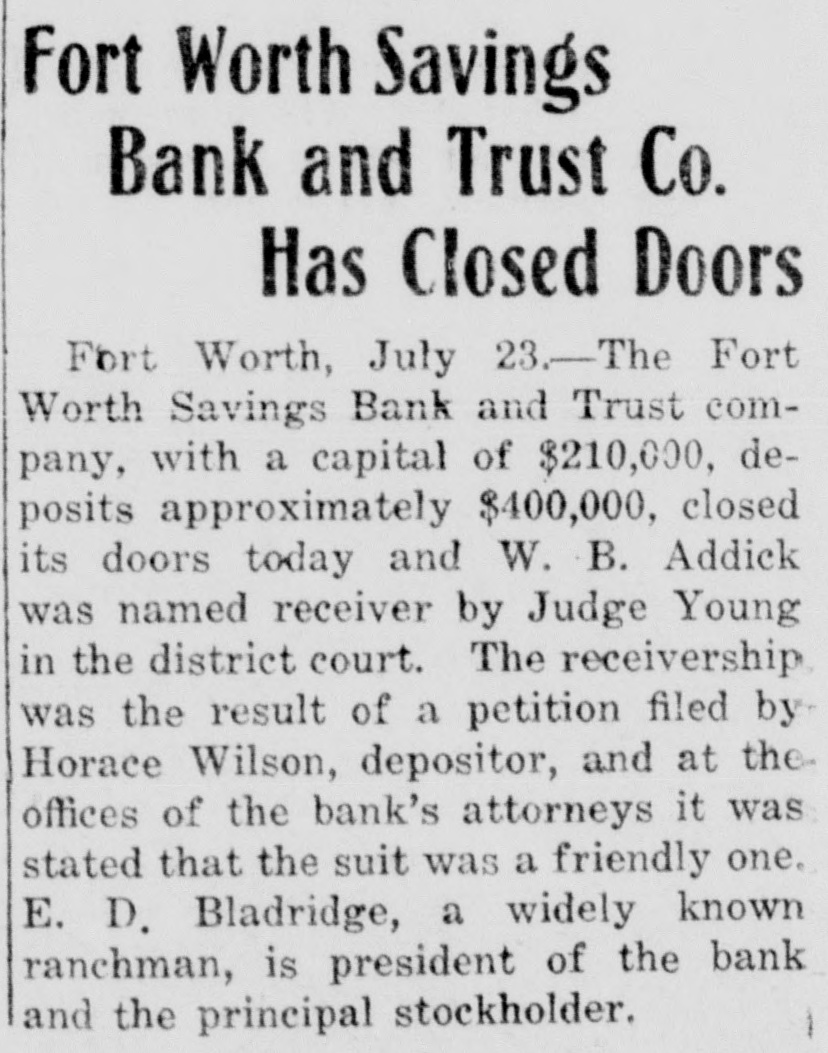

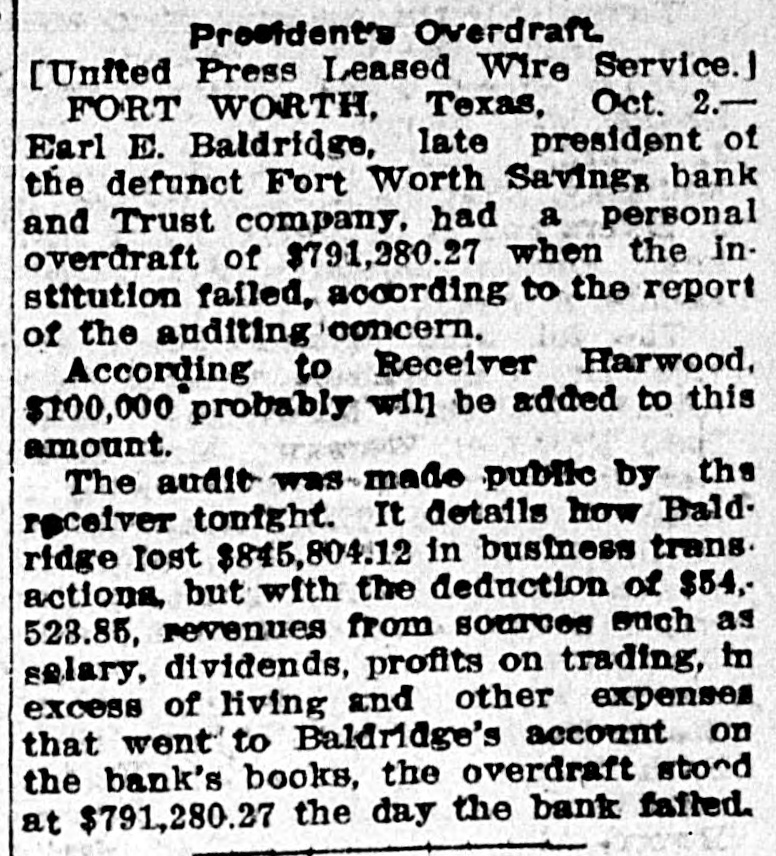

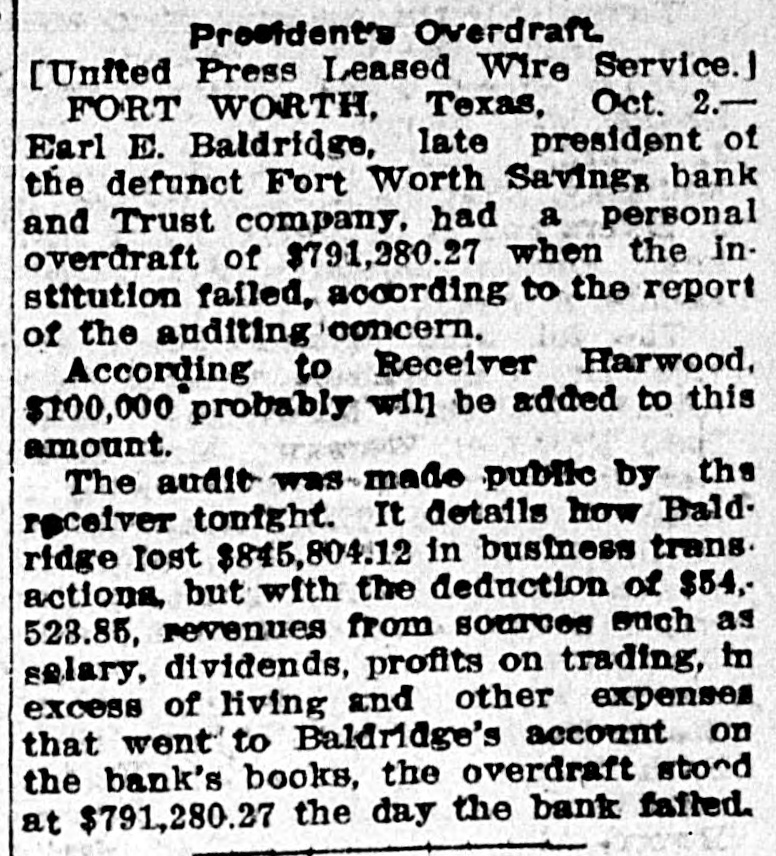

# President's Overdraft

[United Press Leased Wire Service.]

FORT WORTH, Texas, Oct. 2.-

Earl E. Baldridge, late president of the defunct Fort Worth Savings bank and Trust company, had a personal overdraft of $791,280.27 when the institution failed, according to the report of the auditing concern.

According to Receiver Harwood, $100,000 probably will be added to this amount.

The audit was made public by the receiver tonight. It details how Baldridge lost $845,804.12 in business trans-actions, but with the deduction of $54,528.85, revenues from sources such as salary, dividends, profits on trading, in excess of living and other expenses that went to Baldridge's account on the bank's books, the overdraft stood at $791,280.27 the day the bank failed.