Article Text

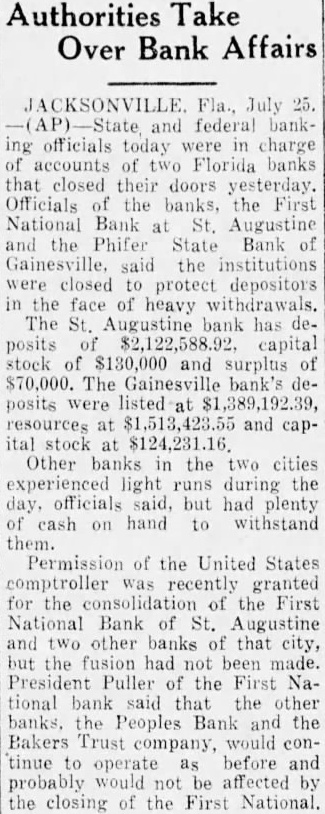

Authorities Take Over Bank Affairs ACKSONVILLE Fla., July federal bankofficials today were charge accounts of Florida banks that closed their doors yesterday. Officials the banks, the First National Bank St. Augustine Phifer State Bank of Gainesville. said the institutions were closed protect depositors the face of heavy withdrawals. The Augustine has posits of $2,122,588.92. capital stock of $130,000 and surplus $70,000. The Gainesville bank's posits were listed and capital stock Other banks the two cities light during day, officials but had plenty cash on hand to withstand them. Permission of the United States comptroller recently granted for the consolidation of the First National Bank St. Augustine and two other banks of that city, but the fusion had not been made. President Puller of the First National bank said that the other banks. the Peoples Bank and the Bakers Trust company, would continue operate before and probably would not be affected by the closing of the First National.