Click image to open full size in new tab

Article Text

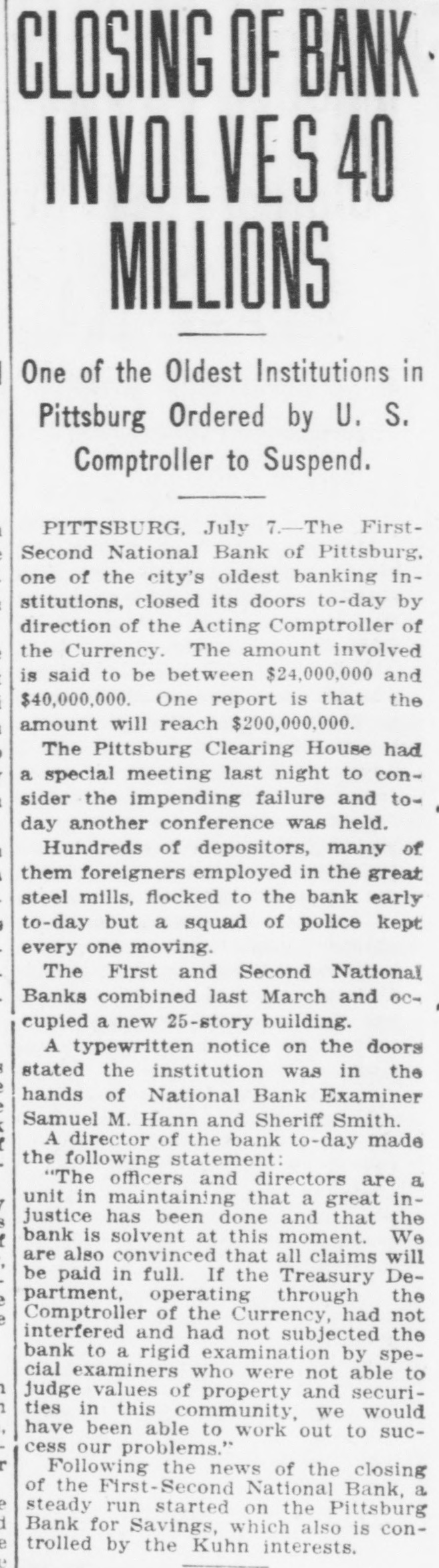

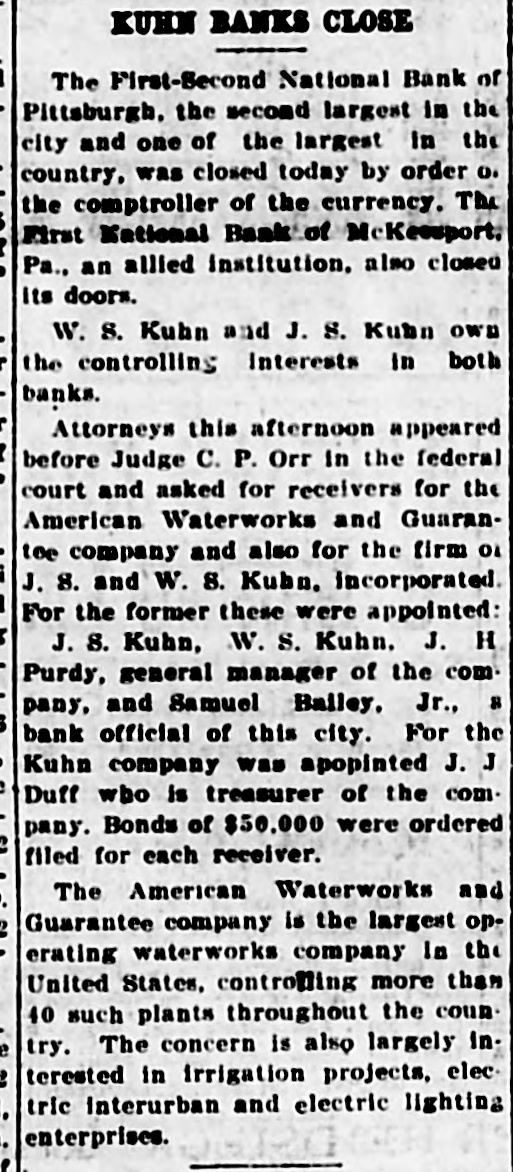

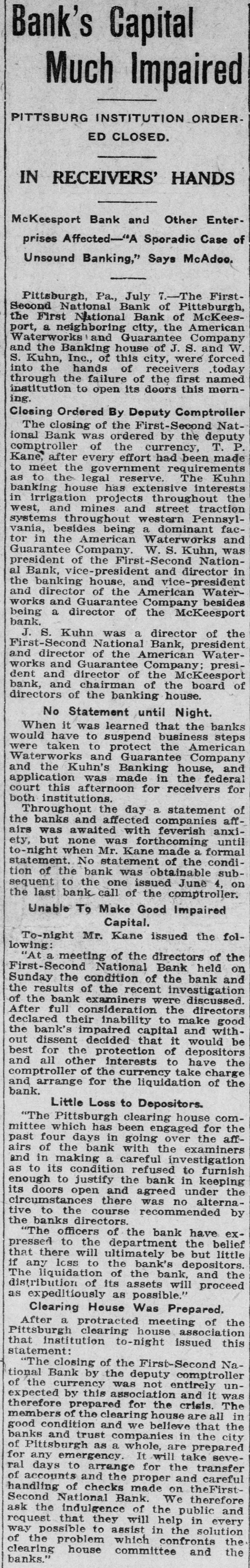

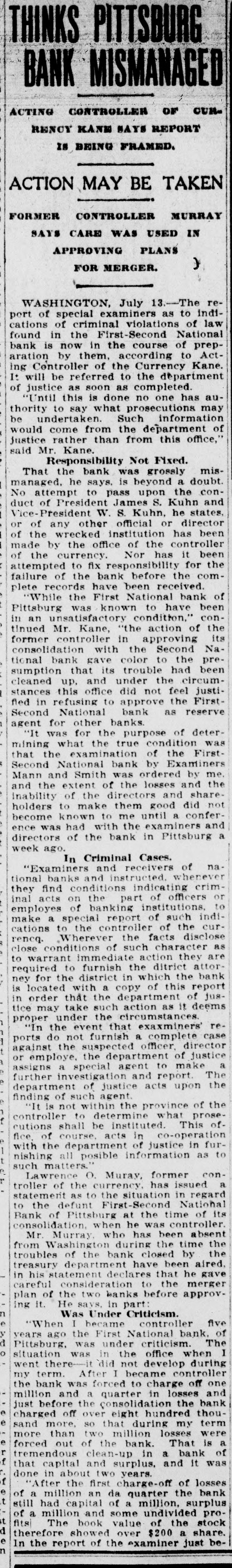

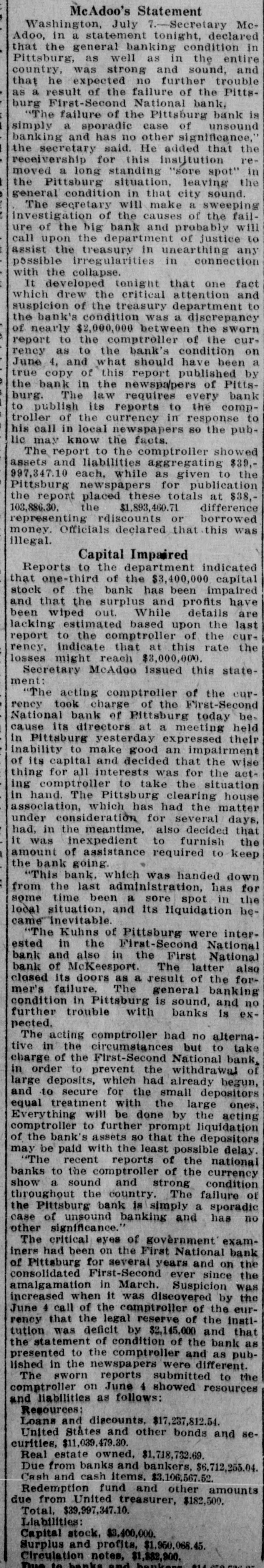

Washington, July 7. Secretary McAdoo, in a statement tonight, declared that the general banking condition in as well as in the entire was strong no country, that Pittsburg, he expected and further of sound, the trouble Pitts- and as a result of the failure burg First-Second National bank, 'The failure of the Pittsburg bank is simply a sporadic case of unsound banking and has no other significance," the secretary said. He added that the receivership for this institution removed a long standing "sore spot" in the Pittsburg situation, leaving the general condition in that city sound. The secretary will make a sweeping investigation of the causes of the failure of the big bank and probably will call upon the department of justice to assist the treasury in unearthing any possible irregularities in connection with the collapse. It developed tonight that one fact which drew the critical attention and suspicion of the treasury department to the bank's condition was a discrepancy of nearly $2,000,000 between the sworn report to the comptroller of the currency as to the bank's condition on June 4, and what should have been a true copy of this report published by the bank in the newspapers of Pittsburg. The law requires every bank to publish its reports to the comptroller of the currency in response to his call in local newspapers so the public may know the facts. The report to the comptroller showed assets and liabilities aggregating $39,997,347.10 each, while as given to the Pittsburg newspapers for publication the report placed these totals at $38,103,886.30, the $1,893,460.71 difference representing rdiscounts or borrowed money Officials declared that this was illegal. Capital Impaired Reports to the department indicated that one-third of the $3,400,000 capital stock of the bank has been impaired and that the surplus and profits have been wiped out. While details are lacking estimated based upon the last report to the comptroller of the curreney, indicate that at this rate the losses might reach $3,000,000. Secretary McAdoo issued this statement: "The acting comptroller of the curreney took charge of the First-Second National bank of Pittsburg today because its directors at a meeting held in Pittsburg yesterday expressed their inability to make good an impairment of its capital and decided that the wise thing for all interests was for the acting comptroller to take the situation in hand. The Pittsburg clearing house association, which has had the matter under consideration for several days, had, in the meantime, also decided that it was inexpedient to furnish the amount of assistance required to keep the bank going. "This bank. which was handed down from the last administration, has for some time been a sore spot in the local situation, and its liquidation became inevitable. "The Kuhns of Pittsburg were interested in the First-Second National bank and also in the First National bank of McKeesport. The latter also closed its doors as a result of the former's failure. The general banking condition in Pittsburg is sound, and no further trouble with banks is expected. The acting comptroller had no alternative in the circumstances but to take in charge of the First-Second National bank, order to prevent the withdrawal of large deposits, which had already begun, and to secure for the small depositors equal treatment with the large ones, Everything will be done by the acting comptroller to further prompt liquidation of the bank's assets so that the depositors may be paid with the least possible delay. 'The recent reports of the national banks to the comptroller of the currency show a sound and strong condition throughout the country. The failure of the Pittsburg bank is simply a sporadic case of unsound banking and has no other significance." The critical eyes of government examiners had been on the First National bank of Pittsburg for several years and on the consolidated First-Second ever since the amalgamation in March. Suspicion was increased when it was discovered by the 4 call of the comptroller of the eurJune that the legal reserve of the instirency was deficit by $2,145,000 and that tution statement of condition of the bank as presented the to the comptroller and as published in the newspapers were different. The sworn reports submitted to the comptroller on June 4 showed resources and liabilities as follows: Loans Resources: and discounts, $17,237,812.54. United States and other bonds and securities, $11,039,479.30 Real estate owned, $1,718,732.69 Due from banks and bankers, $6,712,255.04. Cash and cash items. $3,106,567.52. Redemption fund and other amounts due from United treasurer, $182,500. Total, $39,997,347.10. Liabilities: Capital stock. $3,400,000. Surplus and profits, $1,960,068.45 Circulation notes, $1,882,900. Due to hanks and hankora