Article Text

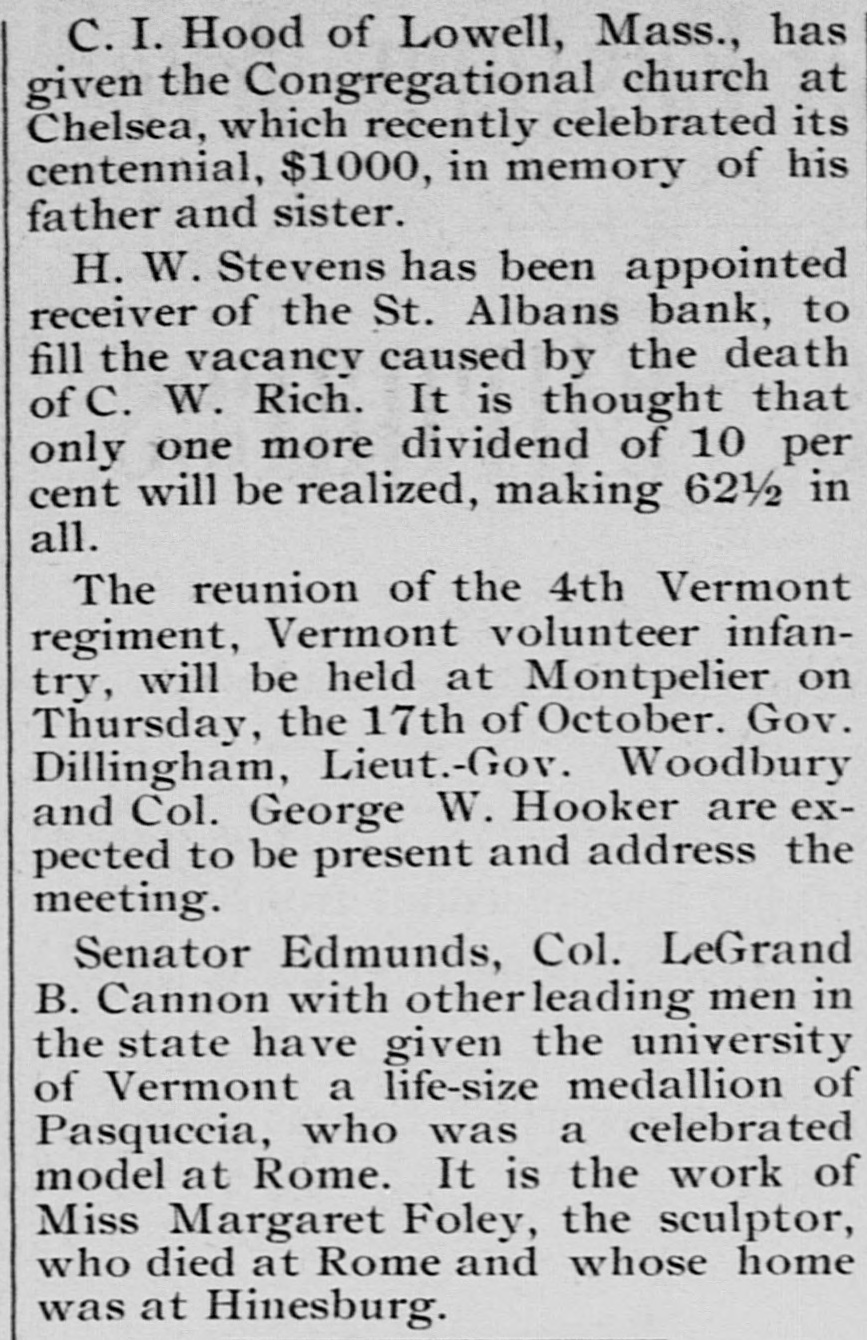

C.I. Hood of Lowell, Mass., has given the Congregational church at Chelsea, which recently celebrated its centennial, $1000, in memory of his father and sister. H. W. Stevens has been appointed receiver of the St. Albans bank, to fill the vacancy caused by the death of C. W. Rich. It is thought that only one more dividend of 10 per cent will be realized, making 62½ in all. The reunion of the 4th Vermont regiment, Vermont volunteer infantry, will be held at Montpelier on Thursday, the 17th of October. Gov. Dillingham, Lieut.-Gov. Woodbury and Col. George W. Hooker are expected to be present and address the meeting. Senator Edmunds, Col. LeGrand B. Cannon with otherleading men in the state have given the university of Vermont a life-size medallion of Pasquccia, who was a celebrated model at Rome. It is the work of Miss Margaret Foley, the sculptor, who died at Rome and whose home was at Hinesburg.