Article Text

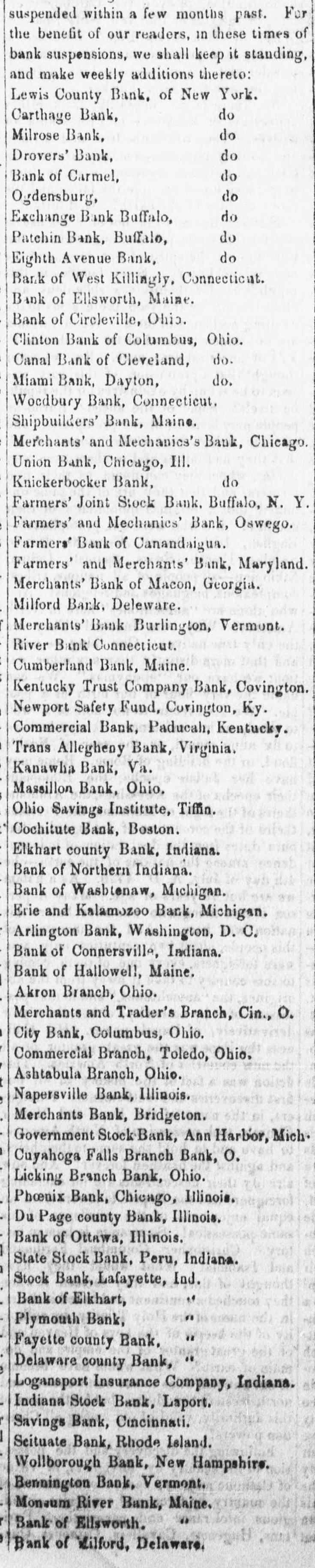

suspended within a few months past. For the benefit of our readers, in these times of bank suspensions, we shall keep it standing, and make weekly additions thereto: Lewis County Bank, of New York. Carthage Bank, do Milrose Bank, do Drovers' Bank, do Bank of Carmel, do Ogdensburg, do Exchange Bank Buffalo, do Patchin Bank, Buffalo, do Eighth Avenue Bank, do Bank of West Killingly, Connecticut. Bank of Ellsworth, Maine. Bank of Circleville, Ohio. Clinton Bank of Columbus, Ohio. Canal Bank of Cleveland, do. Miami Bank, Dayton, do. Woodbury Bank, Connecticut. Shipbuilders' Bank, Maine. Merchants' and Mechanics's Bank, Chicago. Union Bank, Chicago, Ill. Knickerbocker Bank, do Farmers' Joint Stock Bank, Buffalo, N. Y. Farmers' and Mechanics' Bank, Oswego. Farmers' Bank of Canandaigua. Farmers' and Merchants' Bank, Maryland. Merchants' Bank of Macon, Georgia. Milford Bank, Delaware. Merchants' Bank Burlington, Vermont. River Bank Connecticut. Cumberland Bank, Maine. Kentucky Trust Company Bank, Covington. Newport Safety Fund, Covington, Ky. Commercial Bank, Paducah, Kentucky. Trans Allegheny Bank, Virginia. Kanawha Bank, Va. Massillon Bank, Ohio. Ohio Savings Institute, Tiffin. Cochitute Bank, Boston. Elkhart county Bank, Indiana. Bank of Northern Indiana. Bank of Washtenaw, Michigan. Erie and Kalamazoo Bank, Michigan. Arlington Bank, Washington, D. C. Bank of Connersville, Indiana. Bank of Hallowell, Maine. Akron Branch, Ohio. Merchants and Trader's Branch, Cin., O. City Bank, Columbus, Ohio. Commercial Branch, Toledo, Ohio. Ashtabula Branch, Ohio. Napersville Bank, Illinois. Merchants Bank, Bridgeton. Government Stock Bank, Ann Harbor, Mich. Cuyahoga Falls Branch Bank, O. Licking Branch Bank, Ohio. Phoenix Bank, Chicago, Illinois. Du Page county Bank, Illinois. Bank of Ottawa, Illinois. State Stock Bank, Peru, Indiana. Stock Bank, Lafayette, Ind. Bank of Elkhart, Plymouth Bank, Fayette county Bank, Delaware county Bank, Logansport Insurance Company, Indiana. Indiana Stock Bank, Laport. Savings Bank, Cincinnati. Scituate Bank, Rhode Island. Wollborough Bank, New Hampshire. Bennington Bank, Vermont. Monsum River Bank, Maine. Bank of Ellsworth. Bank of Milford, Delaware.