Click image to open full size in new tab

Article Text

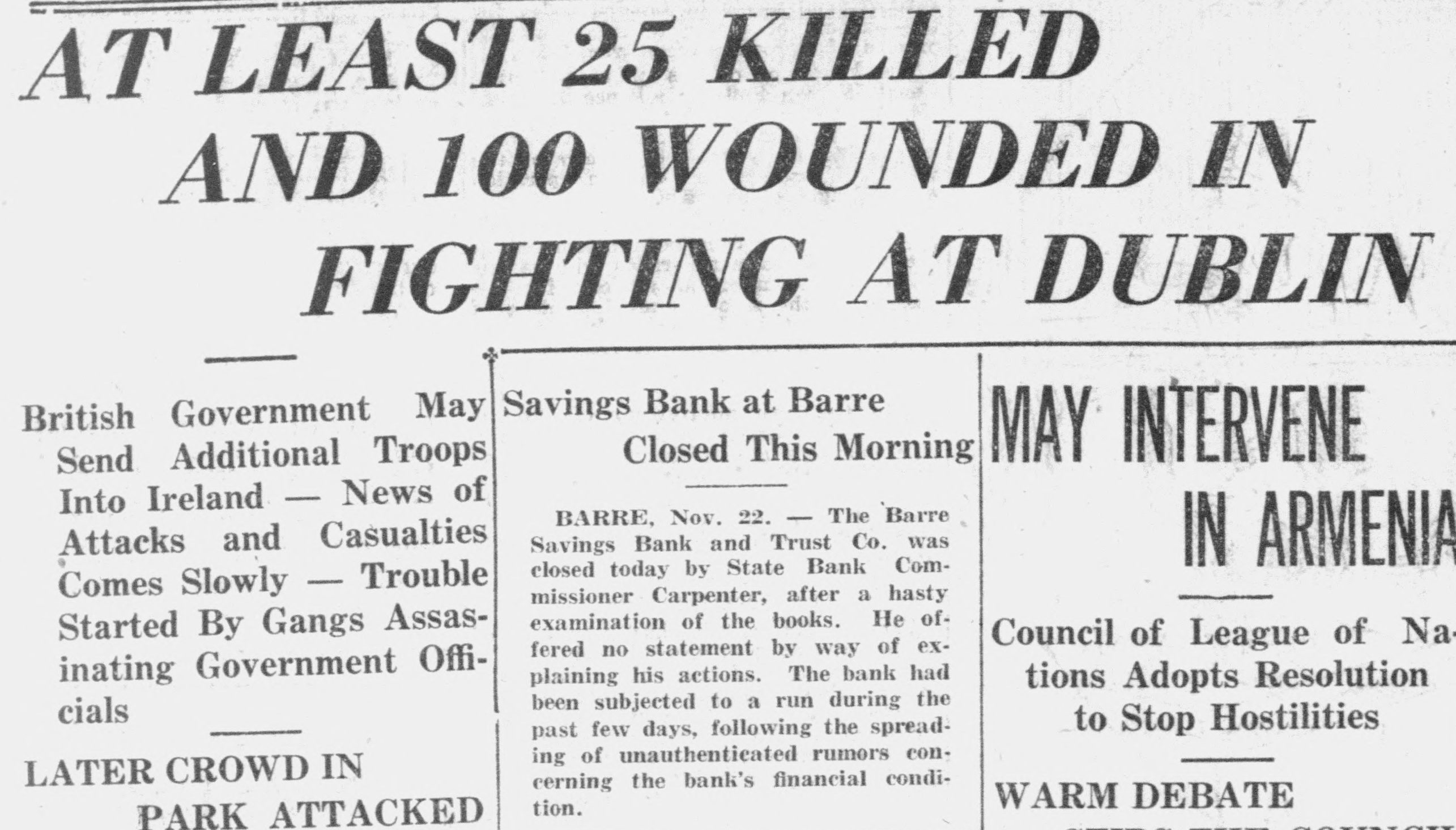

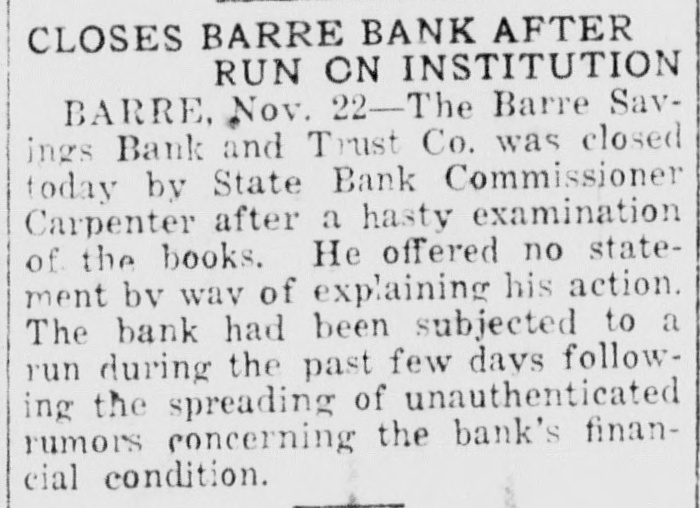

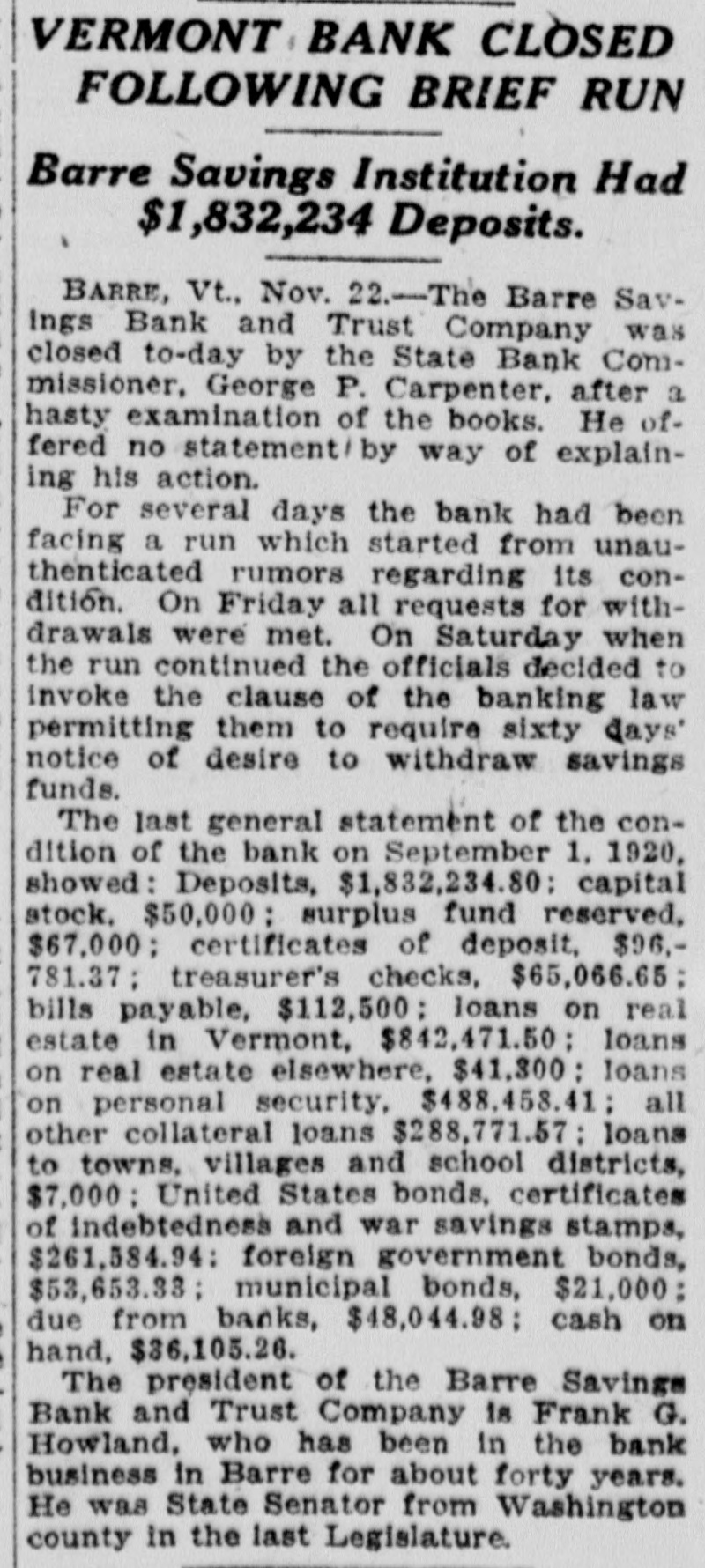

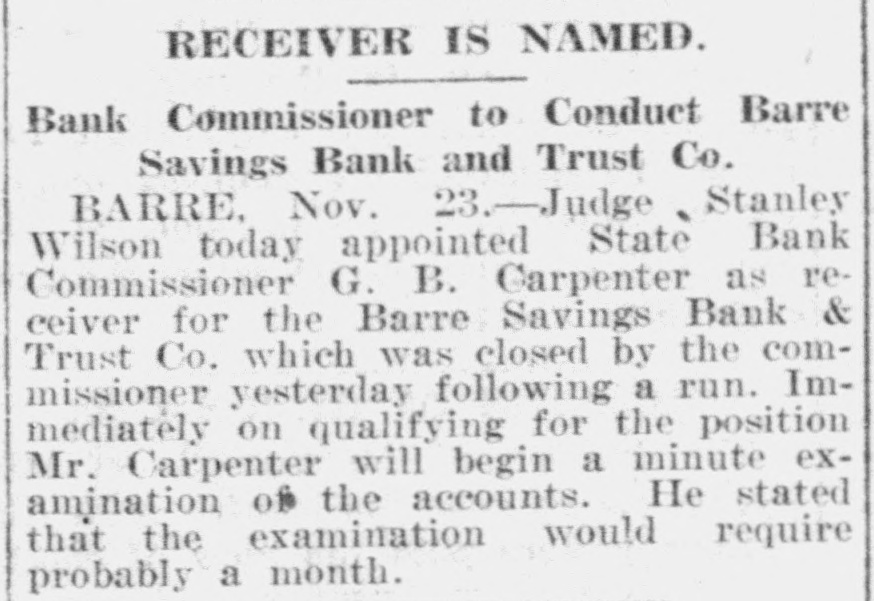

TALK OF THE TOWN Presbyterianş! Let's "go over the tope"-adv. A nice collection of Wallace Nutting pictures at Bell & Houston's.-adv. Extra fancy oranges at especially low prices at Marchetti's Fruit Store. -adv. Have you seen the great variety of home-made gift articles at the woman's exchange, 24 Elm street?-adv. The new Reo six touring car and the Reo truck are on display at the Palace garage, 308 North Main street.--adv 1921 calendars with beautifully hand painted scenes of Vermont on sale at Cummings and Lewis' for 65e and 75c. -adv. Dance, Montpelier armory, every Saturday night. Carroll's orchestra. Special car to Barre after the dance.adv. Mrs. Katherine Lawliss and daughter, Clara, left last night for Holyoke, Mass., where they will spend the holidays. Maccabees, attention! Pratice meeting of officers and guards for installation Monday evening at 7 o'elock sharp. Don't forget, music rolls, bags, cases, violins, bows, ukeleles and mandolins for Christmas at Bailey's Music Rooms. --adv. Clarence Rogers, a sophomore at Middlebury college, is passing the Christmas vacation with his parents, Mr. and Mrs. Frank G. Rogers, of 18 Richardson street. Vermont is second to no other state in natural scenery and color values and that is just what we are showing you in sepia prints at Cummings and Lewis' at the low price of $1.-adv. The five eighth grades of the Spaulding school collected the sum of $42.34 to send to the starving children of Europe, instead of having the usual Christmas celebrations in their rooms. Store will be open every evening till Christmas. A new assortment of Goddard and Spaulding rings just received. Special price on diamonds mounted on green gold with platinum head and otherwise. F. E. Burr. Salvation Army-Sunday services— Holiness 9:45 a. m. Sunday school at 10:30 a. m. Prayer and praise at 3 p. m. Y. P. Legion, 6 p. m. Power house, 6:45 p. m. Salvation service, 8 p. m. Other services Tuesdays, Thursdays and Saturdays. All welcome. The retail stores, members of the Barre Retall Merchants' association, Inc., will observe the following closing hours Christmas week: Monday and Tuesday at 5:30 p. m., as usual; Wednesday and Thursday at 9 p. m.; Friday at 10 p. m.; closed Saturday. Christmas day. E. M. Lyon, Pres., Frank W. Jackson, sec'y. Notice: The Quarry Savings Bank & Trust Co. will be pleased to assist depositors of the Barre Savings Bank & Trust Co. in proving their claims against that institution. May we suggest that books be left with us to be presented to the receiver for proof? This will facilitate the work and relieve creditors of the necessity of their personal attention.-adv. Just returned from New York and Boston with a stock of dry goods to sell at the new low prices: Percales, light and dark, 36 inches wide, 25c; outing flannel, 36 inches wide, 25c; bleached cotton, 36 inches wide, 19c; unbleached cotton, 40 inches wide, 21c; bleached sheets, 82x90, each $1.75. Call and see our stock and prices. Barre Dry Goods Store, 343 North Main street. adv. Depositors of the closed Barre Savings Bank and Trust company who have left their pass books with the People's National bank are requested, if convenient, to come to the People's National bank and sign proof of claim as the books have been verified and now await signature of owners. If you have not already sent in your pass books, please do so at once and we will attend to all matters in connection with the filing of your claim.