Click image to open full size in new tab

Article Text

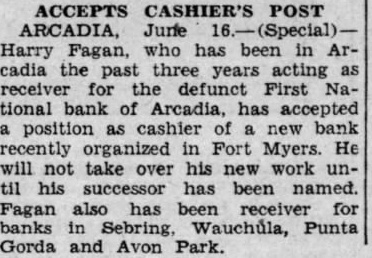

SEBRING, July (Special) Announcement was made here today of the resignation Harry Fagin as receiver of national banks at Avon Park, Sebring, Wauchula, Zolfo Springs and Arcadia. His successor has not been named. Fagin, who took over the banks 1932, accepted position with a Fort Myers bank.

SEBRING RESIDENTS IN CRASH

AVON PARK, July 12.-(Special)Four Sebring residents narrowly escaped serious injury on the Avon Park-Fort Meade road yesterday as their overturned on a curve. James Edge sustained a broken right arm and his wife was injured. M. Sherley, owner the D. Love escaped with bruises.

NOTICE OF SPECIAL MASTER'S SALE NOTICE IS HEREBY GIVEN that under and pursuant to the Final cree of Foreclosure and Sale, made and, on 1st of tober, D. 1931, order dated day 1934, in the Court cial Circuit of the State of Florida, in and for County, in Chancery. in that certain cause now therein pending, wherein Northern Central Trust Company, of Pennsylva corporation, is Complainant, and H. Gallagher, Augustus D. Bush, Farms S. C. Abernethy and Isabel C. Abernethy, his wife, Mary H. Abernethy, single, N. Borrego, single, Abernethy, and Amelia Abernethy. his wife, George Marie Dannenhauer his Florence Ellis, a widow. Valentine Franz, single, Hannigan, Hannigan, his wife. W. Klingel and Anna M. Klingel, his wife, LeRoy A. Lamb, and Lamb, his wife. M. Na(nee M. Marongelli) and Joseph Napoli, her husband, Wm. Siband Sibson, wife, Otto Steinacker, Tillie Ullman, Ullman, her husband, A. M. Harrison (nee M. Vendegrift). and Richard Harrison, her husband Palmer Watson, and Hallie B. Watson, wife, James Whitely. Whitely wife. T. Cunningham, and his wife, Easterling, Ethel his wife, H. Fennell, single, J. M. Goehring. and Romaine Goehring. his wife, H. Hauptfuhrer, and Hauptfuhrer, his wife, Albert Hermann, Hermann, his wife, J. C. Hermann, single, and Linton, Miller Emma J. Miller. Thos. Oliver. Oliver, his John W. Phillips, Phillips, his wife Benjamin Ritter, and Ritter, his wife, Jos. Rucker. and Rucker, Alfred Zabel and Zabel. his wife, H. Nolte. and Nolte, his Frank Barthmaier, single, Thomas Clark, and Emma J Clark, his wife. and Mary Ramspacher, and Joseph Ramspacher, her husband, are defendants, the undersigned Special Master, as directed by said said order. and in order and satisfy the same, will offer for sale and sell at public auction to the highest best bidder therefor. before the front door of the County Court House of Hillsborough County, Florida, in the City of Tampa, between the hours of :00 o'clock M. and o'clock P. M., on Monday, the 6th day of August. A. 1934, that of land, situate being the County and State last aforesaid, and particularly described as follows, to-wit: Southwest Quarter of Southwest Quarter Section Thirty-four (34). Twenty-eight (28) South, of Range Eighteen (18) East, and all except the Southwest Quarter the Southwest Quarter of Section Four (4), Township Twenty-nine (29) South, of Range Eighteen East, being Six Hundred Forty (640) acres, more or less.

FRANK P. INGRAM. Master in Chancery. WILLIAM HUNTER, and SUTTON, TILLMAN AND REEVES. Attorneys Complainant (7)-6-13-20-27-(8)-3-5t

NOTICE TO CREDITORS Notice given that the undersigned has been duly appointed and qualified as executrix of the estate of Harrie Russell Langdon, deceased. All heirs, creditors, legatees, distribuand all other persons having claims or said estate are hereby notified to present them to the County Judge of Hillsborough County at his office at the Court House, Tampa, Florida, properly sworn to within eight calendar months from date hereof or they will be forever barred by All persons indebted to said estate are required come forward and make settlement without delay. Tampa Florida EMMA MAY LANGDON. Executrix. Address 102 E. Virginia St., Tampa, (7)-13-20-27-(8)-3-4t

NOTICE CREDITORS Notice is hereby given that the undersigned has been duly appointed and qualified as executrix of the estate of Amanda Reeves, deceased. All heirs, creditors, legatees, distributees, and all other persons claims or demands against said are hereby notified present to the County Judge of Hillsborough County at his office at the Court Tampa, Florida, properly sworn to within eight calendar months from hereof or they will be forever barred by law All persons indebted to said estate required come forward and settlement without delay. Tampa, Florida. 12th. 1934. OCTAVIA E. RICE. Executrix.

Address 1020 2nd (7)-13-20-27-(8)-3-4t

CLASSIFIED INDEX (A) and Found Travel Notices Where To Dine Detective (B) PROFESSIONAL b-1 Chiropractic Optometrists Insurance Private Sanitarium Drafting (C) Beauty Culture Dancing (D) HELP WANTED Wanted Female Male Wanted Female and Canvassers Agencies (E) SITUATIONS WANTED Situations Wanted Female Situations Wanted Male (F) FINANCIAL Business Business Opps. Wanted Bonds Money To Len Loans $300 Wanted Borrow (G) RENTALS Board Rooms Rooms For Rent Apartments For Houses For Rent Resorts Stores Garages Wanted (H) REAL ESTATE FOR SALE h-1 Residential H-Hyde Park S-Seminole Tampa Heights D-Davis Springs Tampa Tampa Vacant Property Acreage Farms Real Estate For Exchange h-11 Estate (J) ARTICLES FOR For Sale Miscellaneous Swap This That Furniture For -5 Furniture Wanted Sewing Radio and Equipment Machinery Supplies Auction and Wine Supplies (K) BUSINESS SERVICE Repairing Electric Refrigeration Service. Furniture Repairing Heating Plumbing Hats Cleaned and Blocked Shoe Repairing Plating. Welding

Cars For Sale Wanted Tractors For Sale Auto Repairing Accessories Radiator Repairing Boats Carburetor Rebuilding Service Auto Used