Article Text

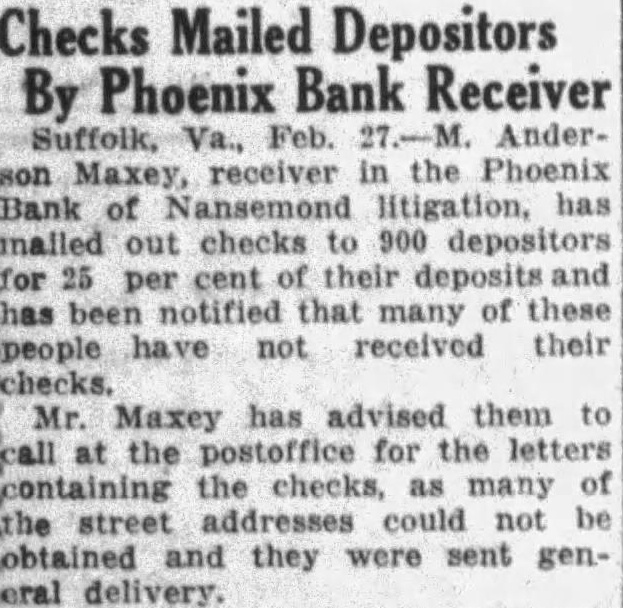

Checks Mailed Depositors By Phoenix Bank Receiver Suffolk, Va., Feb. Anderson Maxey, receiver in the Phoenix Bank of Nansemond litigation, mailed out checks depositors for per cent their deposits has been notified that many of these have not received their checks. Mr. Maxey has advised them call at the for the letters containing the many the could not obtained they were sent genoral delivery.