Article Text

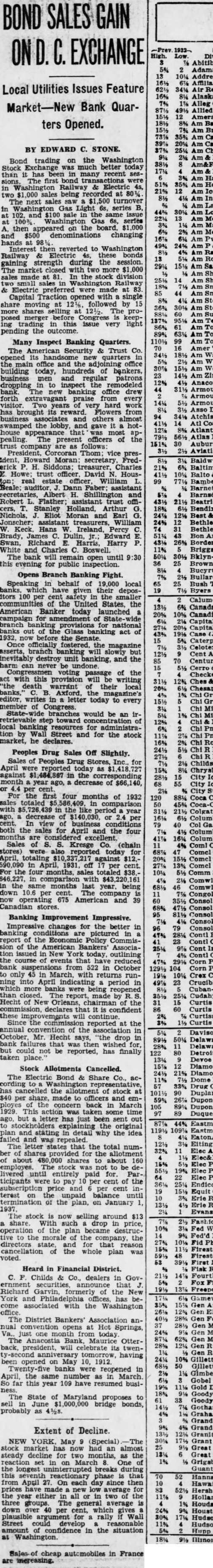

BOND SALES GAIN ON C. EXCHANGE Abitibi Affiliated Local Utilities Issues Feature Market-New Bank QuarAllied Amerada ters Opened. BY EDWARD C. STONE. Bond trading on the Washington Exchange was better today than has in many recent sesThe first bond were in Washington & Electric 4s, Am two $1,000 being at 801/4 The sales turnover Washington Gas Light 6s, series B. 102. and $100 sale in the same issue at 100% Washington Gas series then on the $1,000 and $500 changing hands at Interest then reverted to Washington Railway Electric bonds gaining strength during the session. The market two $1,000 sales made at In the stock division two small Railway Electric preferred were made at 83. Capital Traction opened with single share moving at 12½, followed by more shares 12½. The promerger before ing trading in this issue very light pending outcome. Many Inspect Banking Quarters. The American Security & Trust Co. opened its quarters the and the building today, of bankers, business men patrons dropping the remodeled The new banking office drew forth extravagant praise from every visitor. years very work has brought its reward. Flowers from business and others almost swamped the lobby, and gave hothouse appearance that was most pealing. The present officers of the are as follows: President. Corcoran Thom: vice erick P. H. Siddons: treasurer. Charles Howe: trust officer. David N. Housreal Dann Faber: secretaries, Albert H. and Robert Flather; assistant trust officers, T. Stanley Holland. Arthur Nichols, Moran and Earl G. treasurers, William W. Keck Hans Ireland, Percy Brady, James jr.; Edward Swan, Richard Harris, Harry White and Charles C. Boswell. The will remain open until 9:30 this evening for public Opens Branch Banking Fight. Speaking in behalf of 19,000 local their depositors 100 per the smaller communities of the United States, the American Banker today launched campaign for of branch provisions for national out Glass act of 1932, now before the officially fostered, the magazine asserts, branch banking slowly but inevitably destroy unit banking, and the never be voting of the act with this provision will writing "the death warrant their local banks, Axford, magazine's editor, in letter today to every member of branches would be an irstep toward of local banking resources for administraStreet and for the stock market, he declares. Peoples Drug Sales Off Slightly. Sales Peoples Drug Stores, Inc., April were reported today as against in the corresponding month year ago, decrease of or per the first four months of 1932 totaled in with 439 in like period decrease of $140,030. or 2.4 per Columbia view of business the sales for April and the four Columbia months are considered excellent. Sales of S. S. Kresge Co. (chain Coml stores) were also reported today Comel totaling $12,- Comel 590,090 in April, off per cent. Comel For the four months. sales $38, in comparison with $43,220,161 Comwith in the same months last year. being down 10.6 per The company opera 675 American and 39 Consol Consol Consol Banking Improvement Impressive. Consol changes for the better in Consol banking are in Contl report of the Economic Policy Contl sion of the American Bankers' Association issued in New York today, outlining Contl the course of events reduced bank 522 in October to only 45 in with returns run- Crex ning into April period in Crucible which more were being than closed. The report, made by Cudahy Hecht of New Orleans, chairman of the Curtis declares that it is confident Curtis these will continue Since the reported at the Curtis annual convention of the association October, Mr. Hecht says, "the drop in Delaware bank but could not be reported, has finally taken place. Stock Allotments Cancelled. The Bond Share Co., acDome 33% has the of stock at Duplan $40 per share, made to officers and emthe concern back in March Dupont 1929. This action taken some Duques ago, but letter has just been sent out 87% 44% Eastman to the original 109% Eastman plan and stating detail why the idea failed and was repealed. The letter states that the total number shares for the allotment about to about 160 employes. was to be delivered until entirely paid for. Participants were to pay 10 per cent of the subscription price and per cent inEquit terest the unpaid balance R of the plan, on January 1, The stock now selling around $13 share. With such drop in price, 10% operation of the plan became destructo the morale the company, the directors state, and for that reason cancellation of the whole plan was Firestone voted. Heard in Financial District. Fourth C. Childs & Co., dealers in Govsecurities that Richard Garvin, of the New and Philadelphia offices, has beassociated with the Washington office. The District Bankers' annual Hct Springs, Va., just one today Gen The Anacostia Bank, Maurice OtterGen back, president, will celebrate its twenGen having opened on May 10, Gillette Twenty-five reopened in Gimbel April, the same number as in March So far this year 109 have busiGold The State of Maryland proposes to June $1,000,000 bridge bonds probably as 41/28. Extent of Decline. NEW YORK, May (Special) Grant market now had an almost steady decline for two the reaction set in on March One Grigsby the longest during this seventh reactionary phase that 70 Hanna from April 27. On each day since then Hawaiian new low average Hershey the year either all two of the Holland The average is Houdaille down 40 cent, which Houston plausible argument for rally Wall Hudson Street could develop reasonable of in the situation at Washington. Sales cheap automobiles in France are increasing.