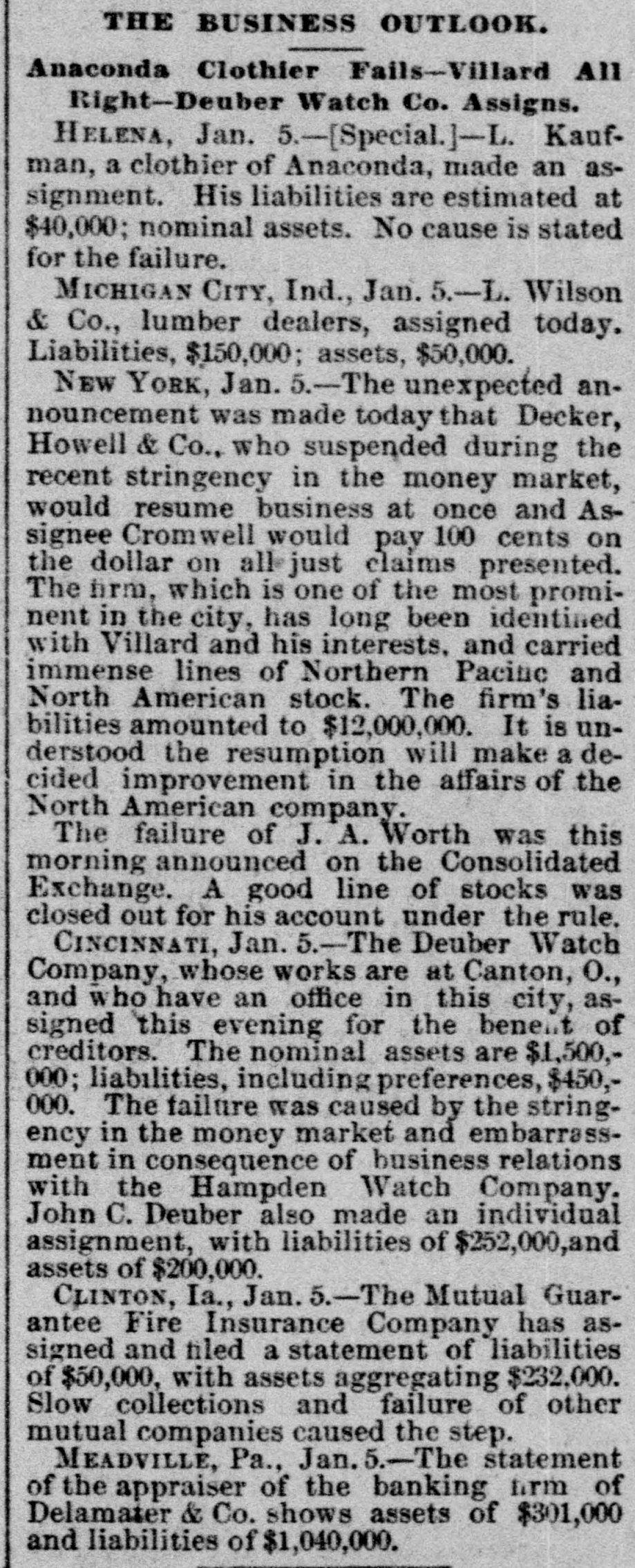

Article Text

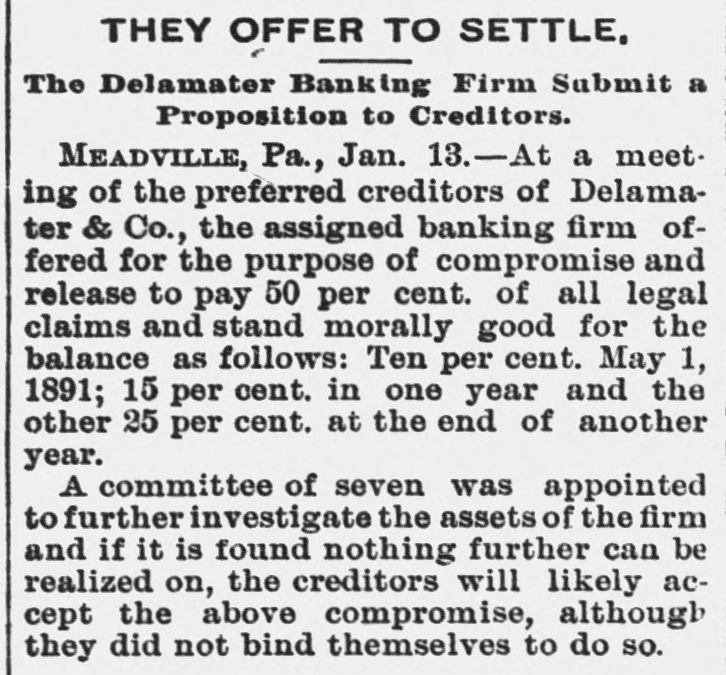

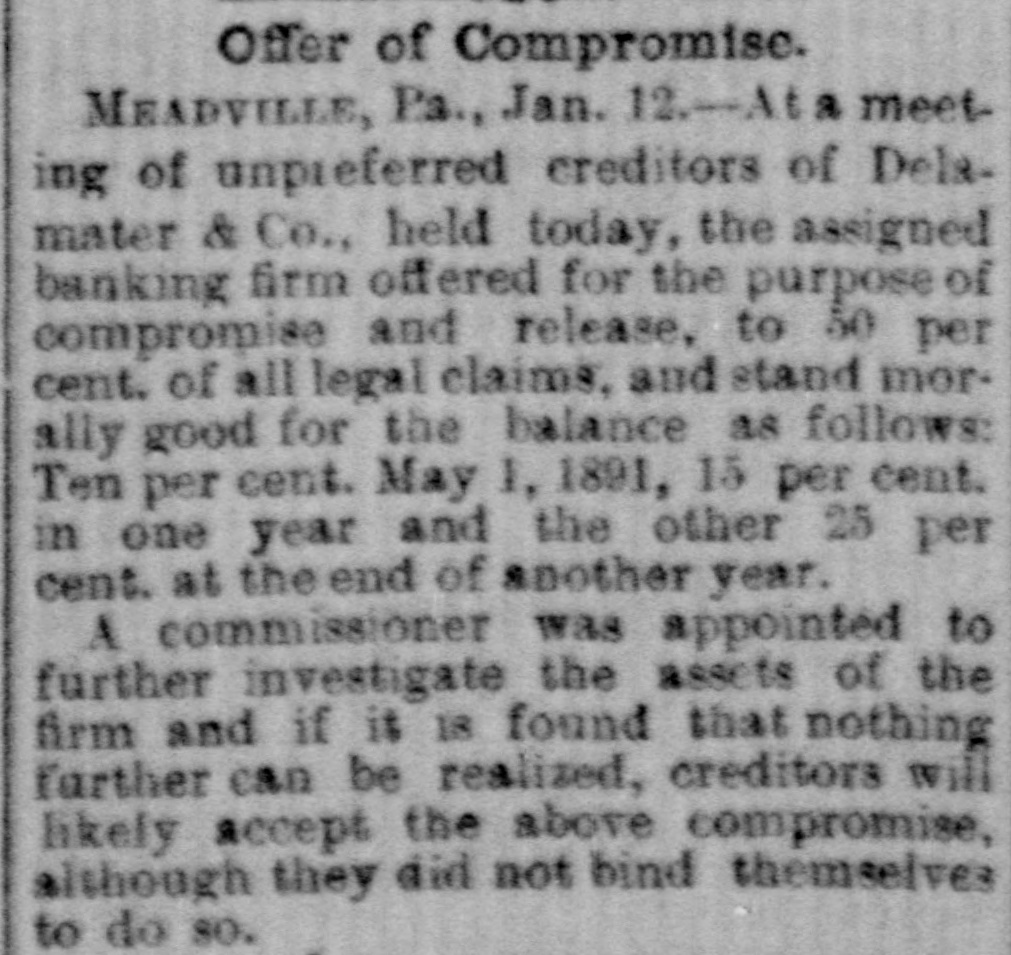

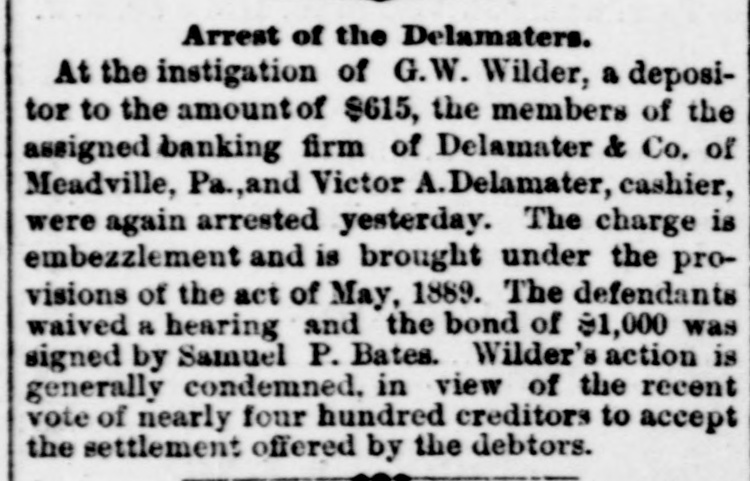

A DELAMATER'S FAILURE. 18 e. Like a Thunder-Clap out of a 1 Clear Sky it Startled e e THE PEOPLE OF MEADVILLE. d 1, 0 The Bank of the Late Candidate 1 for Governor in Pennsy Ivania t. e Closes its Doors .Liabilities n Unknown--The Cause of it. 8 g 0 MEADVILLE, PA., Dec. 5.-Delainater 8 & Co., bankers, of this city, made 011 r. assignment this morning for the benefit y n of their creditore. There is little excite ment, although the suspension caused a profound sensation. The Delamaters t have heretofore enjoyed the entire confidence of the business public and recent B ramors concerning them have been treated as emanations of political rivalr. 0 They have the sympathy of the comIf munity and hopes are expressed that I the suspension will be but temporary. A clap of thunder from a clear tky I could not have <created a greater degree of excitement than did the annoue cement this morning of the failure. As early as 7 o'clock the rumor of the 18signment was on the atreets and spread like wild-fire. When the hour of 9 o'clock arrived, a throng of men stood an the corner of Water and Chestnuta streets, and all eyes were turned toward the door of the banking house herete. fore named. Anxiety became intence and when the bank door did not open as usual, it dawned upon the minus of many that the rumor was true. Shortly after o'clock the following notice was posted on the windows on the Water and Chestnut street sides of the bank: BANK CLOSED. Delamater & Co. have made an assignment for benefit of creditors, [Signed] V. M. DELAMATER, Cashier. December 5, 1890. The firm of Delamater & Co., bankers, is composed of George B., George. W. and T. A. Delamater. The assignment was made to George W. Hasking and John o McClintock, composing the law firm of Haskins & McClintock. In talk. ing with a financier of the city, who 18 in 8 position to know, he said: "I attribate the failure to the stringency of the eastern money market, and the failure to realizing on securities." The assets and liabilities are unknown. The assignees refuse to make any statement at this time, and others interested are non-communicative. The assignment does not affect the other banks of the city. It is known that Delamater & Co. were bondsmen for County Treasurer H. M. Miller and James L. Swickard, Treasurer of the Board of Control of the Public Schools, and that the county funds ($17,000) and school funds are deposited in their bank. It is believed that the failure, if such it may be called, is not as disastrous as it would seem to appear at this time.