Click image to open full size in new tab

Article Text

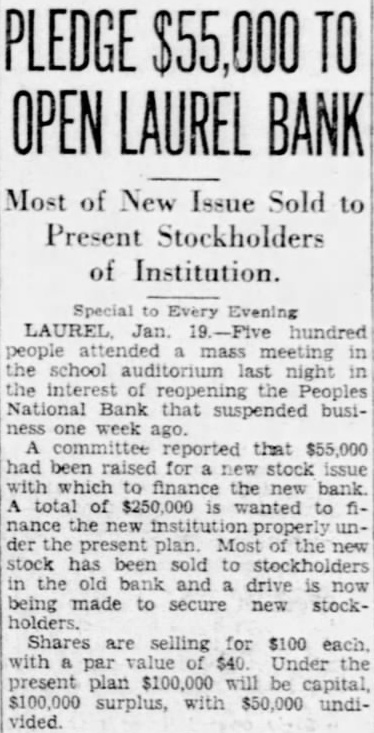

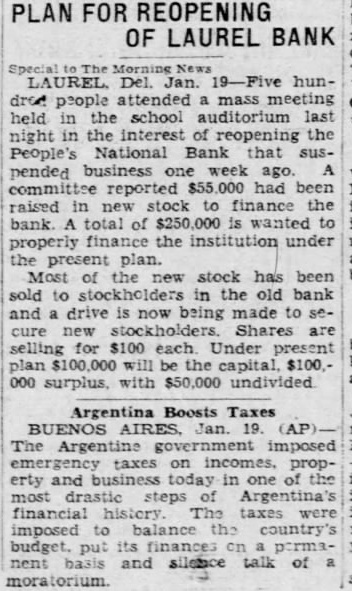

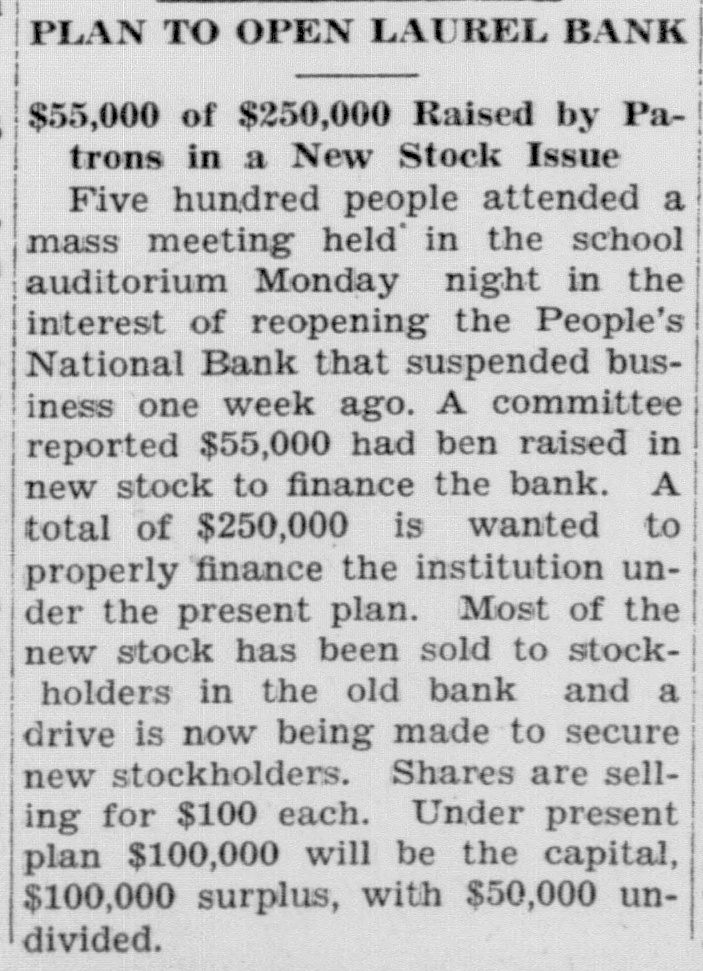

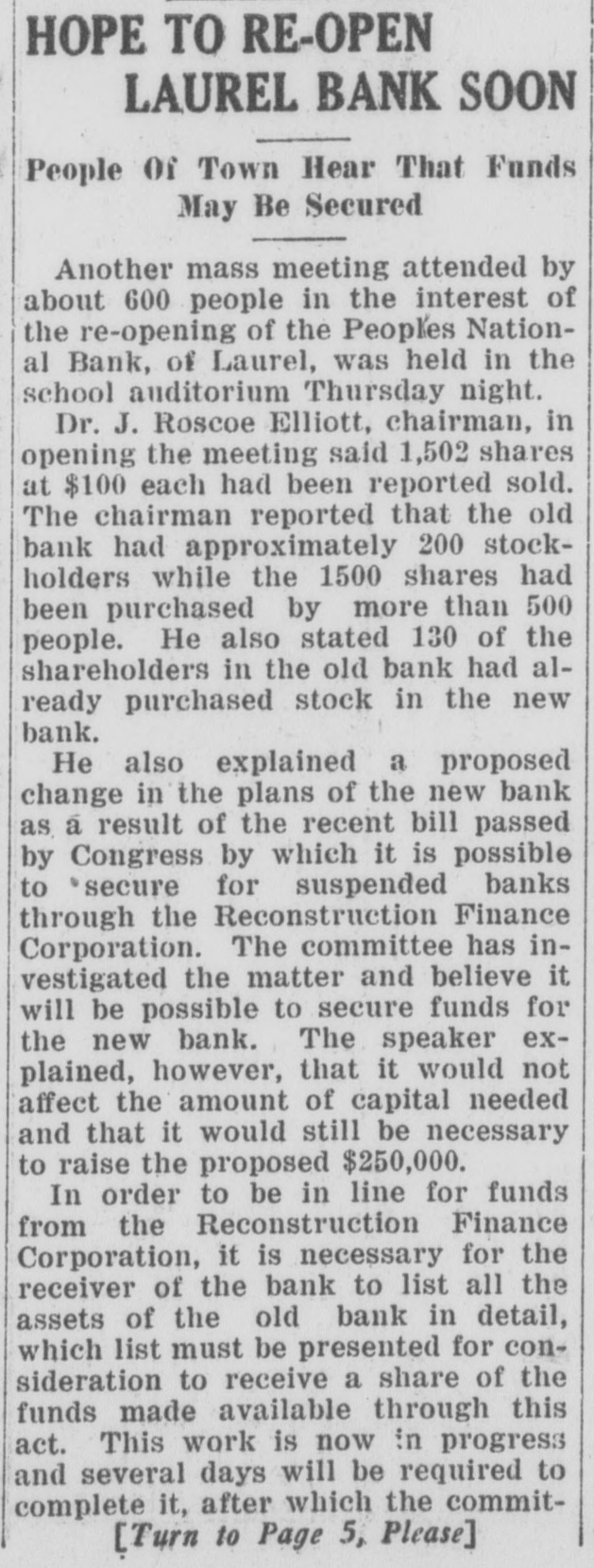

REOPENING OF LAUREL BANK Revived Institution Now Has $100,000 Capital and Same Amount of Surplus ELLIOTT NEW PRESIDENT The Peoples National Bank of Laurel, which closed its doors on January 11 of this year, has established the record of being open for business almost exactly five months later, the official opening date being Wednesday of last week. The bank opened its doors at 8 o'clock with a capital of $100,000, a surplus of $100,000, all paid in cash, with a total of 634 stockholders, and more than 2,000 depositors. The old bank had but 193 stockholders. The new board of directors consisting of Dr. J. Roscoe Elliott as president; Charles L. Horsey, vice-president; J. Wiley Trought, secretary, and George E. Gordy, Harley G. Hastings, George T. Purnell, Arthur S. Hearn, Frank M. Jones and William B. Willey, has been busy since its election getting everything in readiness for the opening. N. Ashley Jenkins, of Philadelphia, is the cashier of the new bank. Mr. Jenkins is a young man, but one with a large experience in banking circles. He has had fifteen years experience in commercial and investment banking, having worked in every department of the Traders National Bank of Scranton, Pa. He has also had much experience in the organization of new banks, having organized twelve banks in Pennsylvania. He is well trained in the investment department, having worked for three years along this line for a large Philadelphia bank. The assistant cashier is J. Harold Edie, a Laurel man, who has been in business in Laurel for a number of years. Gurthie Waller is the teller; Miss Ruth Lloyd, clerk and stenographer, and Miss Sallie Bacon, bookkeeper. The bank opened as a conservative institution. No big opening was planned, but the doors simply. opened for business and the board of directors welcomed all their old customers as well as new ones at that time. According to the re-organization plans, all old stock, consisting of 1,000 shares, was surredered. All undesirable assets of the old bank, including slow paper, real estate, etc., has been placed in a pool and is not a part of the new bank. To balance this item, 20 per cent of the deposits of the old bank were placed in the pool. As soon as the real estate and paper in the pool can be liquidated, it will be paid to the old depositors. The remainder of the deposits will be paid over a period of three years, 1-2 per cent of which is made available immediately upon the opening of the bank. The government has also advised that all reopened banks should pay not more than 3 per cent interest on deposits and the new Peoples National Bank will comply with that request. Since the bank suspended business on January 11, it has been in charge of government official, Alonzo Tweedale having been appointed receiver.