Article Text

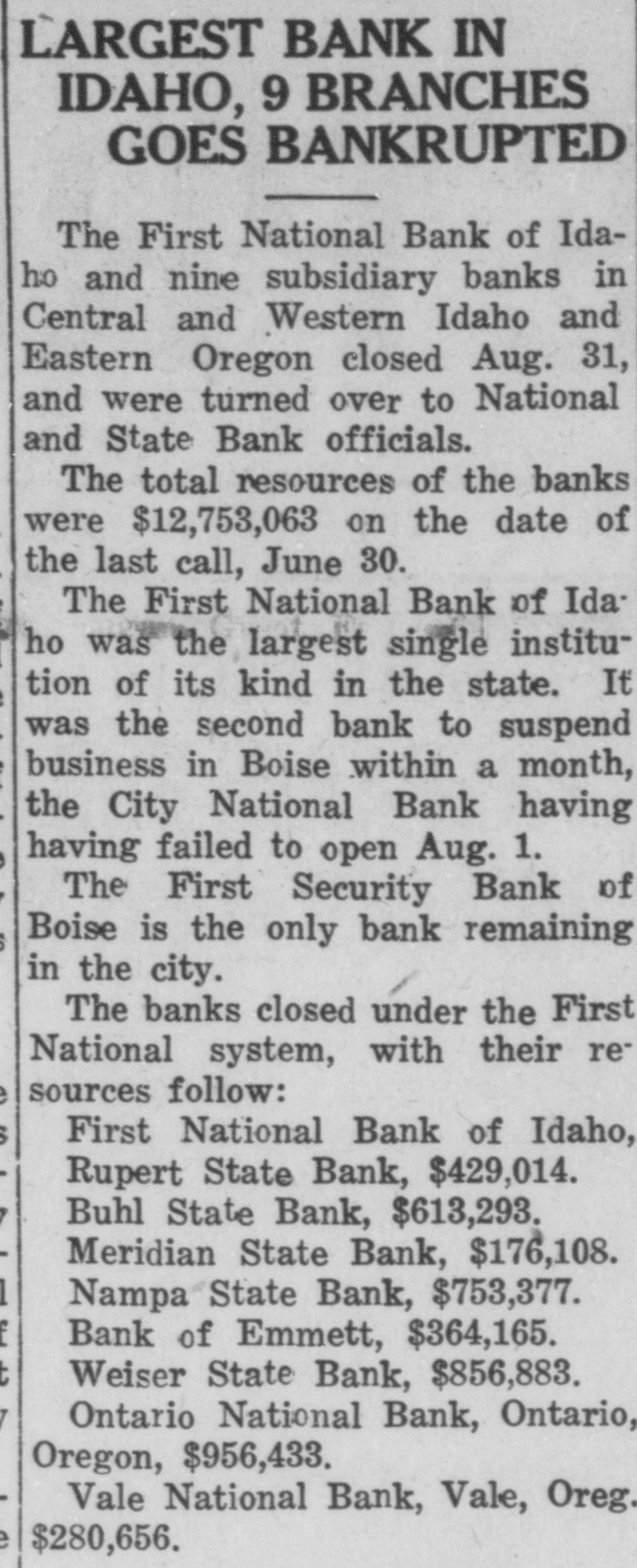

LARGEST BANK IN IDAHO, 9 BRANCHES GOES BANKRUPTED The First National Bank of Idaho and nine subsidiary banks in Central and Western Idaho and Eastern Oregon closed Aug. 31, and were turned over to National and State Bank officials. The total resources of the banks were $12,753,063 on the date of the last call, June 30. The First National Bank of Ida: ho was the largest single institution of its kind in the state. It was the second bank to suspend business in Boise within a month, the City National Bank having having failed to open Aug. 1. The First Security Bank of Boise is the only bank remaining in the city. The banks closed under the First National system, with their resources follow: First National Bank of Idaho, Rupert State Bank, $429,014. Buhl State Bank, $613,293. Meridian State Bank, $176,108. Nampa State Bank, $753,377. Bank of Emmett, $364,165. Weiser State Bank, $856,883. Ontario National Bank, Ontario, Oregon, $956,433. Vale National Bank, Vale, Oreg. $280,656.