Click image to open full size in new tab

Article Text

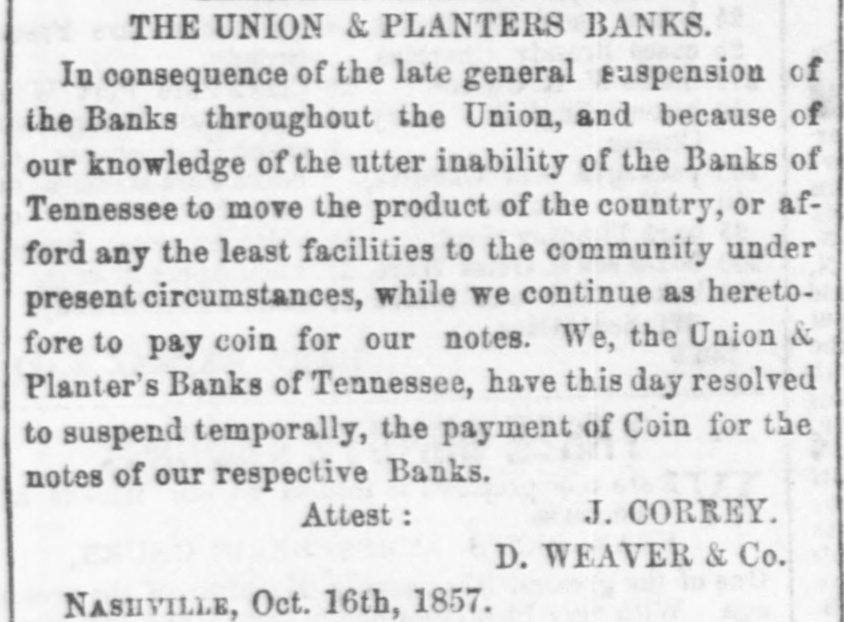

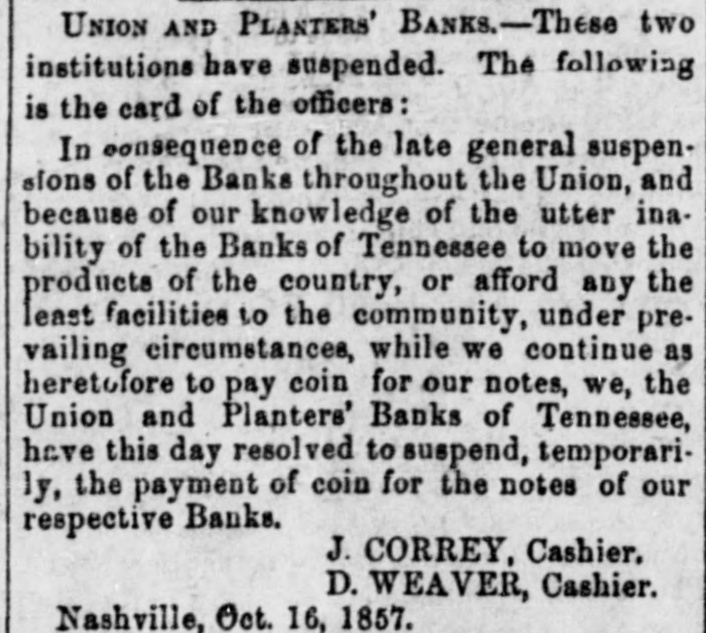

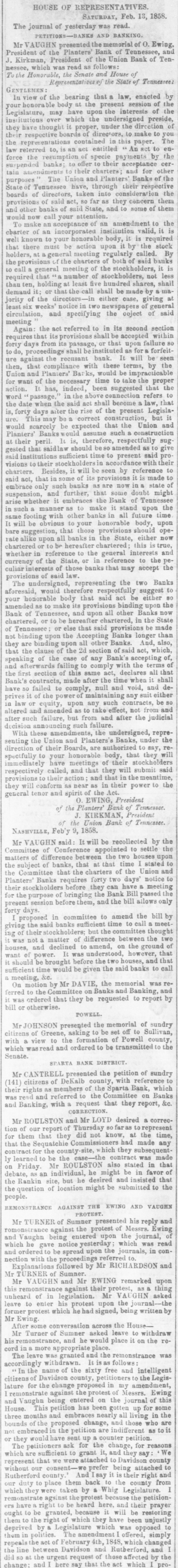

HOUSE OF REPRESENTATY SATURDAY, Feb. 13, 1858. The journal of yesterday was read. PETITIONS-BANKS AND BANKING. Mr VAUGHN presented the memorial of O. Ewing President of the Planters' Bank of Tennessee, and J. Kirkman, President of the Union Bank of Tennessee, which was read as follows: the Honorable, the Senate and House of Representatives.of the State of Tennessee: GENTLEMEN: In view of the bearing that a law, enacted by your honorable body at the present session of the Legislature, may have upon the interests of the institutions over which the undersigned preside, they have thought it proper, under the direction of their respective boards of directors, to make to you the representations contained in this paper. The law referred to, is an act entitled An act to enforce the resumption specie payments by the suspended banks; to offer to their acceptance cer tain to their charters; and for other purposes The Union and Planters Banks of the State of Tennessee have, through their respective boards of directors, taken into consideration the provisions of said act, so far as they cencern them and other banks of said State, and to some of them would now call your attention. To make an acceptance of an amendment to the cbarter of an incorporated institution valid, it is well known to your honorable body, it is required that there must be action upon it by the stock holders, at general meeting regularly called. By the provisions the charters of both of said banks LO call general meeting of the stockholders, it is required that "& number of stockholders, not less than ten, holding at least five hundred shares, shall demand it: or that the call shall be made by majority of the directors-in either case, giving at least six weeks' notice in two newspapers of general circulation, and specifying the object of said meeting Again: the act referred to in its second section requires that its provisions shall be accepted within forty days from its passage, or that upon failure 80 to do, proceedings shall be instituted as for forfeiture against the recusant bank. It will be seen then, that compliance with these terms, by the Union and Planters' Ba: ks, would be impracticable for want of the necessary time to take the proper action. It has, indeed, been suggested that the word passage, in the above connection refers to the date when the said act shall become law, that is, forty days after the rise of the present Legislaure. This may be correct construction, but it would scarcely be expected that the Union and Planters Banks would assume such a construction at their peril It is, therefore, respectfully sug gested that saidlaw should beso amended as to give said sufficient time to present said pro visions to their cordance with their charters. Besides, it will be seen by reference to said act, that of its it is made to embrace only such banks as are now in state of suspension, and further, that some doubt might arise whether embraces the Bank of Tennessee in such manner as to make it stand upon the same footing with other banks in all future time will be obvious to your honorable body, upon bare suggestion, that those provisions should operate alike upon all banks in the State, either now chartered or be hereafter chartered this is true, whether in reference to the general interests and currency of the State, or in reference to the peculiar interests of those banks that may accept the provisions of said law. The undersigned, representing the two Banks aforesaid, would therefore respectfully suggest to your honorable body that said act be either 80 amended as make its provisions binding upon the Bank of Tennessee, and upon all other Banks now chartered, or to be hereafter chartered, in the State of Tennessee or else that said provisions be made not binding upon the Accepting Banks longer than they are binding upon all other Banks. And, also, that the clause of the 2d section of said act, which, speaking of the case of any Bank's accepting of, and afterwards failing to comply with the terms of the first section of this same act, declares all that Bank's contracts, made after the time when it shall have 30 failed to comply, null and void, and deprives it of the power maintaining any suit either in law or equity, upon any such contracts, be 80 altered and amended as to take effect, not from and after such failure, but from and after the judicial decision announcing such failure. With these amendments, the undersigned, representing the Union and Planters's Banks, under the direction of their Boards, are authorized to say, respectfully to your honorable body, that they will immediately have meetings of their stockhold respectively called, and that they will submit said provisions to their action; and that in the meanti they will conform as near as in their power to the general tenor and spirit of the Act. 0. EWING, President of the Planters' Bank of Tennessee J. KIRKMAN, President of the Union Bank of Tennessee. NASHVILLE, Feb'y 9, 1858. Mr VAUGHN said: It will be recollected by the Committee of Conference appointed to settle the matters of difference between the two houses upon the subject of banks, that at that time stated to the Committee that the charters of the Union and Planters' Banks requires forty two days' notice to their stockholders before they can have meeting for the purpose of bringing the Bank Bill passed the present session before them, and the bill allows only forty days. proposed in committee to amend the bill by giving the said banks sufficient time to call meet ing of their stockhold but the committee thought it was not matter of difference between the two houses, and declined to amend, on the ground of want of power. It was understood, however, that it should be brought before the two houses, and that sufficient time would be given the said banks to call &c. meeting, On motion by Mr DAVIE, the memorial was referred to the Committee on Banks and Banking, and it was ordered that they be requested to report by bill or otherwise. POWELL. Mr JOHNSON presented the memorial of sundry citizens of Greene, asking to be set off to Sullivan, with a view to the formation of Powell county, which wasread and ordered to be transmitted to the Senate. SPARTA BANK DISTRICT Mr CANTRELL presented the petition of sundry (141) citizens of DeKalb county, with reference to their rights as members of the Sparta Bank, which was read and referred to the Committee on Banks and Banking, with request that they report, &c. CORRECTION. Mr ROULSTON and Mr LOYD desired a correction of our report of Thursday 80 far as to represent for them that they did not know, at the time, that the Sequatchie Commissioners had made any contract for the county site, which they subsequently learned to be the case-the contract was made on Friday. Mr ROULSTON also stated in that debate, as an individual, he might be in favor of the Rankin site, but he desired and insisted that the question of location might be submitted to the people. REMONSTRANCE AGAINST THE EWING AND VAUGHN PROTEST Mr TURNER of Summer presented his reply and romonstrance against the protest of Messrs. Ewing and Vaughn being entered upon the journal, of which he gave notice yesterday which was read and ordered to be spread upon the journals, in connection with the proceedings referred to. Explanations followed by Mr RICHARDSON and of TURNER Summer. Mr Mr VAUGHN and Mr EWING remarked upon this remonstrance against their protest, as & thing unheard of in legislation. Mr VAUGHN asked leave to enter his protest upon the journal- the former protest which he had signed, being written by Mr Ewing. After some conversation across the HouseMr Turner of Summer asked leave to withdraw his remonstrance, and he would place it on the record in more appropriate place. The leave was granted and the remonstrance was accordingly withdrawn. It is as follows In the name of the sixty free and intelligent citizenso Davidson county, to the Legislature for the change proposed in my amendment, remonstrate against the protest of Messrs. Ewing and Vaughn being entered on the journal of this House. This petition has been gotten up for some three months and embraces nearly all living in the bounds of the proposed change, and those who are not embraced in the petition are indifferent as to it or they would have sent up a counter petition. The petitioners ask for the change, for reasons which are sufficient to grant it, and they say We represent that we were attached to Davidso county without our consent- prefer being attached to Rutherford county And say it is their right and our duty to place them back to the county from which they were taken by Whig Legislature. remonstrate agsinst the protest the petitioners have right be heard here, and their prayer ought be granted, because it will be restoring them the right which they have been unjustly deprived by & Legislature which was opposed to them in polities. The amendment offered, simply