Article Text

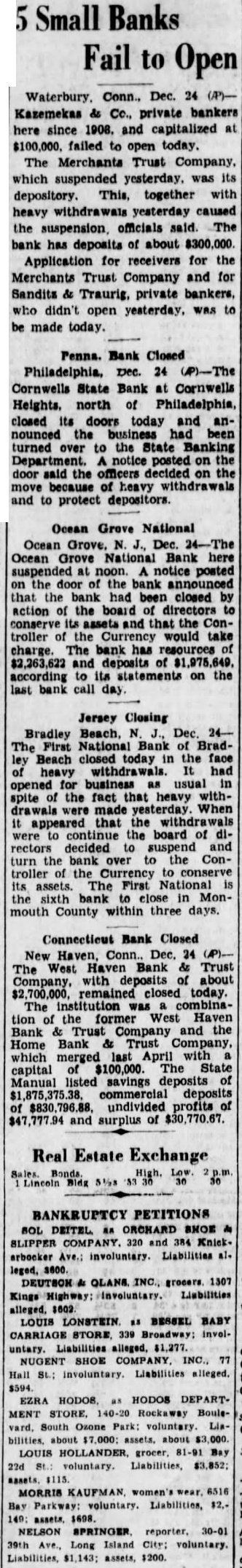

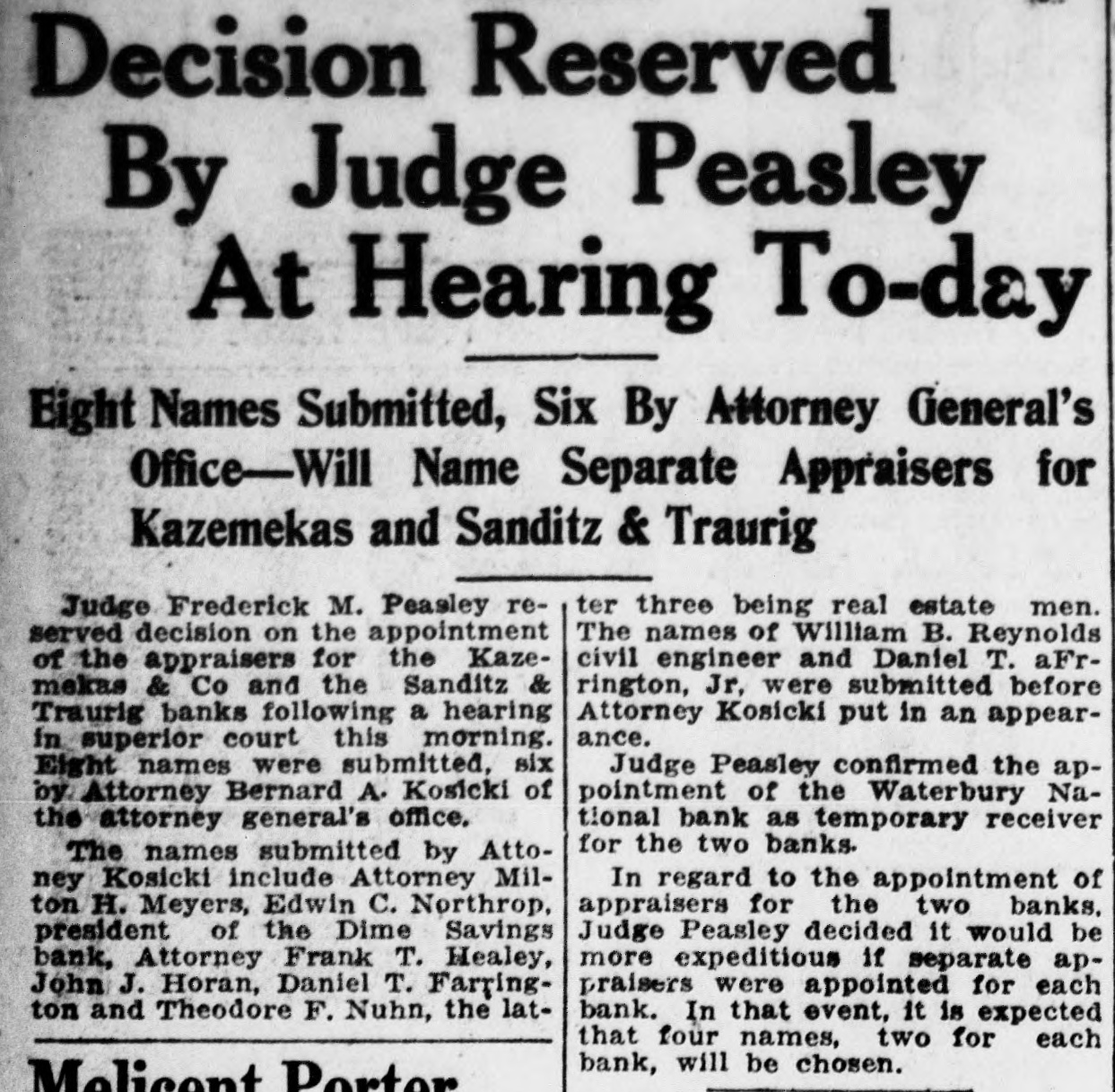

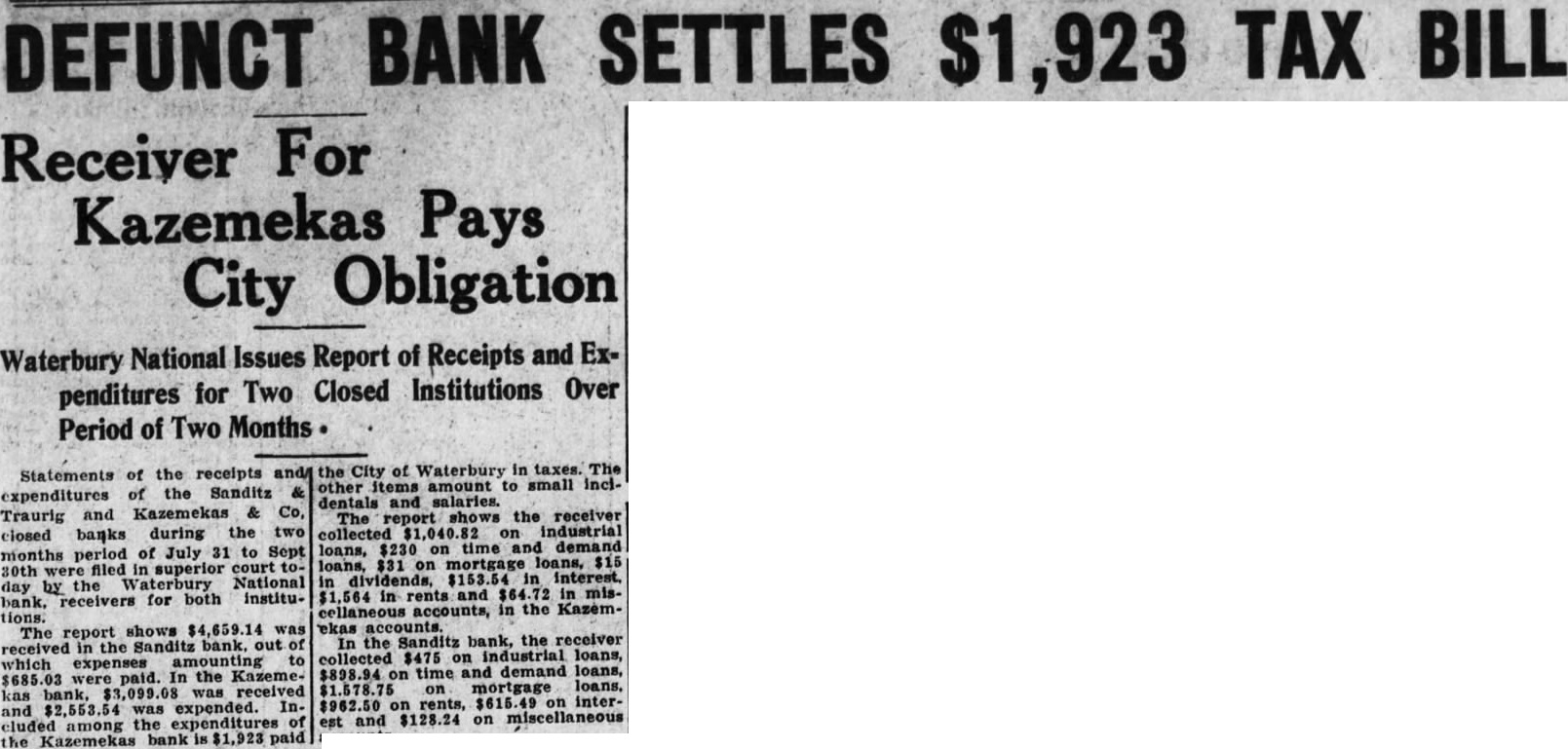

5 Small Banks Fail to Open Waterbury. Conn., Dec. 24 (AP)Kazemekas & Co., private bankers here since 1908. and capitalized at $100,000. failed to open today. The Merchants Trust Company, which suspended yesterday. was its depository. This, together with heavy withdrawals yesterday caused the suspension, officials said. The bank has deposits of about $300,000 Application for receivers for the Merchants Trust Company and for Sandits & Trauris, private bankers. who didn't open yesterday, was to be made today. Penna. Bank Closed Cornwells State Bank at Cornwells Heights. north of Philadelphia, closed its doors today and announced the business had been turned over to the State Banking Department. A notice posted on the door said the officers decided on the move because of heavy withdrawals and to protect depositors. Ocean Grove National Ocean Grove, N. J., Dec. 24-The Ocean Grove National Bank here suspended at noon. notice posted on the door of the bank announced that the bank had been closed by action of the board of directors to conserve its assets and that the Controller of the Currency would take charge. The bank has resources of $2,263,622 and deposits of $1,975,649. according to its statements on the last bank call day. Jersey Closing Bradley Beach, N. Dec. 24The First National Bank of Bradley Beach closed today in the face of heavy withdrawals. It had opened for business as usual in spite of the fact that heavy withdrawals were made yesterday. When it appeared that the withdrawals were continue the board of directors decided to suspend and turn the bank over to the Controller of the Currency to conserve its assets The First National is the sixth bank to close in Monmouth County within three days. Connecticut Bank Closed New Haven. Conn., Dec. 24 (AP)-The West Haven Bank & Trust Company, with deposits of about $2,700,000, remained closed today The institution was combination of the former West Haven Bank Trust Company and the Home Bank & Trust Company, which merged last April with a capital $100,000. The State Manual listed savings deposits of $1,875,375.38. commercial deposits of undivided profits of $47,777.94 and surplus of $30,770.67. Real Estate Exchange Lincoln BANKRUPTCY PETITIONS SLIPPER COMPANY. 320 and 384 Knickarbocker Ave.: involuntary. Liabilities alKings Highway: involuntary. Liabilities LOUIS LONSTEIN as BESSEL BABY CARRIAGE STORE, 339 Broadway: involuntary. Liabilities alleged. $1,277. NUGENT SHOE COMPANY INC., 77 Hall St.; involuntary. Liabilities alleged. EZRA HODOS as HODOS DEPARTMENT STORE. 140-20 Rockaway Boulevard. South Ozone Park: voluntary Lis. bilities about $7,000: assets. about $3,000. LOUIS HOLLANDER, grocer. 81-91 Bay 22d St.: voluntary. $115 MORRIS KAUFMAN, 6516 Bay Parkway: voluntary. Liabilities, $2. NELSON SPRINGER reporter. 30-01 39th Ave., Long City: voluntary Liabilities, $1,143; assets, $200.