Click image to open full size in new tab

Article Text

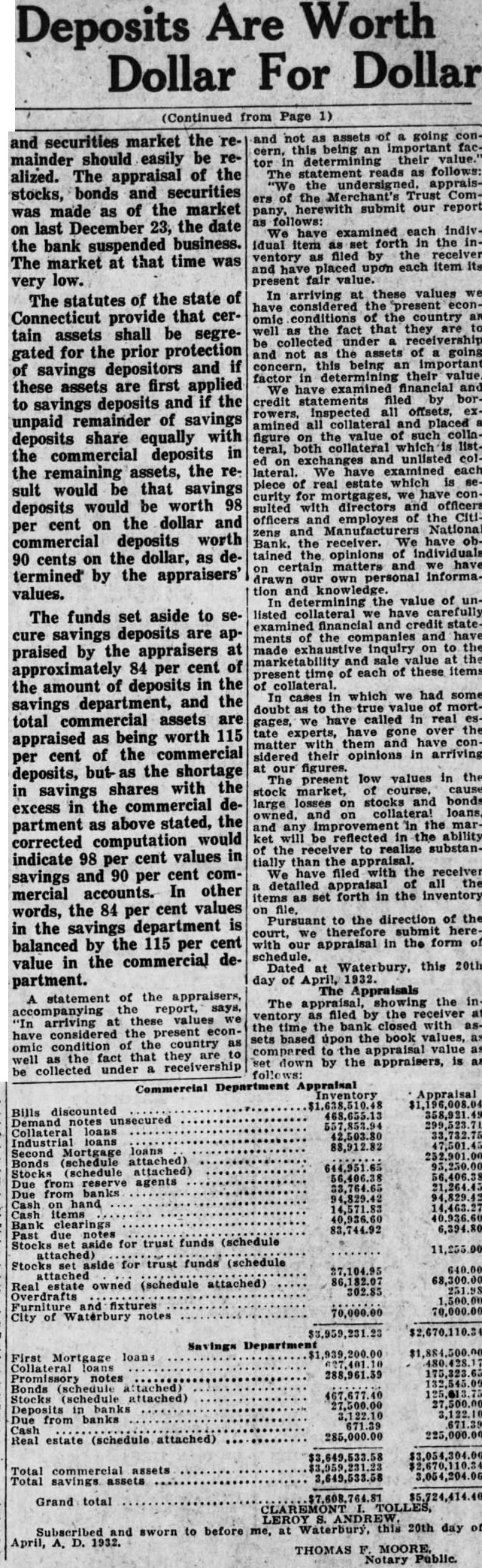

Deposits Are Worth Dollar For Dollar from Page 1) and securities market the mainder should easily be realized. The appraisal of the stocks, bonds and securities made of the market was as on last December 23, the date the bank suspended business. The market at that time was very low. The statutes of the state of Connecticut provide that certain assets shall be segregated for the prior protection of savings depositors and if these assets are first applied to savings deposits and if the unpaid remainder of savings deposits share equally with the commercial deposits in the remaining assets, the result would be that savings deposits would be worth 98 per cent on the dollar and commercial deposits worth 90 cents the dollar, as determined by the appraisers' values.

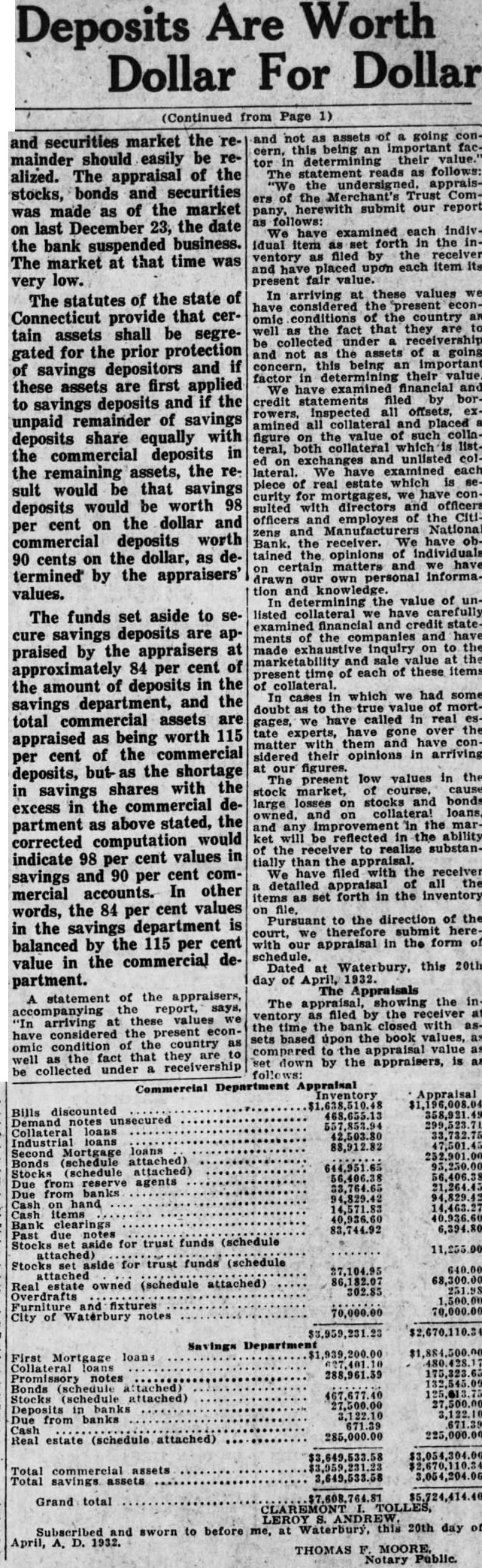

The funds set aside to secure savings deposits are appraised by the appraisers at approximately 84 per cent of the amount of deposits in the savings department, and the total commercial assets are appraised as being worth 115 per cent of the commercial deposits, but- as the shortage in savings shares with the excess in the commercial department as above stated, the corrected computation would indicate 98 per cent values in savings and 90 per cent commercial accounts. In other words, the 84 cent values in the savings department is balanced by the 115 per cent value in the commercial department. statement of the appraisers, report, says, accompanying "In arriving these values have considered the present omic condition fact that they well under receivership be collected and not as assets of going conbeing an important cern, determining their tor reads as follows: appraisCompany, of herewith submit our report follows: We have examined each indivfiled the receiver and placed upon item its present fair value. In arriving at these values considered the present omic conditions of the country well as the fact that they receivership and not going concern, this being important factor their value. We examined financial and credit statements filed Inspected offsets, exrowers. amined collateral and placed figure value such collateral, both collateral which listexchanges unlisted collateral. We examined each piece of real estate which curity for sulted with directors officers officers employes of the Citizens and Manufacturers National Bank. the receiver. We have tained opinions of individuals certain matters and own Information determining value of listed collateral we carefully examined of the companies and ments made inquiry on and sale value present time of each of these items collateral. In cases which we had some doubt as the mortgages, we called in real tate have the with them have matter sidered their opinions in arriving figures. The present low values in the course, cause stock market, large losses stocks bonds owned, the any be reflected ability to realize substanfiled with the receiver detailed appraisal all items set forth in the inventory Pursuant to the direction of the with our appraisal in the form of schedule. Dated at Waterbury, this 20th day of April, The Appraisals The the ventory the at the time closed with upon the book values, compared the appraisal value down by the appraisers,

Commercial Department discounted Demand notes unsecured Industrial loans loans 88,912.82 Second Mortgage attached) 644,951.65 (schedule attached) from reserve agents 21,264.45 hand clearings 83,744.92 6,394.80 funds (schedule Stocks aside for trust 11,255.00 trust funds (schedule aside 37,104.95 attached attached) 68,300.00 Real owned (schedule Overdrafts Furniture fixtures 70,000.00 70,000.00 City of Waterbury $2,670,110.34 Savings Department Mortgage loans Collateral Promissory notes Bonds (schedule Stocks (schedule attached) Deposits Due from 285,000.00 estate (schedule attached) commercial assets 3,649,533.58 3,054,204.06 savings $5,724,414.40 Grand total 20th day of Subscribed sworn to before Waterbury, April, A. D. 1932. THOMAS Notary Public.