Article Text

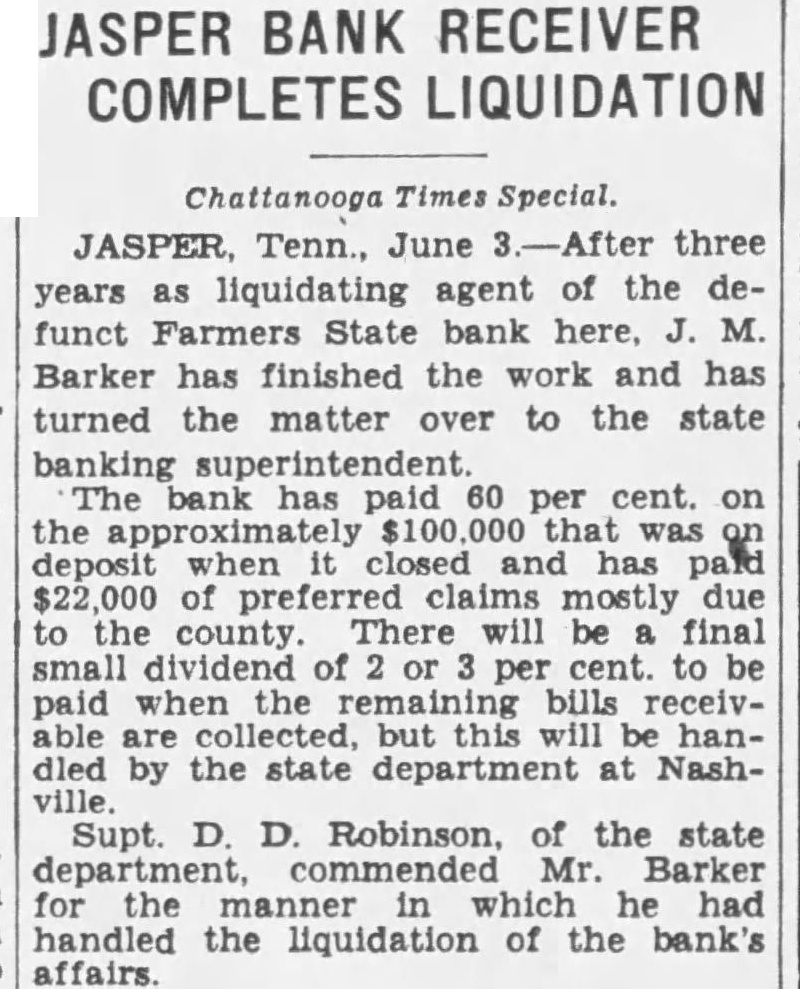

JASPER BANK RECEIVER COMPLETES LIQUIDATION Chattanooga Times Special. JASPER, Tenn., June three years liquidating agent of the defunct Farmers State bank here, M. Barker has finished the work and has turned matter over to the state banking bank has paid per cent. the approximately deposit when closed has $22,000 of preferred claims mostly due the county There will be final small dividend of per cent. to be when remaining bills receivwill dled by the state department NashSupt. D. D. Robinson, of the state Barker for the manner which he had handled the liquidation of the bank's affairs.