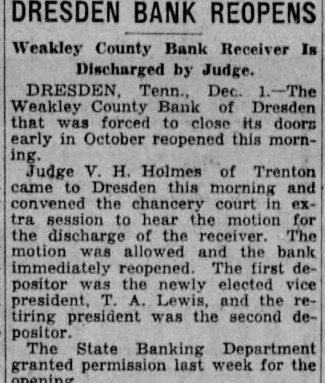

Article Text

Cincinnati live market reported by November Actual rec'ts for 416 Monday 418 87 steers and helfers too light for the demands the trade, and market reigned strong higher in tively. $1 or have been enforced tion with and lower grades the greatest line some grade beef early in week at Eastern cenNothing grading above good was offered on these sold fully steady to with some the close competition. Bulls upturn spots and medium steers figure being grading good late 50c with hog tion basis 160 packers sales which $8.50 and $2 good choice weight 180 500 lbs) pigs Steers $8. medium Bulls common and milk (per (per Lambs- and choice medium to all and SUIT FILED To Void Stock Sale. Banker Says Connection With Caldwell Is Misstated. Depositor Sues Louisville Institu tion For Money Deposited After Hours On Saturday. Louisville, Ky., November 25-(AP) Litigation in and Federal Courts today from the closing week ago Monday of the National Bank Kentucky and the subsequent receivership for BancoKentucky, its holding company Paul C. receiver for the National of Kentucky, made in suit filed in Federal Court here by Venhoff & Hillen, hatters, who seeking to recover which they claim was in the bank after the close business Saturday, November 15. The petition avers the money was entered in the firm's pass book as November 17 and hence did not become the property of the bank. The plantiffs charge the officers of the bank knew was insolvent when the money was received and they ask return of the principal with in In McCracken Circuit Court at Paducah an injunction suit was filed today by Jesse Weil, Paducah banker, and his wife, Vivien R. Weil They ask the Court void stock transaction the BancoKentucky Company the grounds the BancoKentucky misrepresented its connection with Caldwell & Co. Nashville bankers, now They set out in their petition that they 518 shares of Trust Bank stock for 5,171 of BancoThe claim that because of alleged false assurances them by BancoKentucky executive the transaction was The plaintiffs ask that the BancoKentucky be enjoined from acquir ing the stock transfer on the books of the Mechanics Trust & Savings Bank. Rome, November banks capital reserve of $1,209,000 closed their doors Northern Italy. The largest the Credito Veneto with headquarters in Padua and 65 small branches. The which closed yesterday and asked for liquidation its affairs. capiof The two banks which closed were the Rovido, with of 000, and the Banca Venetia Giplia, of Trieste. with capital surplus of $315,000. Ind. November 25-(AP) The Bank here failed to open for business today inis capitalized at $30,000 and had of $360,000. Dresden, Tenn., November Three banks Weakley County. Tenn. closed today. The cashier of the Weakley County bank here reported it was closed to stop bank of Martin and the City State Bank at Martin. closed the day. Little Rock, Ark., November 25banks, which last reported to the State Banking Department today they for business With reopenings, 10 of 70 banks the state which closed or suspended within week have resumed operations. Those resuming business today the Bank Ozan, the Bank of McNeil and the Bank of Stamps in towns of the Six reopened yesterday and one last week. Caruthersville, Mo., November 25First National Bank of Caruthersville closed this afternoon by its Directors after run It said withdrawals the last few days had amounted to $100,000. Chicago including good and and good good and and lambs and WEEKLY CAR LOADINGS 25freight the November were today by the American Railway Association totaling This of from the preceding and decline decrease and live decrease METAL New November unsettled. Electrolytic: future Iron unchanged. spot Lead steady; New York 10c. East Louis spot and 4.95c. East 4.10c. future Lead future future