Article Text

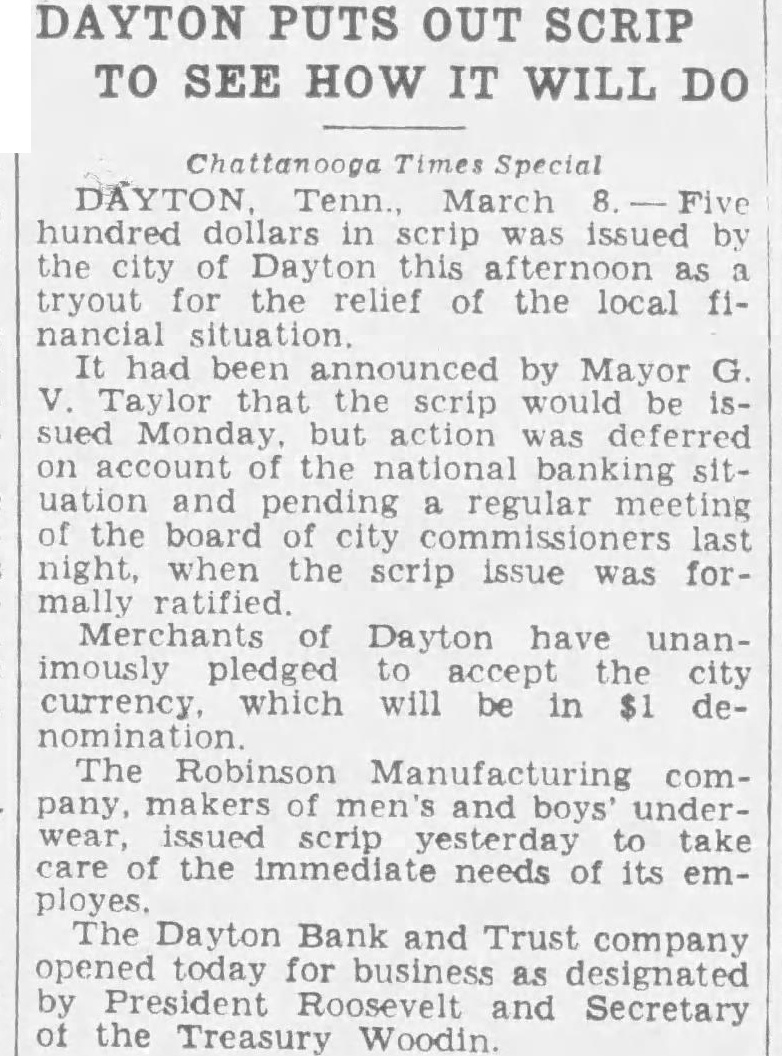

DAYTON PUTS OUT SCRIP TO SEE HOW IT WILL DO Special DAYTON Tenn. March hundred issued of this afternoon tryout relief the local fihad Mayor scrip be Monday. but action on account the national situation and pending regular meeting last night, when the scrip issue was forMerchants Dayton have unanimously pledged currency. which will in denomination Robinson Manufacturing makers undertake the needs of its emDayton Bank and Trust company opened today for business and Secretary the Treasury Woodin.