Click image to open full size in new tab

Article Text

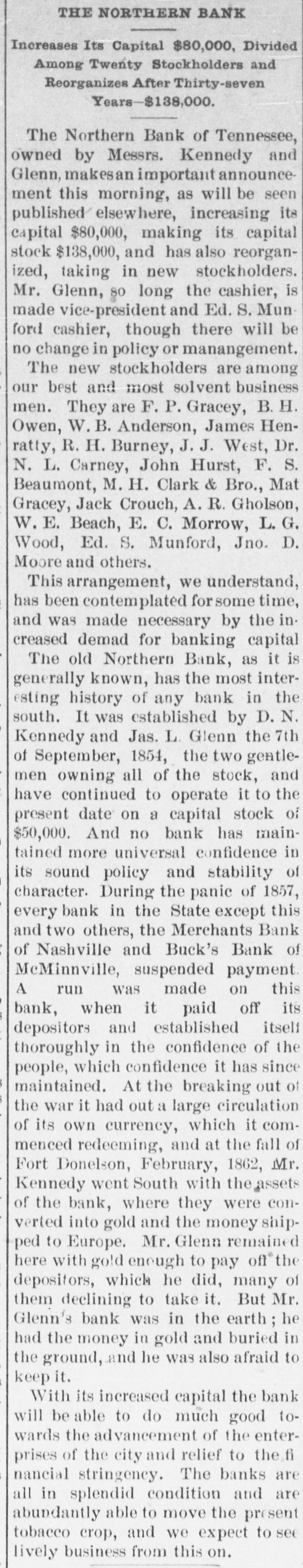

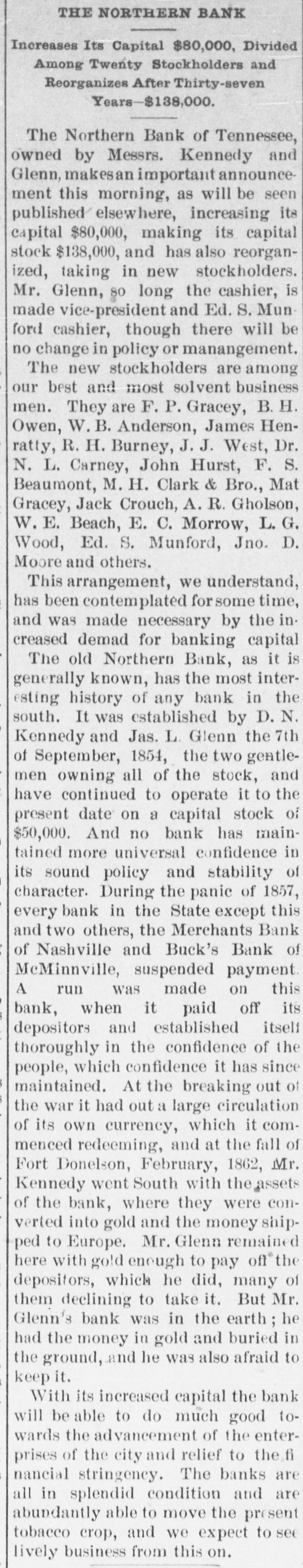

# THE NORTHERN BANK

Increases Its Capital $80,000, Divided

Among Twenty Stockholders and

Reorganizes After Thirty-seven

Years $138,000.

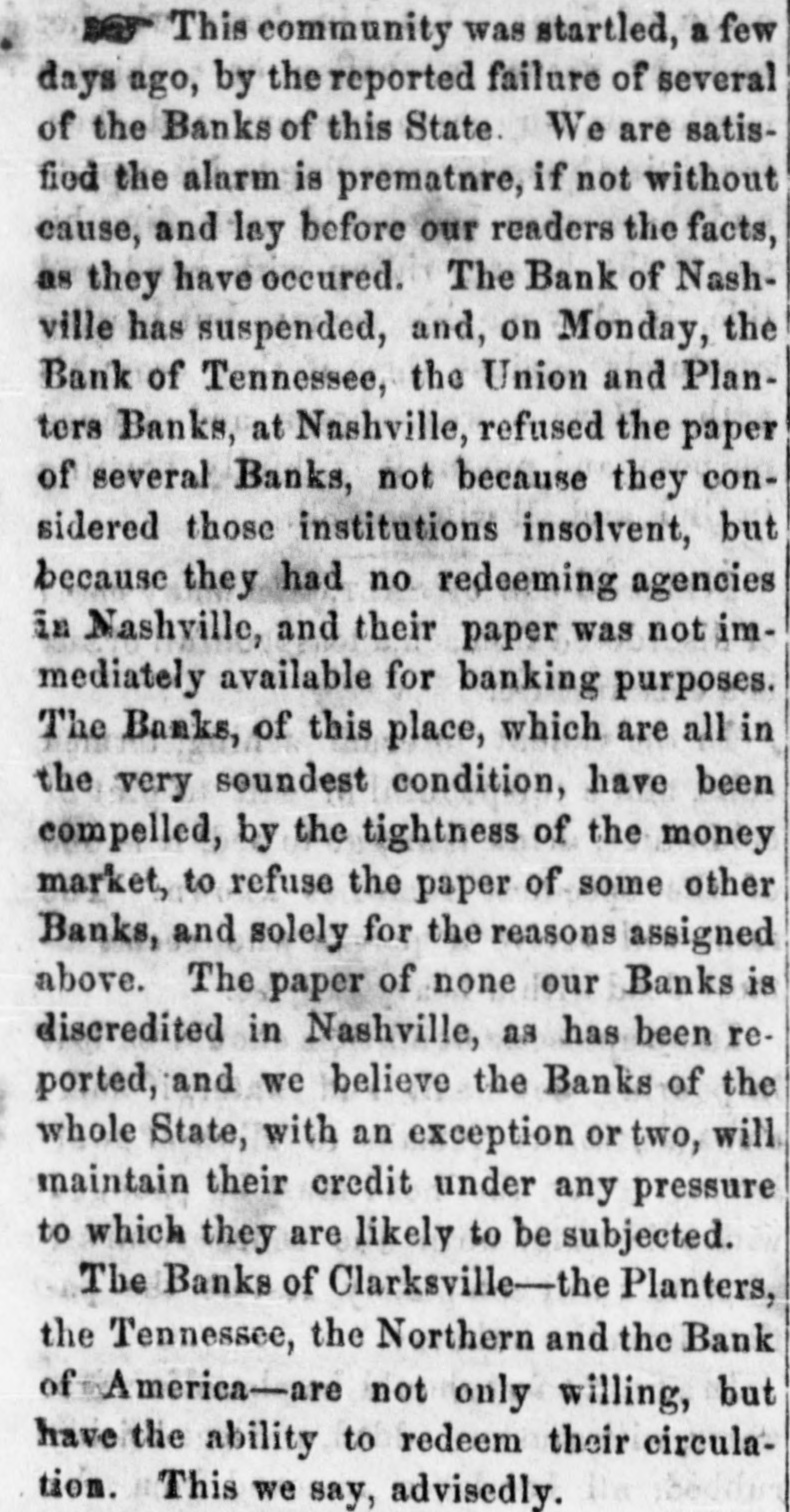

The Northern Bank of Tennessee, owned by Messrs. Kennedy and Glenn, makes an important announcement this morning, as will be seen published elsewhere, increasing its capital $80,000, making its capital stock $138,000, and has also reorganized, taking in new stockholders. Mr. Glenn, so long the cashier, is made vice-president and Ed. S. Munford cashier, though there will be no change in policy or manangement. The new stockholders are among our best and most solvent business men. They are F. P. Gracey, B. H. Owen, W. B. Anderson, James Henratty, R. H. Burney, J. J. West, Dr. N. L. Carney, John Hurst, F. S. Beaumont, M. H. Clark & Bro., Mat Gracey, Jack Crouch, A. R. Gholson, W. E. Beach, E. C. Morrow, L. G. Wood, Ed. S. Munford, Jno. D. Moore and others.

This arrangement, we understand, has been contemplated for some time, and was made necessary by the increased demad for banking capital

The old Northern Bank, as it is generally known, has the most interesting history of any bank in the south. It was established by D. N. Kennedy and Jas. L. Glenn the 7th of September, 1854, the two gentlemen owning all of the stock, and have continued to operate it to the present date on a capital stock of $50,000. And no bank has maintained more universal confidence in its sound policy and stability of character. During the panic of 1857, every bank in the State except this and two others, the Merchants Bank of Nashville and Buck's Bank of McMinnville, suspended payment. A run was made on this bank, when it paid off its depositors and established itself thoroughly in the confidence of the people, which confidence it has since maintained. At the breaking out of the war it had out a large circulation of its own currency, which it commenced redeeming, and at the fall of Fort Donelson, February, 1862, Mr. Kennedy went South with the assets of the bank, where they were converted into gold and the money shipped to Europe. Mr. Glenn remained here with gold enough to pay off the depositors, which he did, many of them declining to take it. But Mr. Glenn's bank was in the earth; he had the money in gold and buried in the ground, and he was also afraid to keep it.

With its increased capital the bank will be able to do much good towards the advancement of the enterprises of the city and relief to the financial stringency. The banks are all in splendid condition and are abundantly able to move the present tobacco crop, and we expect to see lively business from this on.