Click image to open full size in new tab

Article Text

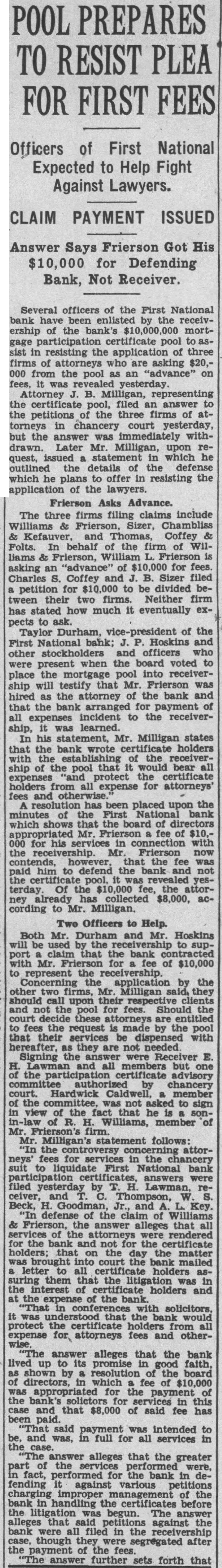

POOL PREPARES TO RESIST PLEA FOR FIRST FEES

Officers of First National Expected to Help Fight Against Lawyers.

CLAIM PAYMENT ISSUED

Answer Says Frierson Got His $10,000 for Defending Bank, Not Receiver.

Several officers of the First National bank by the receivership the bank's mortgage certificate pool sist in resisting the application of three firms of are asking $20,000 from the pool an "advance" on fees, was yesterday Attorney B. Milligan, representing the certificate pool, filed an answer the petitions the three firms of attorneys in chancery court yesterday, but the answer was immediately withdrawn. Later Mr. Milligan, upon request, issued statement which he outlined details the defense which plans offer in resisting the application of the lawyers.

Frierson Asks Advance. The three firms filing claims include Sizer, Chambliss Kefauver, Thomas, Coffey & Folts. In behalf of the firm of Williams & Frierson, William Frierson is asking an "advance" of for fees. Charles S. Coffey and J. B. Sizer filed petition for $10,000 to be divided between their two firms. Neither firm has stated how much it eventually expects to Taylor Durham, vice-president of the First National bank; Hoskins and other stockholders and officers who were present when the board voted to place the mortgage pool into receivership will testify that Mr. Frierson was hired the attorney of the bank and that the bank arranged for payment of all expenses incident to the receivership, learned. In his statement, Mr. Milligan states that the bank wrote certificate holders establishing of the receivership the pool that bear all expenses protect the certificate holders all expense for attorneys' and resolution has been placed upon the minutes First National bank which shows that board of directors Mr. fee of $10,for his in connection with the Frierson however, that the fee was paid him defend the bank and not pool, was revealed yesterday. Of the $10,000 fee, the attorney collected $8,000, according to Mr. Milligan.

Two Officers to Help. Both Mr. Durham and Mr. Hoskins be by the to supthe bank Mr. Frierson of $10,000 to represent the Concerning the application by the other two Mr Milligan they should call upon their clients and not the pool for fees. Should the these attorneys are entitled to the request made by the that their services be with hereafter, they are not needed Signing the were Receiver E. Lawman and all members but one the participation certificate advisory committee authorized by chancery court. the to sign view of the that sonR. H. Williams, of Mr. firm. Mr. Milligan's statement follows: the controversy attorneys' for in the suit to First National bank answers were filed yesterday H. Lawman, receiver, and Thompson, Beck, H. Goodman, Jr., and Key. defense of the claim of Williams & Frierson, the answer alleges that all the were rendered for the bank and not for the certificate holders; the matter was brought into court the bank mailed letter to all certificate holders assuring them that the litigation was in the certificate holders of the bank. it was that the would protect the certificate from all expense for attorneys fees and otherwise. answer alleges that the bank lived up to its promise in faith, shown by resolution the board in which fee of $10,000 appropriated for the payment of the for this and that $8,000 of said fee has paid. "That said payment intended to and was, in full for all services the "The answer alleges that the greater of services were, fact, performed for the bank in defending against various petitions charging of the bank handling the certificates before the was begun. The answer alleges that said against the bank were all filed in the receivership though they were segregated after the payment the fees. "The answer further sets forth that