Click image to open full size in new tab

Article Text

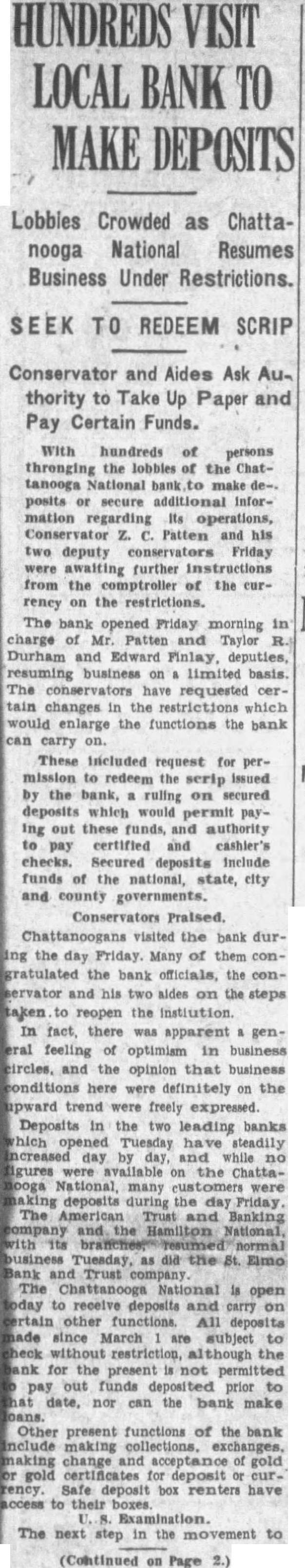

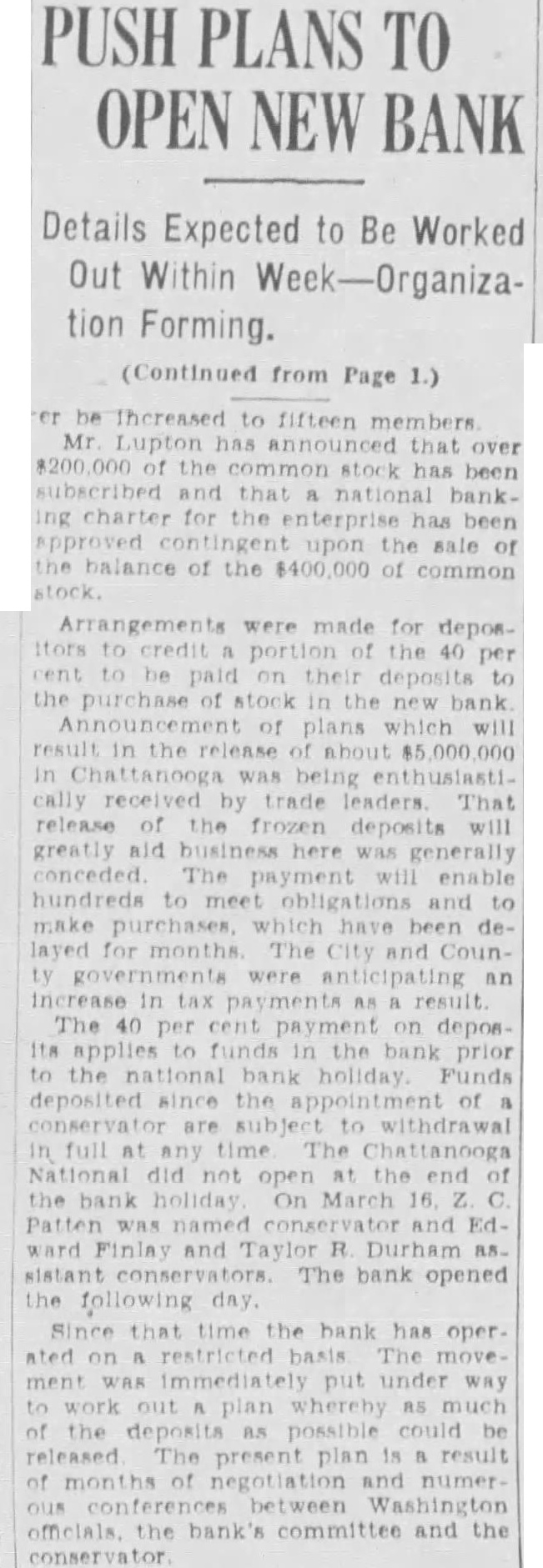

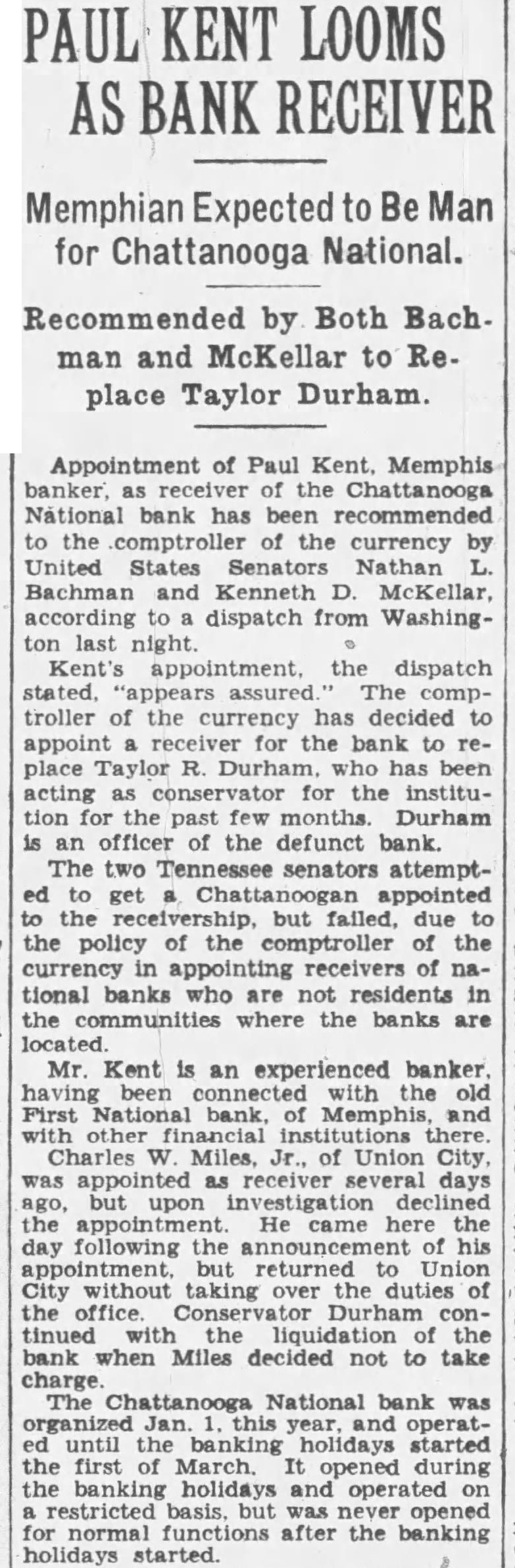

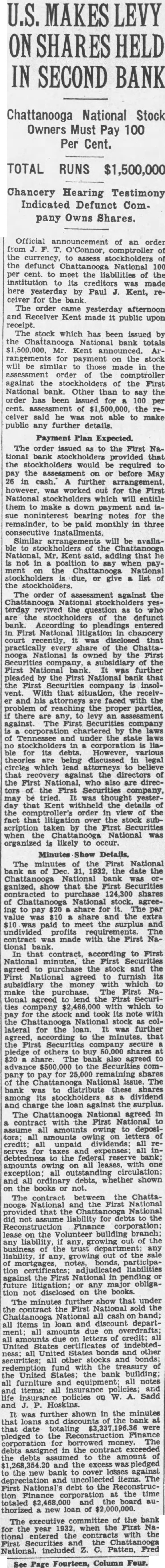

SECOND BANK

Chattanooga National Stock Owners Must Pay 100 Per Cent.

TOTAL RUNS $1,500,000

Chancery Hearing Testimony Indicated Defunct Company Owns Shares.

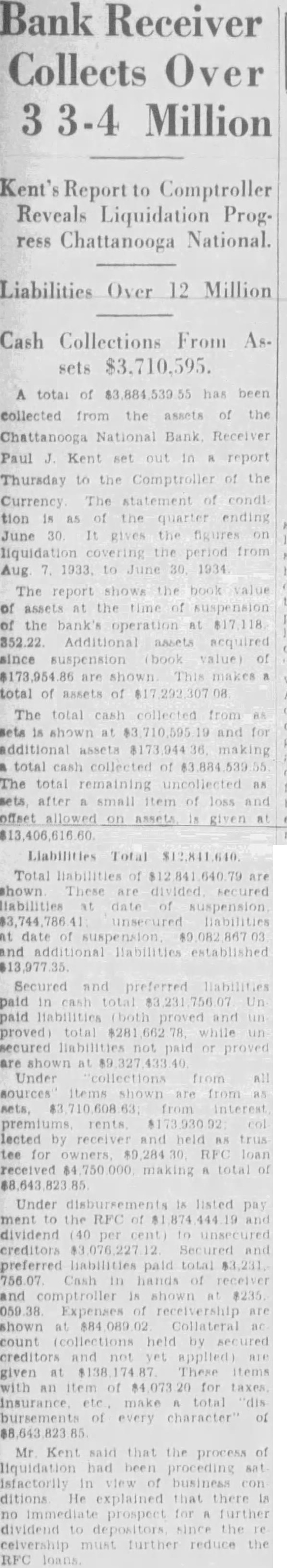

Official announcement of an order from T. O'Connor, comptroller the currency, assess stockholders the defunct Chattanooga National 100 cent. meet the liabilities the institution creditors made here yesterday by Paul Kent, receiver for the bank. The order came yesterday afternoon and Receiver Kent made public upon receipt. The stock which has been issued by the Chattanooga National bank totals Kent announced. Arrangements for payment on the stock will similar those made in the assessment the comptroller against stockholders of the First National Other than to say the order been issued 100 cent. assessment $1,500,000, the ceiver said he not able to make public further details.

Payment Plan Expected.

The order issued to the First National bank that the would required pay the before May in cash. further however, was worked out for the First National which will entitle them to make down sue bearing notes for the remainder, to be paid monthly in three consecutive installments. Similar arrangements will be availaof National, Mr. Kent said, adding that not in position to say when ment the National stockholders due, or give list stockholders. The order of assessment against the Chattanooga National stockholders terday the as the defunct According entered in First National chancery recently, that practically share the Chattanooga owned the Securities company, subsidiary the First National bank. It was further pleaded by the First National that the First company insolvent. With that and his attorneys faced the reaching the proper parties, there any, levy against. The First Securities company chartered Tennessee and under state stockholders corporation for its debts. However, theories discussed legal circles which lead that against the of the First who are directors the First Securities company, may tried. thought day that Kent withheld the details the comptroller's order view the that litigation stock the First when National was organized likely to

Minutes Show Details. The minutes the First National bank of 1932, date Chattanooga ganized, show that the First contracted 124,300 shares National agreeing to pay share The par $10 share and the extra $10 was paid meet the surplus and undivided profits The contract made with the First National contract, according to First minutes, First agreed purchase the stock the First agreed furnish its subsidiary the money which make purchase. The First tional agreed the First Securicompany which stock and took note with stock collateral for the loan. was further the minutes, that Securities secure pledge others shares share. bank also agreed advance to the Securities comfor 25,000 remaining shares the Chattanooga The bank to shares among dividend and charge the against the surplus. The National agreed contract with the First assume to deposiall amounts owing letters credit; unpaid dividends; taxes and expenses; debtedness amounts all and debts, shown the books contract the Chattathe First National provided that National did not liability for debts to assume Finance corporation; the Volunteer liability of business the any liability, any, growing out the mortgages, bonds, adjudicated liabilities against the First National in pending future litigation major obligadisclosed books. The minutes further show that under the contract cash hand; items loan discount departdue on due letters credit; States certificates indebtedStates bonds other ness; United stocks and redemption fund treasury United States; the bank building; notes all furniture and items; all policies; policies on Sadd insurance and Hoskins. was further shown the minutes loans bank date totaling were pledged the borrowed The in the the to the amount and the the new bank to cover losses against uncollected items. The First National's debt to the ReconstrucFinance the time corporation totaled board authorized new loan of

The executive committee of the bank 1932, when the First the year with the First the National, included Patten, Fred

See Page Fourteen, Column Four.