Article Text

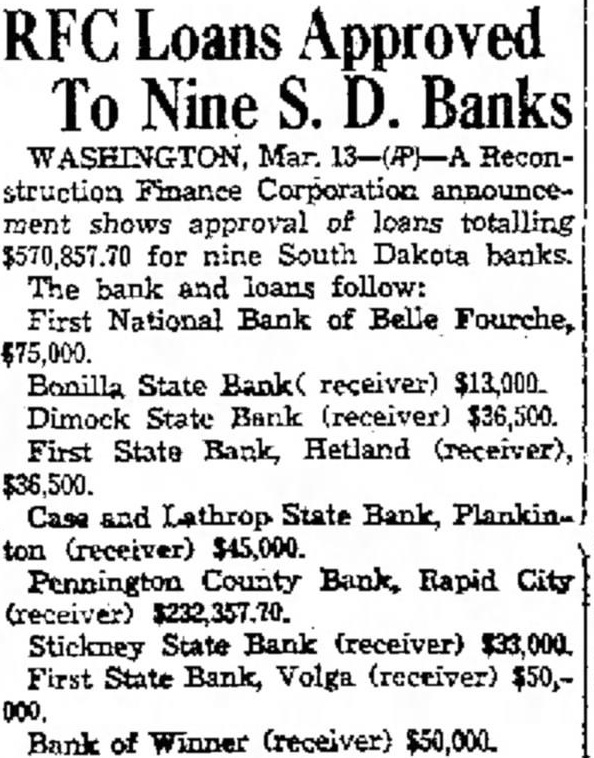

Approved To Nine S. Banks WASHINGTON Mar. Reconstruction Finance Corporation announcement shows approval of loans totalling $570,857.70 for nine South Dakota banks. The bank and loans follow: First National Bank of Belle Fourche, $75,000. Bonilla State Bank( receiver) $13,000. Dimock State Bank (receiver) $36,500. First State Bank, Hetland (receiver), $36,500. Case Lathrop State Bank, Plankinton (receiver) $45,000. Pennington County Bank, Rapid City (receiver) Stickney State Bank (receiver) $33,000. First State Bank, Volga (receiver) $50,Bank of Winner (receiver) $50,000.