Article Text

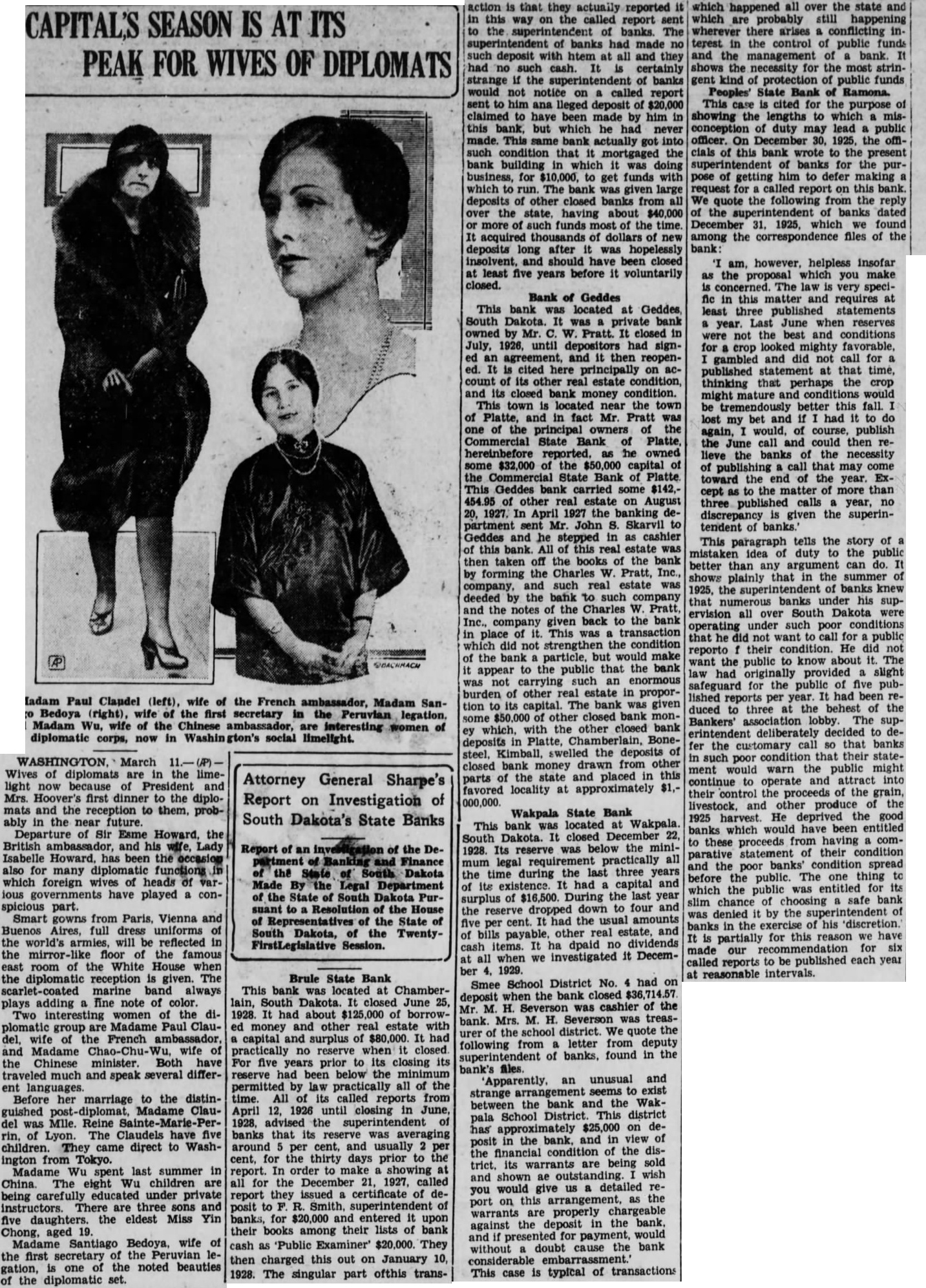

CAPITAL'S SEASON IS AT ITS PEAK FOR WIVES OF DIPLOMATS Wives of diplomats are in the limelight now because of President and Mrs. Hoover's first dinner to the diplomats and the reception to them. probably in the near future. Departure of Sir Esme Howard, the British ambassador, and his wife, Lady Isabelle Howard. has been the occasion also for many diplomatic functions in which foreign wives of heads of various governments have played a conspicious part. Smart gowns from Paris. Vienna and Buenos Aires, full dress uniforms of the world's armies, will be reflected in the mirror-like floor of the famous east room of the White House when the diplomatic reception is given. The scarlet-coated marine band always plays adding a fine note of color. Two interesting women of the diplomatic group are Madame Paul Claudel, wife of the French ambassador. and Madame Chao-Chu-Wu, wife of the Chinese minister. Both have traveled much and speak several different Before her marriage to the distinguished post-diplomat, Madame Claudel was Mlle. Reine Sainte-Marie-Perrin, of Lyon. The Claudels have five children. They came direct to Washington from Tokyo. Madame Wu spent last summer in China The eight Wu children are being carefully educated under private instructors. There are three sons and five daughters. the eldest Miss Yin Chong, aged 19. Madame Santiago Bedoya, wife of the first secretary of the Peruvian legation, one of the noted beauties of the diplomatic set. Attorney General Sharpe's Report on Investigation of South Dakota's State Banks Report of an of the Department of and Finance the State of South Dakota Made By the Legal Department of the State of South Dakota Pursuant to a Resolution of the House of Representatives of the State of South Dakota, of the TwentyFirstLegislative Session. Brule State Bank This bank was located at Chamberlain, South Dakota. It closed June 25, 1928. It had about $125,000 of borrowed money and other real estate with a capital and surplus of $80,000. It had practically no reserve when it closed For five years prior to its closing its reserve had been below the minimum permitted by law practically all of the time. All of its called reports from April 12, 1926 until closing in June, 1928, advised the superintendent of banks that its reserve was averaging around per cent, and usually 2 per cent, for the thirty days prior to the report. In order to make showing at all for the December 21, 1927, called report they issued certificate of deposit to F. R. Smith, superintendent of banks, for $20,000 and entered it upon their books among their lists of bank cash as Public Examiner' $20,000. They then charged this out on January 10, 1928. The singular part ofthis trans- action is that they actually reported it in this way on the called report sent to the superintendent of banks. The superintendent of banks had made no such deposit with htem at all and they had no such cash. It is certainly strange if the superintendent of banks would not notice on a called report sent to him ana lleged deposit of $20,000 claimed to have been made by him in this bank, but which he had never made. This same bank actually got into such condition that it mortgaged the bank building in which it was doing business, for $10,000. to get funds with which to run. The bank was given large deposits of other closed banks from all over the state. having about $40,000 or more of such funds most of the time. It acquired thousands of dollars of new deposits long after it was hopelessly insolvent, and should have been closed at least five years before it voluntarily closed. Bank of Geddes This bank was located at Geddes, South Dakota. It was a private bank owned by Mr. C. W. Pratt. It closed in July, 1926, until depositors had signed an agreement, and it then reopened. It is cited here principally on account of its other real estate condition, and its closed bank money condition. This town is located near the town of Platte, and in fact Mr. Pratt was one of the principal owners of the Commercial State Bank of Platte, hereinbefore reported. as the owned some $32,000 of the $50,000 capital of the Commercial State Bank of Platte This Geddes bank carried some $142,454.95 of other real estate on August 20, 1927. In April 1927 the banking department sent Mr. John S. Skarvil to Geddes and he stepped in as cashier of this bank. All of this real estate was then taken off the books of the bank by forming the Charles W. Pratt, Inc., company, and such real estate was deeded by the bank to such company and the notes of the Charles W. Pratt, Inc., company given back to the bank in place of it. This was a transaction which did not strengthen the condition of the bank a particle, but would make it appear to the public that the bank was not carrying such an enormous burden of other real estate in proportion to its capital. The bank was given some $50,000 of other closed bank money which. with the other closed bank deposits in Platte, Chamberlain, Bonesteel, Kimball, swelled the deposits of closed bank money drawn from other parts of the state and placed in this favored locality at approximately $1,000,000. Wakpala State Bank This bank was located at Wakpala South Dakota. It closed December 22, 1928. Its reserve was below the minimum legal requirement practically all the time during the last three years of its existence. It had a capital and surplus of $16,500. During the last year the reserve dropped down to four and five per cent. It had the usual amounts of bills payable, other real estate, and cash items. It ha dpaid no dividends at all when we investigated it December 1929. Smee School District No. 4 had on deposit when the bank closed $36,714.57 Mr. M. H. Severson was cashier of the bank. Mrs. M. H. Severson was treasurer of the school district. We quote the following from a letter from deputy superintendent of banks, found in the bank's files. Apparently. an unusual and strange arrangement seems to exist between the bank and the Wakpala School District. This district has approximately $25,000 on deposit in the bank, and in view of the financial condition of the district. its warrants are being sold and shown ae outstanding wish you would give us detailed report on this arrangement, as the warrants are properly chargeable against the deposit in the bank. and if presented for payment, would without doubt cause the bank considerable embarrassment.' This case is typical of transactions which happened all over the state and which are probably still happening wherever there arises a conflicting interest in the control of public funds and the management of a bank. It shows the necessity for the most stringent kind of protection of public funds Peoples' State Bank of Ramona. This case is cited for the purpose of showing the lengths to which misconception of duty may lead a public officer. On December 30, 1925, the officials of this bank wrote to the present superintendent of banks for the purpose of getting him to defer making a request for called report on this bank. We quote the following from the reply of the superintendent of banks dated December 31, 1925, which we found among the correspondence files of the bank: 'I am, however, helpless insofar as the proposal which you make is concerned. The law is very specific in this matter and requires at least three published statements a year. Last June when reserves were not the best and conditions for crop looked mighty favorable, I gambled and did not call for a published statement at that time, thinking that perhaps the crop might mature and conditions would be tremendously better this fall. lost my bet and if had it to do again, would, of course, publish the June call and could then relieve the banks of the necessity of publishing call that may come toward the end of the year. Except as to the matter of more than three published calls a year, no discrepancy given the superintendent of banks. This paragraph tells the story of mistaken idea of duty to the public better than any argument can do. It shows plainly that in the summer of 1925, the superintendent of banks knew that numerous banks under his supervision all over South Dakota were operating under such poor conditions that he did not want to call for public reporto their condition. He did not want the public to know about it. The law had originally provided a slight safeguard for the public of five published reports per year. It had been reduced to three at the behest of the Bankers' association lobby. The superintendent deliberately decided to defer the customary call so that banks in such poor condition that their statement would warn the public might continue to operate and attract into their control the proceeds of the grain, livestock. and other produce of the 1925 harvest. He deprived the good banks which would have been entitled to these proceeds from having comparative statement of their condition and the poor banks' condition spread before the public. The one thing to which the public was entitled for its slim chance of choosing a safe bank was denied it by the superintendent of banks in the exercise of his discretion. It is partially for this reason we have made our recommendation for six called reports to be published each year at reasonable intervals.