Article Text

# THE WAY BANKS ARE MANAGED IN CONNECTICUT.

[From the New Haven Courier, May 28.]

We are obliged to Mr. Commissioner Noyce for copy of the Bank Commissioners' Report for the yearjst expired.

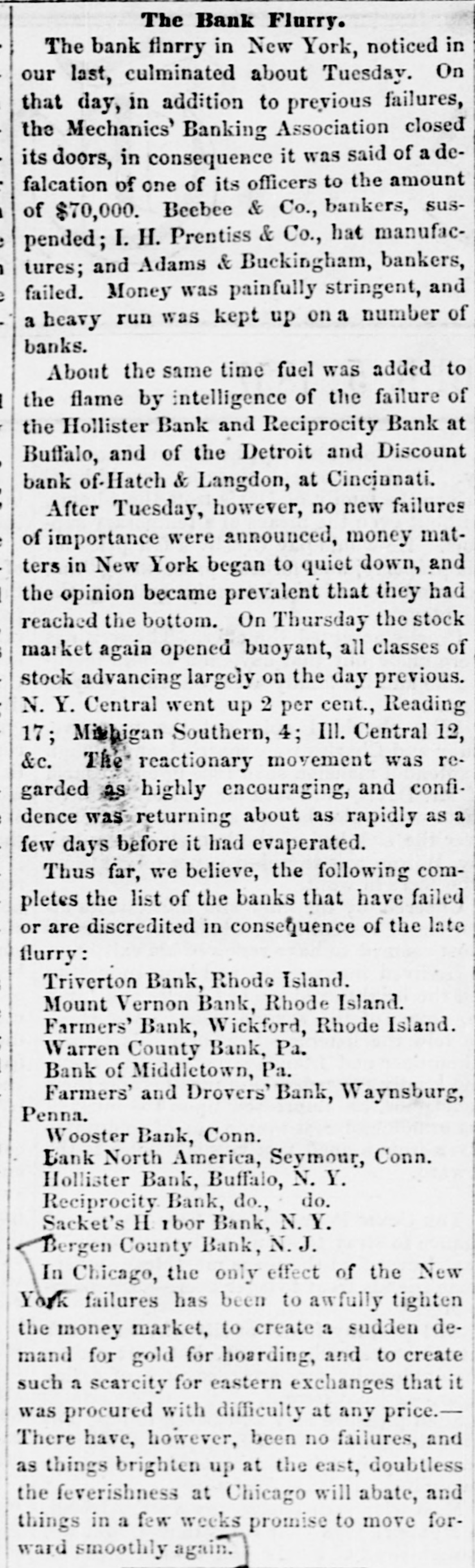

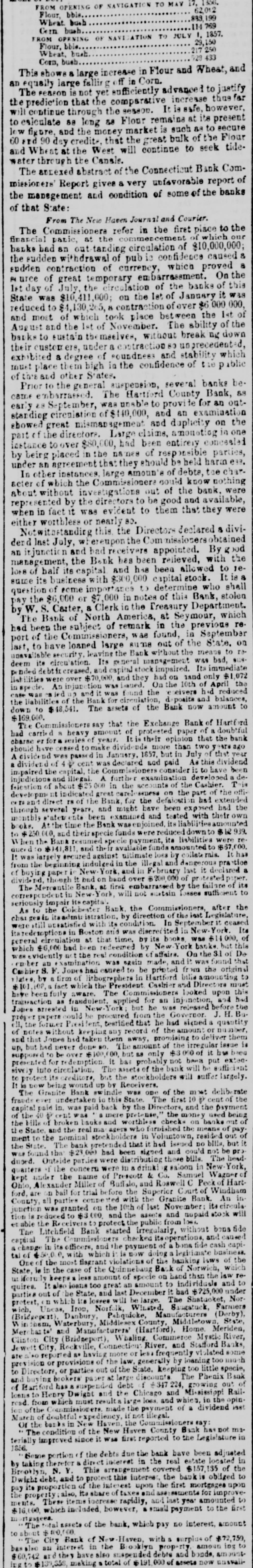

The commissioners refer in the first place to the financial panis, at the commencement of which our banks had he outstanding circulation of $10,000,000; the sudden withdrawal of public confidence caused a sudden contraction of currency, which proved a source of great temporary embarrassment. On the first day of July the circulation of the banks of this State was $10,411,000; on the first of January it was reduced to $4,130,266, a contraction of over $6,000,000, and most of which took place between the first of August and the first of November. The ability of the banks to sustain themselves, without breaking down their customers, under a contraction so unprecedented, exhibited a degree of soundness and stability which must place them high in the confidence of the public of this and other States.

With but few exceptions, they continued to redeem their notes in Boston and New York, and to pay specie at their banking house until the general suspension of the banks in New York and Boston, which took place on the 14th of October. On the 15th most of the banks of this State suspended specie payment, but in a majority of cases continued their redemption in Boston or New York, thus keeping the currency of this State from depreciation, and enabling all parts of the country possessing it to go forward in the liquidation of their debts, without suffering loss from the currency of Connecticut. Of the nine banks chartered by the last Legislature only the Etna, Merchants' and Manufacturers' of Hartford, and Bank of Norwalk, have gone into operation.

Prior to the general suspension several banks became embarrassed The Harford County Bank, as early as September, was unable to provide for an outstanding circulation of $440.000, and an examination showed great mismanagement and duplicity on the part of the directors. Large claims, amounting in one instance to over $80,000, had been entirely concealed by being placed in the names of responsible parties, under an agreement that they should be held harmless.

In other instances large amounts of debts, the character of which the commissioners could know nothing about without investigations out of the bank, were represented by the directors to be good and available, when in fact it was evident to them that they were either worthless or nearly so. Notwithstanding this the directors declared a dividend last July, whereupon the commissioners obtained an injunction and had receivers appointed. By good management the bank has been relieved, with the loss of half its capital, and has been allowed to resume its business with $300,000 stock. It is a question of some importance to determine who shall pay the $6,000 or $7,000, in notes of this bank, stolen by W. S. Carter, a clerk in the treasury department

The Bank of North America, at Seymour, which had been the subject of remark in the previous report of the commissioners, was found in September last to have loaned large sums out of the State, on unavailable security, leaving the bank without the means to redeem its circulation. Its general management was bad, suspended debt increased, and capital stock impaired. Its immediate liabilities were over $70.000, and they had on hand only $1,072 in specie. An injunction was issued. On the 10th of April the case was called up, and it was found the receivers had reduced the liabilities of the bank for circulation, deposits and balances, down to $48,541. The assets of the bank now amount to $169,000.

The commissioners say that the Exchange Bank of Hartford had carried a heavy amount of protested paper of a doubtful character for a series of years. It is their opinion that the bank should have ceased to make dividends more than two years ago. A dividend was passed in January, 1857, but in July of that year a dividend of 4 per cent was declared and paid. As this dividend impaired the capital the commissioners consider it to have been injudicious and illegal. A further examination developed a defalcation of about $25,000 in the accounts of the Cashier. This developement indicated great carelessness on the part of the officers and directors of the bank, for the defalcation had extended through several years, and might have been exposed, had the monthly statements been examined and tested with their own books. At the time the bank was enjoined its liabilities amounted to $250,000, and their specie funds were reduced down to $2,939. When the bank resumed specie payments its liabilities were reduced to $141,811, and their available funds amounted to $67,000. It was largely secured against ultimate loss by collaterals. It has from the beginning indulged in the illegal and dangerous practice of buying paper in New York, and in February last it declared a dividend, though it had on hand over $200,000 of protested paper.

The Mercantile Bank, at first embarrassed by the failure of its correspondent in New York, will not sustain losses sufficient to seriously impair its capital.

As to the Colchester Bank, the commissioners, after the changes in its administration, by direction of the last legislature, were still unsatisfied with its condition. In September it ceased its redemptions in Boston and was discredited in New York. Its general circulation at that time, by its books, was $14,000, of which $6,000 had been redeemed by New York banks; but this was evidently not the real condition of affairs. On the 3d of December an examination was made again, and it was found that Cashier F. S. Jones had caused to be printed from the original plates, by a firm of lithographers in Hartford, bills amounting to $101,108, a fact of which the president, cashier and directors must have been fully aware. The commissioners looked upon this transaction as fraudulent, applied for an injunction, and had Jones arrested in New York; but he was released before the proper papers could be procured from the Governor. J. H. Buell, the former President, testified that he had signed a quantity of notes without keeping any record of the amount or number, and that Jones had taken them away, promising to deliver them up, but had never done so. The amount of the irregular issue is supposed to be over $100,000, but as only $3,000 of it has been presented for redemption, it has probably not been put extensively into circulation. The assets of the bank will be sufficient to protect its creditors, but the stockholders will suffer largely. It is now being wound up by receivers.

The Granite Bank swindle was one of the most deliberate frauds ever undertaken in this State. The first 10 per cent of the capital paid in was paid back by the directors, and the payment of the 40 per cent. was "a mere pretence," the money used being the bills of broken banks and worthless checks on banks out of the State, and the real managers who furnished the means of payment to the nominal stockholders in Voluntown resided out of the State. The bank pretended that it had issued no bills, but it was found that $23,000 had been signed and could not be produced. Outside parties were distributing these bills the headquarters of the concern were in a drinking saloon in New York, kept under the name of Prescott & Co. Samuel Wagner, of Ohio, Alexander Miller, of Buffalo, and Roswell C. Peck, of Hartford, are held on bail for trial before the Superior Court of Windham county as parties connected with the Granite Bank. An injunction was granted on the 10th of last November; its circulation is reduced to $3,000, and the assets and unpaid stock will enable the receivers to protect the public from loss.

The Litchfield Bank started irregularly, without a bona fide capital. The commissioners checked its operations, and caused a change in its officers, and the payment of a bona fide cash capital of $50,000, with which it is now doing a legitimate business.

One of the most flagrant violations of the banking laws of the State is in the case of the Quinnebaug Bank, of Norwich, which uniformly keeps a less amount of specie on hand than the law requires. It also loans too great an amount to individuals and to parties out of the State, and last December it had $225,000 under protest, on which its losses will be large. The Shetucket, Norwich, Uncas, Iron, Norfolk, Winsted. Saugaluck, Farmers' (Bridgeport), Danbury, Pabquioke, Manufacturers' (Derby), Windham, Waterbury, Middlesex County, Middletown, State, Merchants' and Manufacturers' (Hartford), Home, Meriden, Clinton, City (Bridgeport), Whaling, Commerce, Mystic River, Jewett City, Rockville, Connecticut River, and Stafford Banks are also reported as having, more or less, frequently violated some provision or provisions of the law, generally by loaning too much to directors or parties out of the State, keeping too little specie and buying brokers' paper at large discounts. The Phoenix Bank of Hartford has a suspended debt of $347,224, growing out of loans to Henry Dwight and the Chicago and Mississippi Railroad, from which must result a large loss, and which, in the opinion of the commissioners, made the payment of a dividend last March of doubtful expediency, if not illegal.

Of the banks in New Haven, the commissioners say:

The condition of the New Haven County Bank has not materially improved since it was first reported to the Legislature in 1856.

Some portion of the debts due the bank have been adjusted by taking therefor a direct interest in the real estate, located in Brooklyn, N. Y. This arrangement covered $137,135 of the Dwight debt, and to protect this interest the bank is obliged to pay its proportion of the interest upon the first mortgages upon the property; also, its share of taxes and assessments for improvements. These items increase rapidly, and last year amounted to $16,000, which included, however, a small payment to the first mortgagees.

The directors have been careful at all times to keep at command available means sufficient to protect the bill holders and depositors. But it is not in harmony with the uniform policy of the State to allow a bank so greatly depreciated to represent so large a capital stock. In the opinion of the commissioners the capital of the bank should be reduced to a proper level or its affairs placed