Article Text

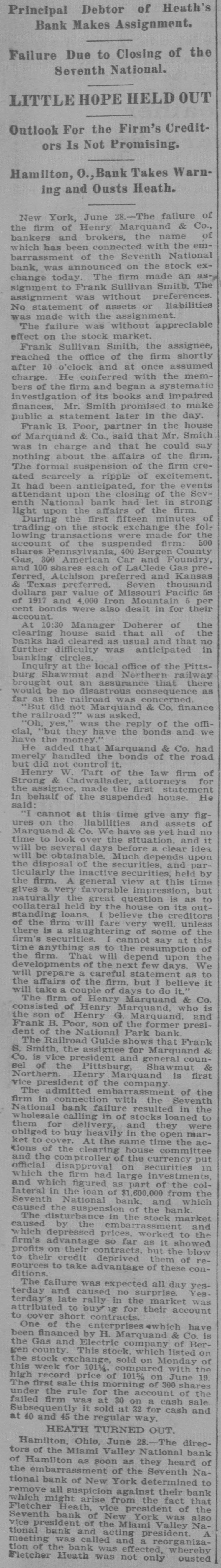

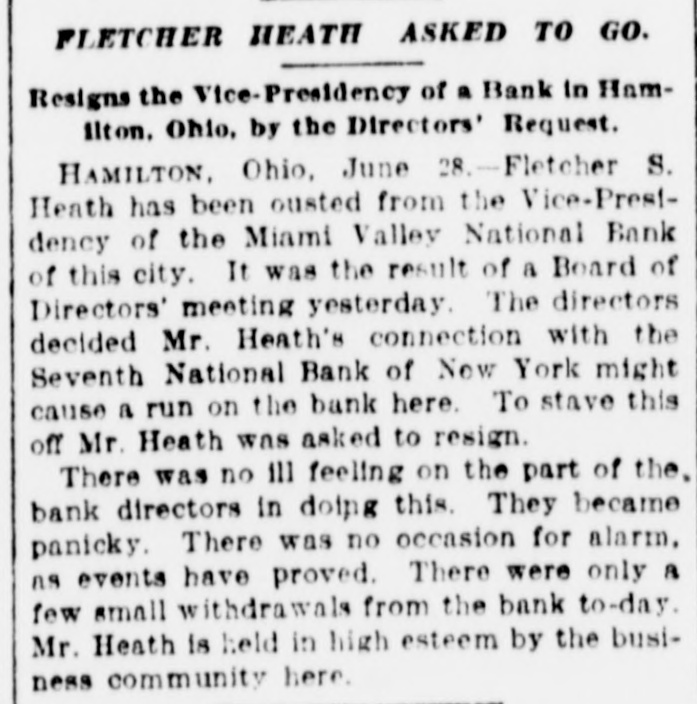

Principal Debtor of Heath's Bank Makes Assignment. Failure Due to Closing of the Seventh National. LITTLEHOPE HELD OUT Outlook For the Firm's Creditors Is Not Promising. Hamilton, 0., Bank Takes Warning and Ousts Heath. New York, June 28.-The failure Co., of the firm of Henry Marquand & of and brokers, the name bankers with the emwhich has been connected barrassment of the Seventh National bank, was announced on the stock exchange today. The firm made an The assignment to Frank Sullivan Smith. assignment was without preferences. No statement of assets or liabilities made with the assignment. was The failure was without appreciable effect on the stock market. Frank Sullivan Smith, the assignee, reached the office of the firm shortly after 10 o'clock and at once assumed charge. He conferred with the members of the firm and began a systematic investigation of its books and impaired finances. Mr. Smith promised to make public a statement later in the day. Frank B. Poor, partner in the house of Marquand & Co., said that Mr. Smith was in charge and that he could say nothing about the affairs of the firm. The formal suspension of the firm created scarcely a ripple of excitement. It had been anticipated, for the events Sevattendant upon the closing of the enth National bank had let in strong light upon the affairs of the firm of During the first fifteen minutes foltrading on the stock exchange the the lowing transactions made for 500 of the suspended firm account County shares nsvlvania 400 Bergen Gas, 300 American Car and Foundry, and 100 shares each of LaClede Gas preferred, Atchison preferred and Kansas Seven thousand Texas preferre 5s dollars par value of Missouri Pacific of 1917 and 4.000 Iron Mountain 5 per cent bonds were also dealt in for their account. At 10:30 Manager Doherer of the clearing house said that all of the banks had cleared as usual and that no in further difficulty was anticipated banking circles. Inquiry at the local office of the Pittsburg Shawmut and Northern railway brought out an assurance that there would be no disastrous consequence as far as the railroad was concerned. 'But did not Marquand & Co. finance the railroad was asked. Oh, yes," was the reply of the official, 'but they have the bonds and we the have money He added that Marquand & Co. had merely handled the bonds of the road but did not control it. Henry W. Taft of the law firm of Strong & Cadwallader, attorneys for the assignee, made the first statement in behalf of the suspended house. He said: cannot at this time give any figures on the liabilities and assets of Marquand & Co. We as yet had no time to look over the situation. and it will be several days before a clear idea will be obtainable. Much depends upon the disposal of the securities, and particularly the inactive securities held by the firm. A general view at this time gives a very favorable impression, but naturally the great question is as to collateral held by the house on its outstanding loans. I believe the creditors of the firm will fare very well. unless there is slaughtering of some of the firm's securities. I cannot say at this time anything as to the resumption of the firm. That will depend upon the developments of the next few days We will prepare a careful statement as to the affairs of the firm. but I believe it will take a couple of days to do it. The firm of Henry Marquand & Co consisted of Henry Marquand, who is the son of Henry G. Marquand, and Frank B. Poor, son of the former president of the National Park bank The Railroad Guide shows that Frank S. Smith. the assignee for Marquand & Co. is vice president and general counsel of the Pittsburg. Shawmut & Northern. Henry Marquand is first vice president of the company The admitted embarra of the firm in connection with the Seventh National bank failure resulted in the wholesale calling in of stocks loaned to them for delivery, and they were obliged to buy heavily in the open market to cover. At the same time the tions of the clearing house committee and the comptroller of the currency put official disapproval on securities in which the firm had large investments, and which figured as part of the collateral in the ioan of $1,600,000 from the Seventh National bank and which caused the suspension of the bank The distur bance in the stock market caused by the embar and which depressed prices, worked to the firm's advantage so far as it showed profits on their contracts. but the blow to their credit deprived them of resources to take advantage of these conditions. The failure was expected all day yesterday and caused no surprise. Yes terday's late rally in the market was attributed to buy g for their account to cover short contracts. One of the enterprises which have been financed by H. Marquand & Co. is the Gas and Electric company of Bergen county This stock. which listed on the stock exchange, sold on Monday of this week for 1011/4 compared with the high record price of 101% on June 19 The first sale this morning of 300 shares under the rule for the account of the failed firm was at 30 on a cash sale Subsequently it sold at 32 for cash and at 40 and 45 the regular way. HEATH TURNED OUT. Hamilton, Ohio, June 8.-The directors of the Miami Valley National bank of Hamilton as soon as they heard of the embarrassment of the Seventh National bank of New York determined to remove all suspicion against their bank which might arise from the fact that Fletcher Heath vice president of the Seventh bank of New York was also vice president of the Miami Valley National bank and acting president. A meeting was called and a reorganization of the bank was effected, whereby Fletcher Heath was not only ousted