Click image to open full size in new tab

Article Text

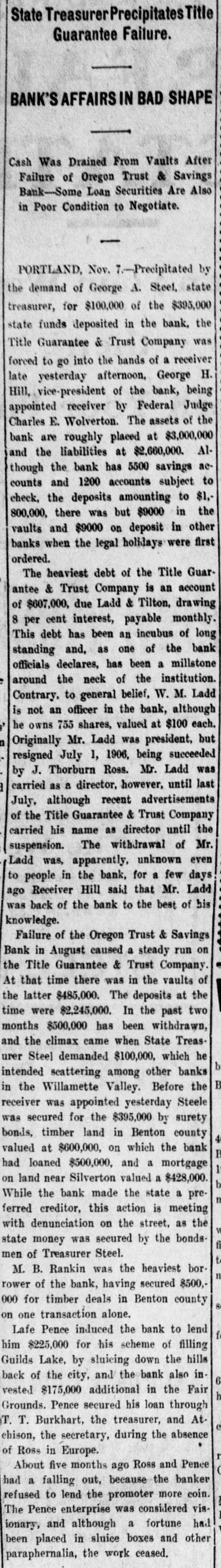

State Treasurer Precipitates Title Guarantee Failure. BANK'S AFFAIRS IN BAD SHAPE Cash Was Drained From Vaults After Failure of Oregon Trust & Savings Bank-Some Loan Securities Are Also in Poor Condition to Negotiate. PORTLAND, Nov. 7.-Precipitated by the demand of George A. Steet, state treasurer, for $100,000 of the $395,000 state funds deposited in the bank, the Title Guarantee & Trust Company was forced to go into the hands of a receiver late yesterday afternoon, George H. Hill, vice-president of the bank, being appointed receiver by Federal Judge Charles E. Wolverton. The assets of the bank are roughly placed at $3,000,000 and the liabilities at $2,660,000. Although the bank has 5500 savings accounts and 1200 accounts subject to check, the deposits amounting to $1,800,000, there was but $9000 in the vaults and $9000 on deposit in other banks when the legal holidays were first ordered. The heaviest debt of the Title Guarantee & Trust Company is an account of $607,000, due Ladd & Tilton, drawing 8 per cent interest, payable monthly. This debt has been an incubus of long standing and, as one of the bank officials declares, has been a millstone around the neck of the institution. Contrary, to general belief, W. M. Ladd is not an officer in the bank, although he owns 755 shares, valued at $100 each. Originally Mr. Ladd was president, but resigned July 1, 1906, being succeeded by J. Thorburn Ross. Mr. Ladd was carried as a director, however, until last July, although recent advertisements of the Title Guarantee & Trust Company carried his name as director until the suspension. The withdrawal of Mr. Ladd was, apparently, unknown even to people in the bank, for a few days ago Receiver Hill said that Mr. Ladd was back of the bank to the best of his knowledge. Failure of the Oregon Trust & Savings Bank in August caused a steady run on the Title Guarantee & Trust Company. At that time there was in the vaults of the latter $485,000. The deposits at the time were $2,245,000. In the past two months $500,000 has been withdrawn, and the climax came when State Treasurer Steel demanded $100,000, which he b intended scattering among other banks B in the Willamette Valley. Before the receiver was appointed yesterday Steele was secured for the $395,000 by surety bonds, timber land in Benton county 4 valued at $600,000, on which the bank B had loaned $500,000, and a mortgage 1 on land near Silverton valued a $428,000. b While the bank made the state a pren ferred creditor, this action is meeting with denunciation on the street, as the W state money was secured by the bondsfi men of Treasurer Steel. t M. B. Rankin was the heaviest born rower of the bank, having secured $500,000 for timber deals in Benton county S on one transaction alone. Lafe Pence induced the bank to lend f him $225,000 for his scheme of filling Guilds Lake, by sluicing down the hills back of the city, and the bank also in 6 vested $175,000 additional in the Fair h Grounds. Pence secured his loan through T. T. Burkhart, the treasurer, and Ate chison, the secretary, during the absence of Ross in Europe. r About five months ago Ross and Pence ( had a falling out, because the banker refused to lend the promoter more coin. PROV. The Pence enterprise was considered visionary, and although a fortune had been placed in sluice boxes and other paraphernalia, the work ceased.