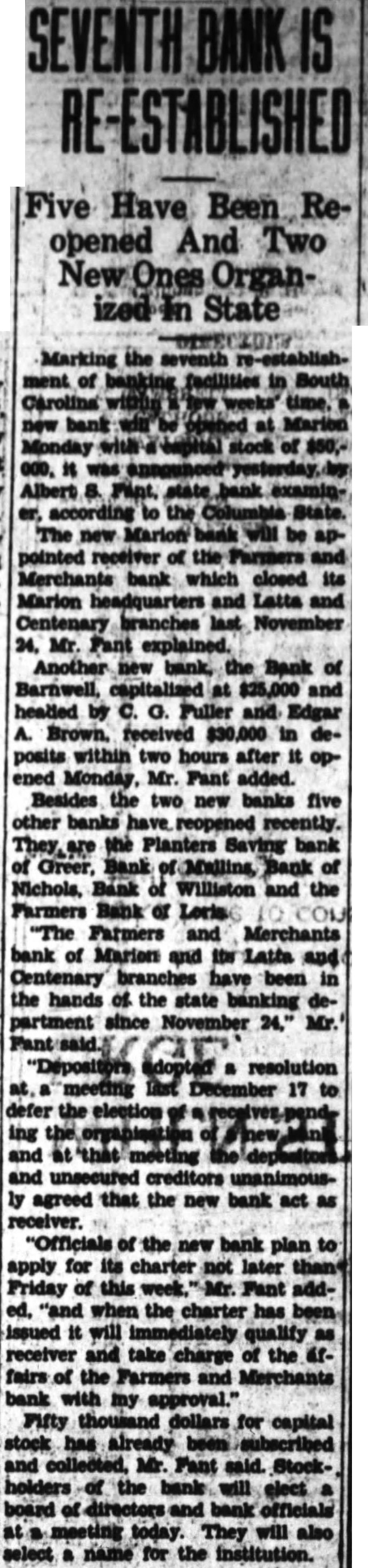

Article Text

Five Have Been Reopened And Two New Ones OrganState Marking the seventh ment of banking facilities in Carolina within weeks' new bank at Marion Monday stock of $50,000, it was Albert state according to the Columbia State. The new Marion bank will be appointed receiver of the Parmers and Merchants bank which closed its Marion headquarters and Latta and Centenary branches last November 24, Mr. Fant explained. Another new bank, the Bank of Barnwell, capitalized at $25,000 and headed by c. Fuller and Edgar A. Brown. received $30,000 in deposits within two hours after it opened Monday, Mr. Fant added. Besides the two new banks five other banks have reopened recently. the Planters Saving bank of Greer, Bank Bank of Nichols, Bank of Williston and the Farmers Bank or Loris "The Farmers and Merchants bank of Marion and the Latta and Centenary branches have been in the hands of the state banking department since November 24," Mr. Depositors resolution meeting December 17 to defer the election ing and at that meeting and unsecured creditors unanimously agreed that the new bank act as receiver. "Officials of the new bank plan to apply for its charter not later Friday of this week. Fant added. "and when the charter has been issued it will immediately qualify as receiver and take charge of the arfairs of the Farmers and Merchants bank with my approval." Fifty thousand dollars for capital stock has already been subscribed and collected, Mr. Fant said. Stockholders of the bank will elect board of directors and bank officials at a meeting today. They will also select a name for the institution.