Article Text

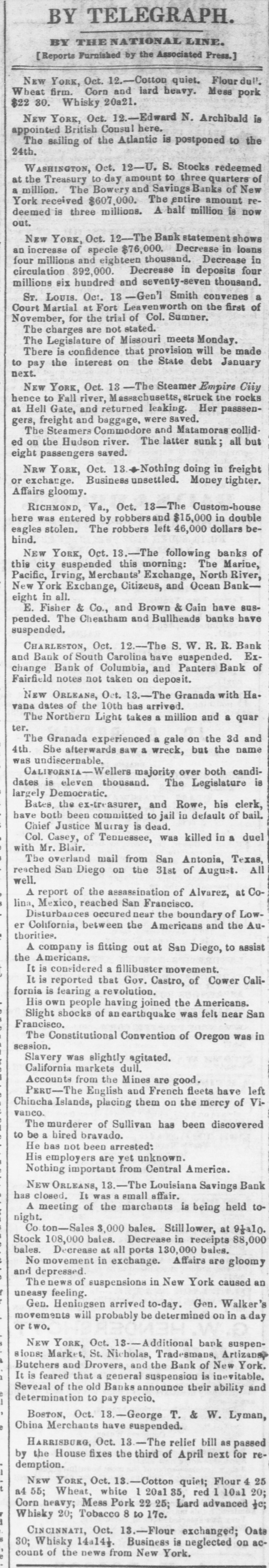

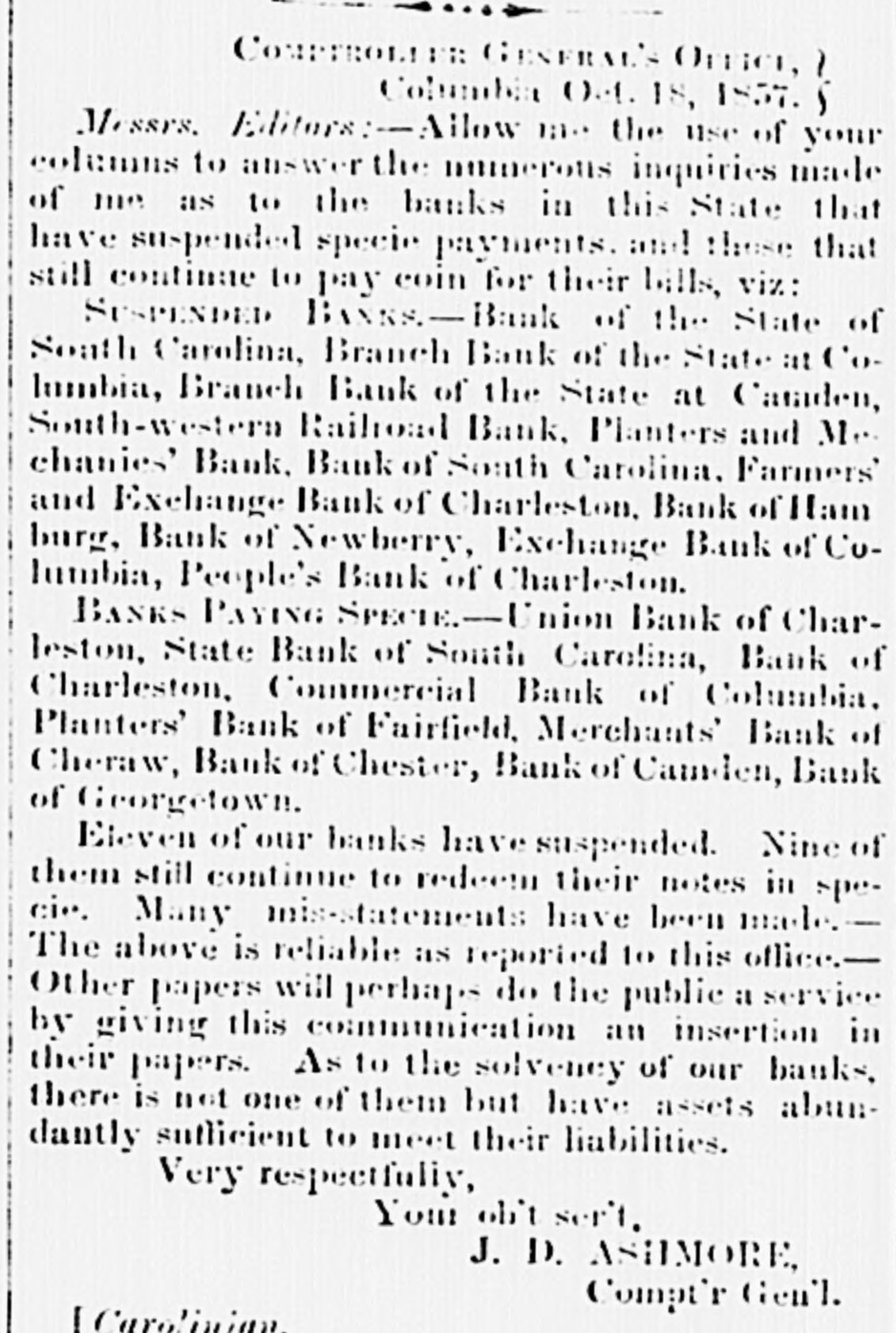

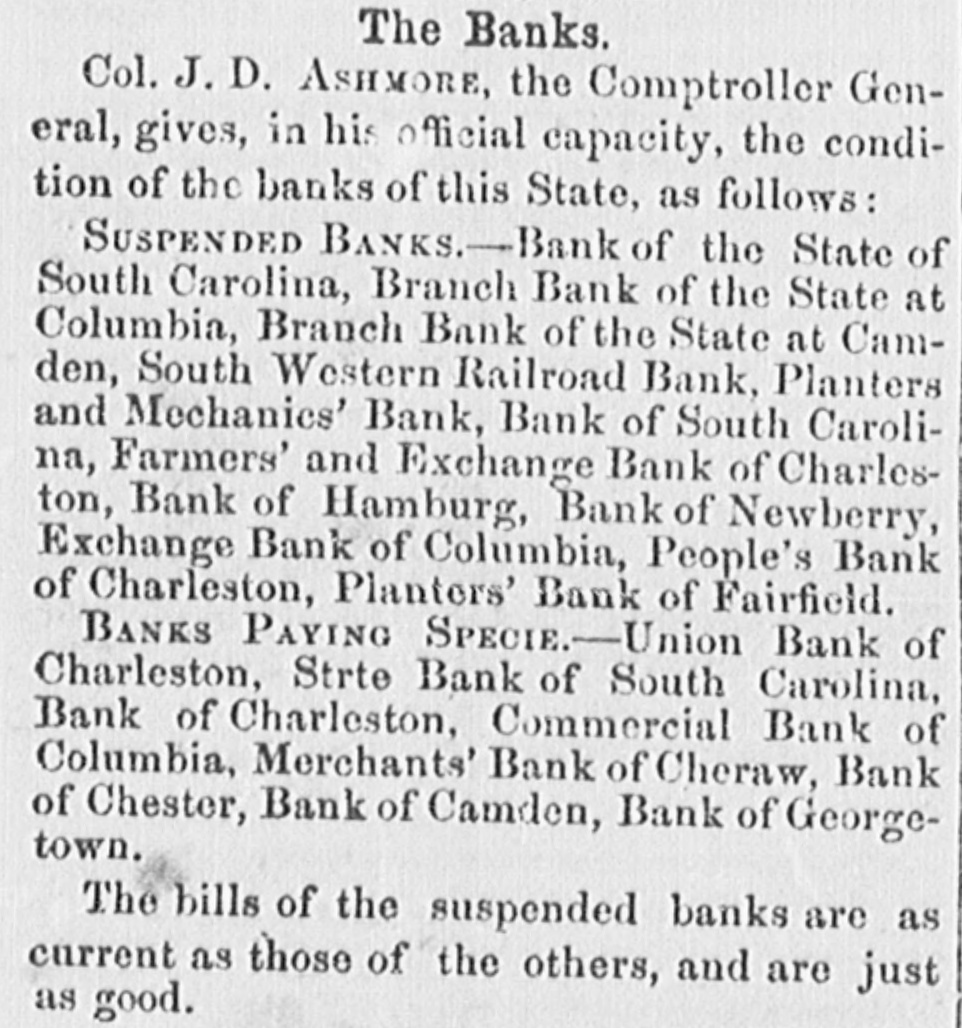

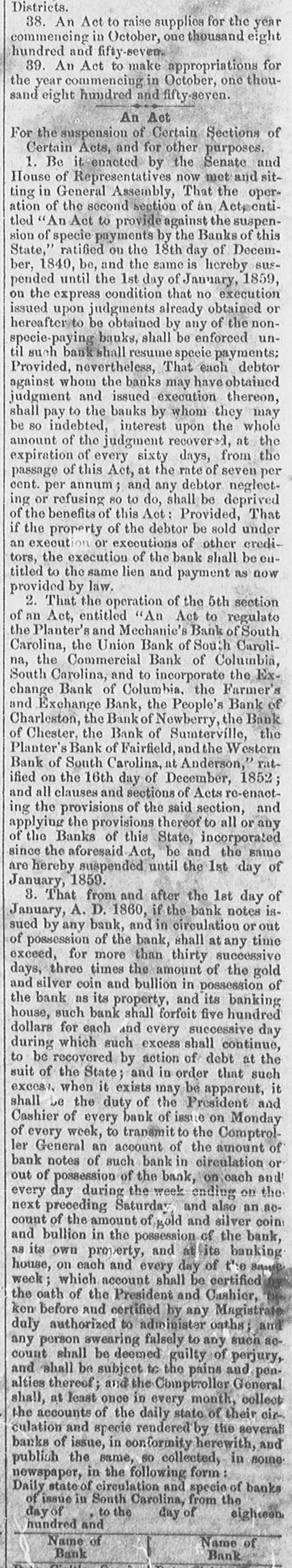

BY TELEGRAPH. BY THE NATIONAL LINE. [Reports Furnished by the Associated Press.] NEW YORK, Oct. 12.-Cotton quiet. Flour dull. Wheat firm. Corn and lard heavy. Mess pork $22 30. Whisky 20a21. NEW YORK, Oct. 12.-Edward N. Archibald is appointed British Consul here. The sailing of the Atlantic is postponed to the 24th. WASHINGTON, Oct. 12-U. S. Stocks redeemed at the Treasury to day amount to three quarters of & million. The Bowery and Savings Banks of New York received $607,000. The entire amount redeemed is three millions. A half million is now out. NEW YORK, Oct. 12-The Bank statement shows an increase of specie $76,000. Decrease in loans four millions and eighteen thousand. Decrease in circulation 392,000. Decrease in deposits four millions six hundred and seventy-seven thousand. Sr. LOUIS. Oct. 13 -Gen'l Smith convenes a Court Martial at Fort Leavenworth on the first of November, for the trial of Col. Summer. The charges are not stated. The Legislature of Missouri meets Monday. There is confidence that provision will be made to pay the interest on the State debt January next. NEW YORK, Oct. 13 -The Steamer Empire Ciiy hence to Fall river, Massachusetts, struck the rocks at Hell Gate, and returned leaking. Her passsengers, freight and baggage, were saved. The Steamers Commodore and Matamoras collided on the Hudson river. The latter sunk; all but eight passengers saved. NRW YORK, Oct. 13.-Nothing doing in freight or exchange. Business unsettled. Money tighter. Affairs gloomy. RICHMOND, Va., Oct. 13-The Custom-house here was entered by robbers and $15,000 in double eagles stolen. The robbers left 46,000 dollars behind. NEW York, Oct. 13.-The following banks of this city suspended this morning: The Marine, Pacific, Irving, Merchants' Exchange, North River, New York Exchange, Citizens, and Ocean Bankeight in all. E. Fisher & Co., and Brown & Cain have suspended. The Cheatham and Bullheads banks have suspended. CHARLESTON, Oct. 12.-The S. W. R. R. Bank and Bank of South Carolina have suspended. Exchange Bank of Columbia, and Panters Bank of Fairfield notes not taken on deposit. NEW ORLEANS, Oct. 13.-The Granada with Havana dates of the 10th has arrived. The Northern Light takes a million and a quar ter. The Granada experienced a gale on the 3d and 4th. She alterwards saw & wreck, but the name was undiscernable. CALIFORNIA-Wellers majority over both candidates is eleven thousand. The Legislature is largely Democratic. Bates, the ex-treasurer, and Rowe, bis clerk, have both been committed to jail in default of bail. Chief Justice Murray is dead. Col. Casey, of Tennessee, was killed in a duel with Mr. Blair. The overland mail from San Antonia, Texas, reached San Diego on the 31st of August. All well. A report of the assassination of Alvarez, at Colina, Mexico, reached San Francisco. Disturbances occurednear the boundary of Lower Colifornia, between the Americans and the Authorities. A company is fitting out at San Diego, to assist the Americans. It is considered a fillibuster movement. It is reported that Gov. Castro, of Cower California is fearing a revolution. His own people having joined the Americans. Slight shocks of an earthquake was felt near San Francisco. The Constitutional Convention of Oregon was in session. Slavery was slightly agitated. California markets dull. Accounts from the Mines are good. PERU-The English and French fleets have left Chincha Islands, placing them on the mercy of Vivanco. The murderer of Sullivan has been discovered to be a hired bravado. He has not been arrested: His employers are yet unknown. Nothing important from Central America. NEW ORLEANS, 13.-The Louisiana Savings Bank has closed. It was a small affair. A meeting of the marchants is being held tonight. Co ton-Sales $,000 bales. Still lower, at 91a10. Stock 108,000 bales. Decrease in receipts 88,000 bales. Decrease at all ports 130,000 bales. No movement in exchange. Affairs are gloomy and depressed. The news of suspensions in New York caused an uneasy feeling. Gen. Heningsen arrived to-day. Gen. Walker's movements will probably be determined on in a day or two. NEW YORK, Oct. 18-Additional bank suspensions: Market, St. Nicholas, Tradesmans, Artizans, Butchers and Drovers, and the Bank of New York. It is feared that a general suspension is inevitable. Several of the old Banks announce their ability and determination to pay specio, BOSTON, Oct. 13.-George T. & W. Lyman, China Merchants have suspended. HARRISBURG, Oct. 13.-The relief bill as passed by the House fixes the third of April next for redemption. NEW YORK, Oct. 18.-Cotton quiet; Flour 4 25 a4 55; Wheat, white 1 20a1 35, red 1 10a1 20; Corn heavy; Mess Pork 22 25; Lard advanced c; Whisky 20; Tobacco 8 to 17c. CINCINNATI, Oct. 13.-Flour exchanged; Oate 30; Whisky 14a144. Business is neglected on account of the news from New York.