Click image to open full size in new tab

Article Text

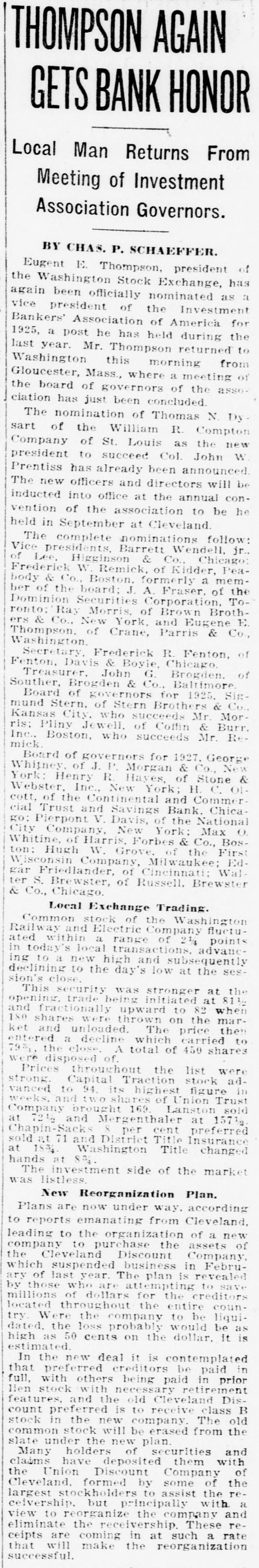

Local Man Returns From Meeting of Investment Association Governors. BY CHAS. P. SCHAEFFER. Eugent E. Thompson, president of the Washington Stock Exchange, has again been officially nominated as vice president of the Investment a Bankers' Association of a post he has held last 1925, America during the for year. Mr. Thompson returned to from Washington this morning Gloucester, Mass., where a meeting of the board of governors of the association has just been concluded The nomination of Thomas N. Dy sart of the William R. Compton Company of St. Louis as the new president to succeed Col. John W Prentiss has already been announced The new officers and directors will be inducted into office at the annual con. vention of the association to be he held in September at Cleveland The complete nominations follow: Vice presidents, Barrett Higginson & Co., W. Remick, of Frederick body of Lee. & Kidder, Wendell, Chicago: Pea- jr.. Co., Boston, formerly a board; J. A. Securities ber Dominion of the Corporation. Fraser. of mem- To- the ronto; Ray Morris, of Brown Brothers & Co., New York, and Eugene E Thompson. of Crane, Parris & Co., Washington Secretary, Frederick R. Fenton, of Davis & John G. Brogden & Co., Souther, Fenton, Treasurer. Board Boyle. Chicago. Brogden. Baltimore of of governors for of Stern Brothers City, who succeeds mund Kansas Stern, 1925, Mr. & Mor- Sig- Co., ris; Pliny Jewell, of Coffin & Burr. Inc., Boston, who succeeds Mr. Remick. Board of governors for 1927. George Whitney, of J. P. Morgan & Co., New York: Henry R. Hayes, of Stone & Webster, Inc., New York; H. C. 01cott. of the Continental and Commer cial Trust and Savings Bank. go: V. Davis, of the New York: City Pierpont Company, National Max Chica O. of Harris, Forbes & W. Grove. Company, Whitine, ton: Wisconsin Hugh Milwaukee; of the Co., First Bos- Edgar Friedlander, of Cincinnati; Walter S. Brewster, of Russell, Brewster & Co., Chicago. Local Exchange Trading. Common stock of the Washington Railway and Electric Company fluctuated within a range of 21/4 points in today's local transactions, advance ing to a new high and subsequently declining to the day's low at the session's close. This security was the trade being initiated 811. opening. and stronger at at fractionally upward to 82 when 180 shares were thrown on the market and unloaded. The a decline which the close. A total of 450 entered were 193, disposed of price carried shares then to Prices throughout the list were strong. Capital Traction stock advanced to 94. its highest figure in weeks, and two shares of brought 169 at Mergenthaler at Company 72% and Lanston Union 1571 Trust sold Chapin-Sacks 8 per cent preferred sold at 71 and District Title Insurance at 1834 Washington Title changed hands at 8% The investment side of the market was listless. New Reorganization Plan. Plans are now under way. according o reports emanating from Cleveland, leading to the organization of a new company to purchase the assets of he Cleveland Discount Company which suspended business in Februry of last year. The plan is revealed y those who are attempting to save millions of dollars for the creditors located throughout the entire counry. Were the company to be liquidated. the loss probably would be as high as 50 cents on the dollar. it is estimated. In the new deal it is contemplated that preferred creditors be paid in full, with others being paid in prior lien stock with necessary retirement features, and the old Cleveland Discount preferred is to receive class B stock in the new company. The old common stock will be erased from the slate under the new plan. Many holders of securities and claims have deposited them with the Union Discount Company of some of to the Cleveland, largest stockholders formed by assist the receivership, but principally with a to and eliminate the These review reorganize receivership. the company ceipts are coming in at such a rate that will make the reorganization