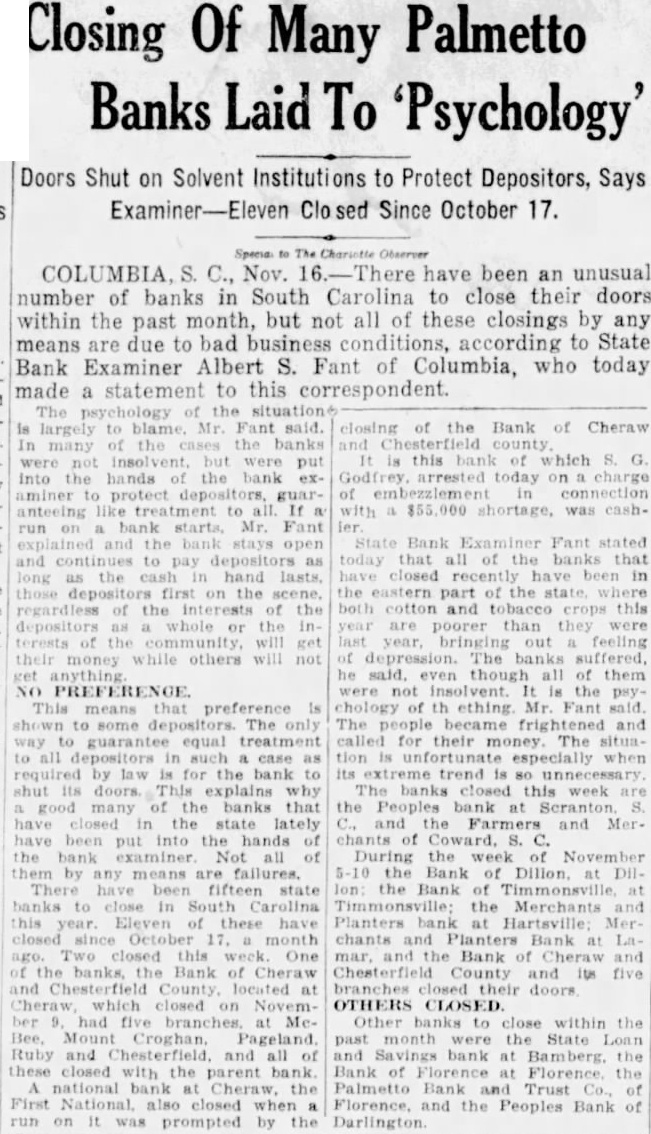

Article Text

Closing Of Many Palmetto Banks Laid To 'Psychology' Doors Shut on Solvent Institutions to Protect Depositors, Says Since October 17. COLUMBIA. C., Nov. have been an unusual number of banks in South Carolina to close their doors within the past month, but not all of these closings by any means are due to bad business conditions, according to State Bank Examiner Albert S. Fant of Columbia, who today made a statement to this correspondent. largely blame Mr said. closing many the banks were insolvent were the hands the bank aminer guar- of like treatment to all run bank Mr. Fant the and as today hand the regardless of the interests of the depositors as the money while others will not means preference The The way equal all case required law for the bank to doors. This explains good many of the banks that have closed the state lately been put into the hands of the bank examiner of by are There banks to Eleven these have month Two closed this the banks, Bank of Cheraw Chesterfield County located Cheraw which closed Novemhad branches. at Mount Ruby and all and these closed the parent bank national Cheraw, the First run on It was prompted by the of the Bank of Cheraw is this bank which Godfrey arrested today on charge connection shortage, was cashState Bank Fant stated all banks that in the eastern part the both and this poorer than they were bringing out feeling of The banks suffered. he said. though all of them were not insolvent the chology of th ething Mr. Fant and called for their The situawhen its extreme trend unnecessary banks closed this week the Peoples bank Scranton Farmers and MerDuring week November the Bank at DilIon: the Bank of the Merchants and Planters Hartsville; Merchants Bank mar, the Bank Cheraw and Chesterfield County and doors OTHERS CLOSED. Other close within the month the State Savings bank at Bamberg the Bank Florence the Palmetto Trust Florence. and the Peoples Bank of