Click image to open full size in new tab

Article Text

CURRENT NEWS.

WASHINGTON.

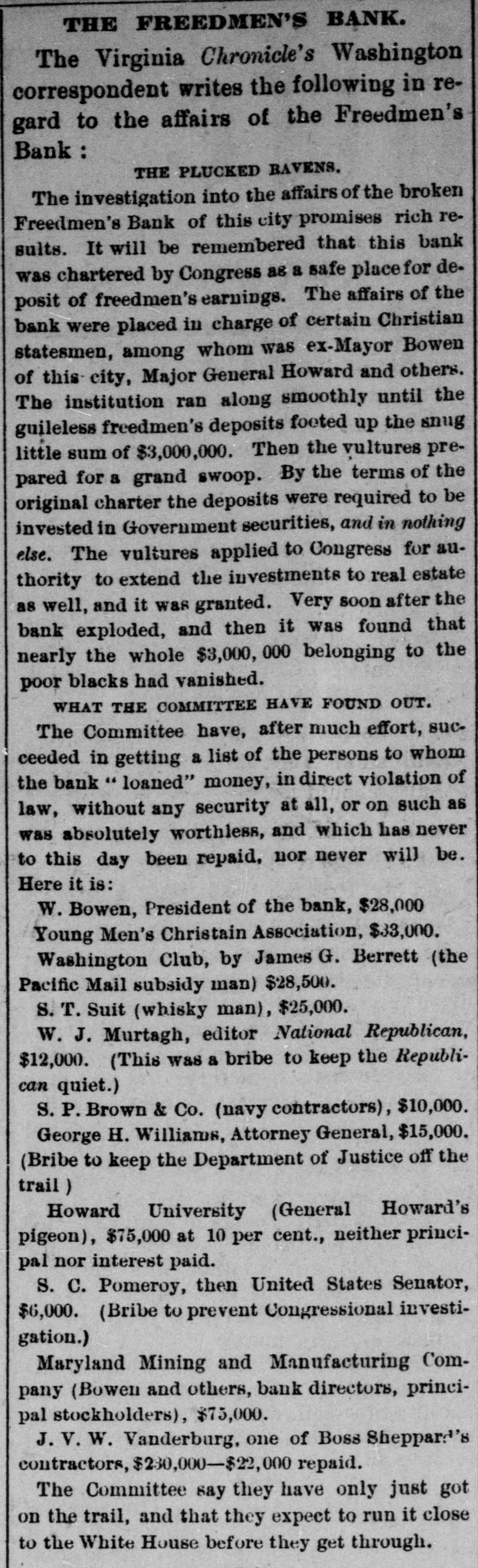

The Commissioners appointed under an act of Congress to wind up the affairs of the Freedmen's Savings and Trust Company report that, in addition to the 30 per cent. dividend heretofore paid, another dividend of 20 per cent. will probably be declared, making 50 per cent. in all. In order to enable them to do this, however, they ask Congress to purchase the Freedmen's Bank building in Washington, a large portion of which is now rented for Government offices, and a bill will soon be introduced for that purpose. The Commissioners have heretofore asked to be relieved from the duties imposed, and on submitting this bill, will reiterate that request.

The President has nominated William J. Gilbraith of Iowa, Associate Justice of the Supreme Court of Montana; John F. Morgan of Illinois, Chief-Justice of the Supreme Court of Idaho; Norman Buck of Idaho, Associate Justice of the same court.

A Washington dispatch of the 22d says: There is a decided disposition on the Republican side of the House to prevent the consideration of any general legislation after the disposal of the Warner Silver bill, and prominent members of the party said to-day there was no doubt but that all the Republicans would follow this course if an attempt should be made to take up any of the various other measures which have been reported by committees the present session other than those making appropriations for the Army and the Executive branch of the Government. To accomplish this, the Republicans will have to refrain from voting, which will leave the House without a quorum.

The President has nominated Eugene Schuyler of New York, Consul General at Rome, and also the following Consuls: Judson A. Lewis, Sierre Leone, at that place; Wilson King, Pennsylvania, at Birmingham; Wm. F. Grinnell, New York, at Bremen; Alex. McLean, New Jersey, at Guayaquil.

Supervising-Architect Hill, having been fully exonerated from the charges brought against him in connection with the construction of the Chicago Custom-house, has been reinstated in office.

In reply to numerous inquiries, Secretary of Treasury Sherman states that the reason why he does not advance the price of refunding certificates is that the act of Congress makes it mandatory for him to exchange them at par for lawful money of the United States. If these securities, the Secretary says, could only be sold to actual investors in limited sums, it would be a wise disposition of them, and it is believed that a great majority do get into the hands of such people, but the Postmasters and other disbursing officers can not distinguish between real investors and those who buy to sell again.

The Secretary of the Treasury on the 27th stopped the sale of $10 certificates in the large cities of the East. Up to this time $36,000,000 had been sold, and two-thirds of these east of the Alleghanies. The Secretary says he will try to get the remaining $4,000,000 into the hands of the people of the small Western towns until all are disposed of. Cincinnati, St. Louis and Chicago are to have but $40,000 worth a day.

At a Cabinet meeting held on the 27th it was decided that Capt. Eads was entitled to the $500,000 payment for the depth of 25 feet in the Mississippi jetty, over which payment the authorities have been hesitating six weeks. The Cabinet has reached the conclusion that under the law the depth and width are secured, the payment is to be made and the only requirement as to the maintenance of depth and width is after 30 feet has been reached, for which $1,000,000 is to be held as security for a term of years.

Holders of called bonds which mature before the first of July next, are requested by Secretary Sherman to send them to the Department for payment during the month of June. In this way holders of such bonds will receive payment for them with interest to maturity before the bonds mature. All United States bonds forwarded for redemption should be addressed to the Loan Division, Secretary's office, and all registered bonds should be assigned to the Secretary of the Treasury for redemption.

WEST AND SOUTHWEST.

The Iowa Democratic State Convention was held at Council Bluffs on the 21st. Judge H. H. Trimble was nominated by acclamation for Governor, the other nominees being J. V. Yeoman for Lieutenant-Governor, Reuben E. Noble, Supreme Judge, and Irvin Baker, Superintendent of Public Instruction. The resolutions indorse the action of Congress and denounce the President's vetoes; favor the substitution of Treasury notes for national bank notes and the abolition of national banks of issue; the reduction of the bonded debt as fast as possible.