Article Text

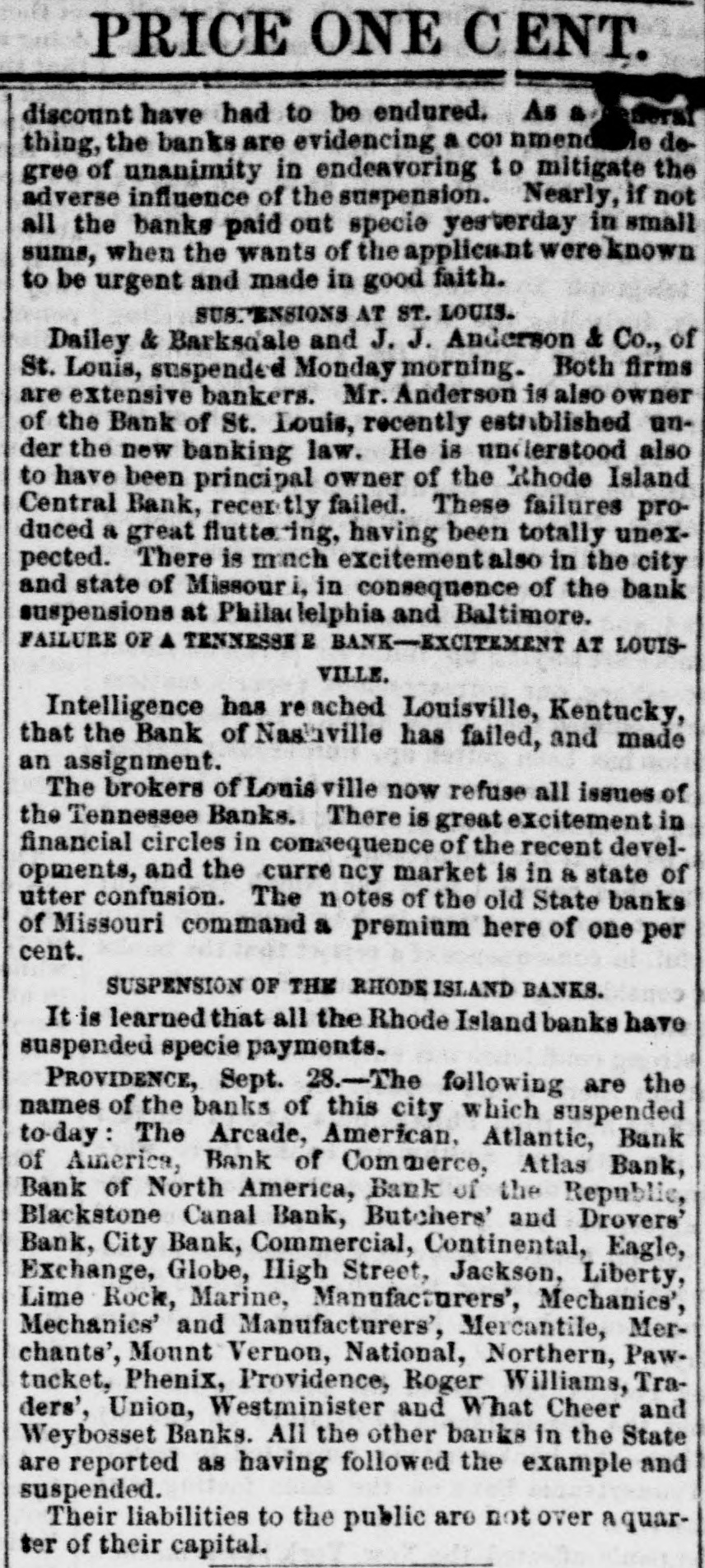

PRICE ONE CENT. eboral discount have had to be endured. As thing, the banks are evidencing a CO1 nmend le degree of unanimity in endeavoring to mitigate the adverse influence of the suspension. Nearly, if not all the banks paid out specie yesterday in small sums, when the wants of the applica nt were known to be urgent and made in good faith. SUBTENSIONS AT ST. LOUIS. Dailey & Barksdale and J. J. Anderson & Co., of St. Louis, suspended Monday morning. Both firms are extensive bankers. Mr. Anderson is also owner of the Bank of St. Louis, recently estriblished under the new banking law. He is understood also to have been principal owner of the Rhode Island Central Bank, recer tly failed. These failures produced a great flutte. ing, having been totally unexpected. There is much excitement also in the city and state of Missouri, in consequence of the bank suspensions at Phila lelphia and Baltimore. FAILURE OF A TENNESSE E BANK-EXCITEMENT AT LOUISVILLE. Intelligence has re ached Louisville, Kentucky, that the Bank of Nashville has failed, and made an assignment. The brokers of Louis ville now refuse all issues of the Tennessee Banks. There is great excitement in financial circles in consequence of the recent developments, and the curre ncy market is in a state of utter confusion. The notes of the old State banks of Missouri command a premium here of one per cent. SUSPENSION OF THE RHODE ISLAND BANKS. It is learned that all the Rhode Island banks have suspended specie payments. PROVIDENCE, Sept. 28.-The following are the names of the banks of this city which suspended to-day: The Arcade, American, Atlantic, Bank of America, Bank of Commerce, Atlas Bank, Bank of North America, Bank of the Republic, Blackstone Canal Bank, Butchers' and Drovers' Bank, City Bank, Commercial, Continental, Eagle, Exchange, Globe, High Street, Jackson, Liberty, Lime Rock, Marine, Manufacturers', Mechanics', Mechanics' and Manufacturers', Mercantile, Merchants', Mount Vernon, National, Northern, Pawtucket, Phenix, Providence, Roger Williams, Traders', Union, Westminister and What Cheer and Weybosset Banks. All the other banks in the State are reported as having followed the example and suspended. Their liabilities to the public are not over a quarter of their capital.