Click image to open full size in new tab

Article Text

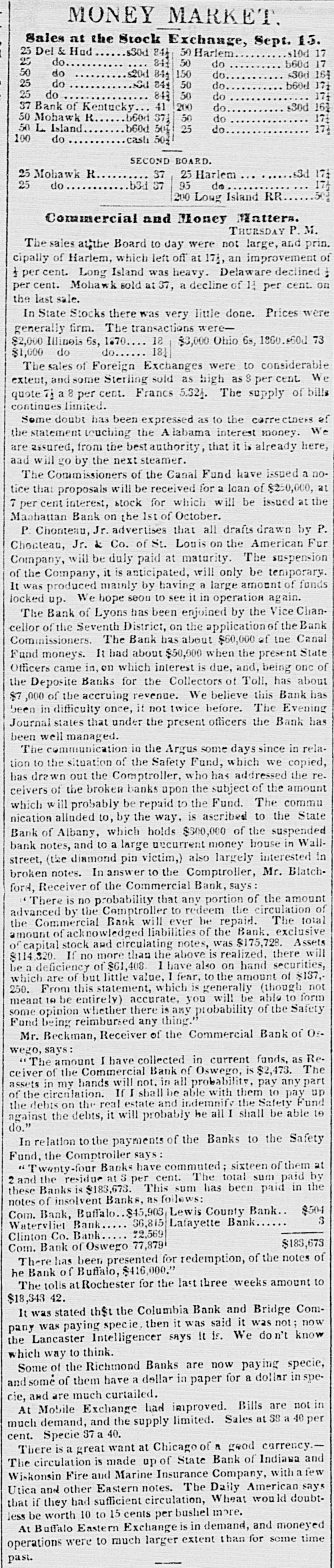

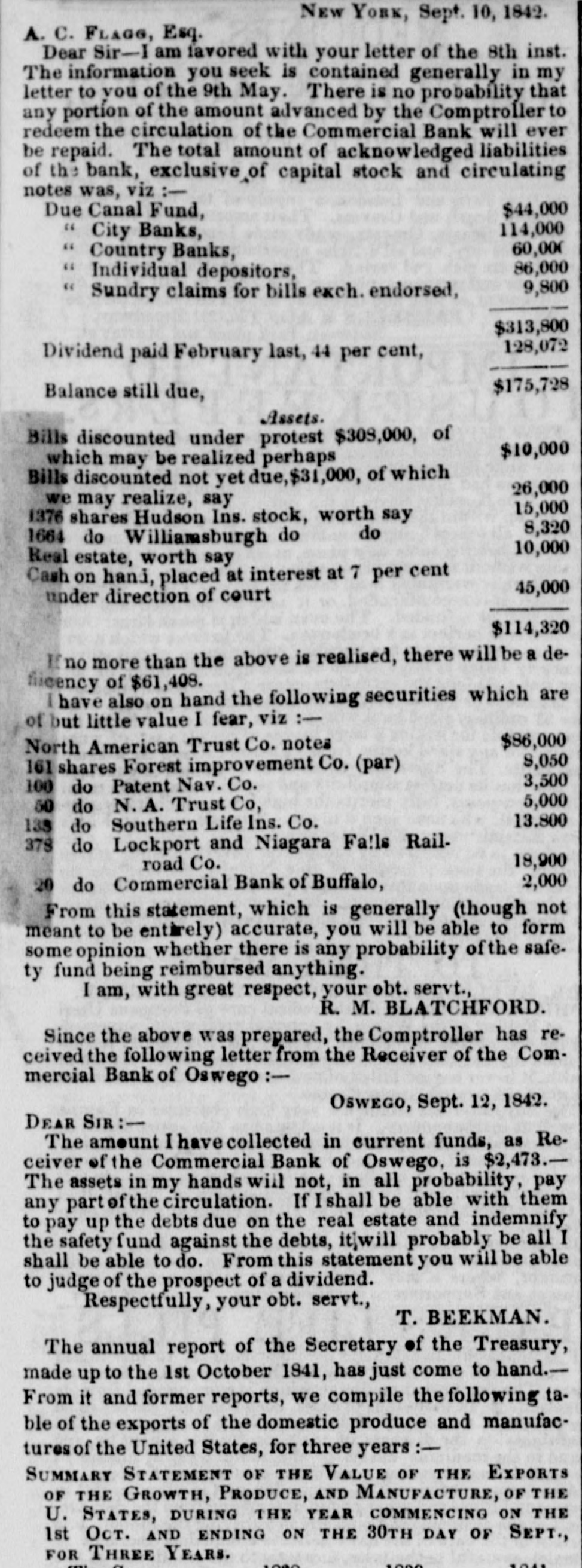

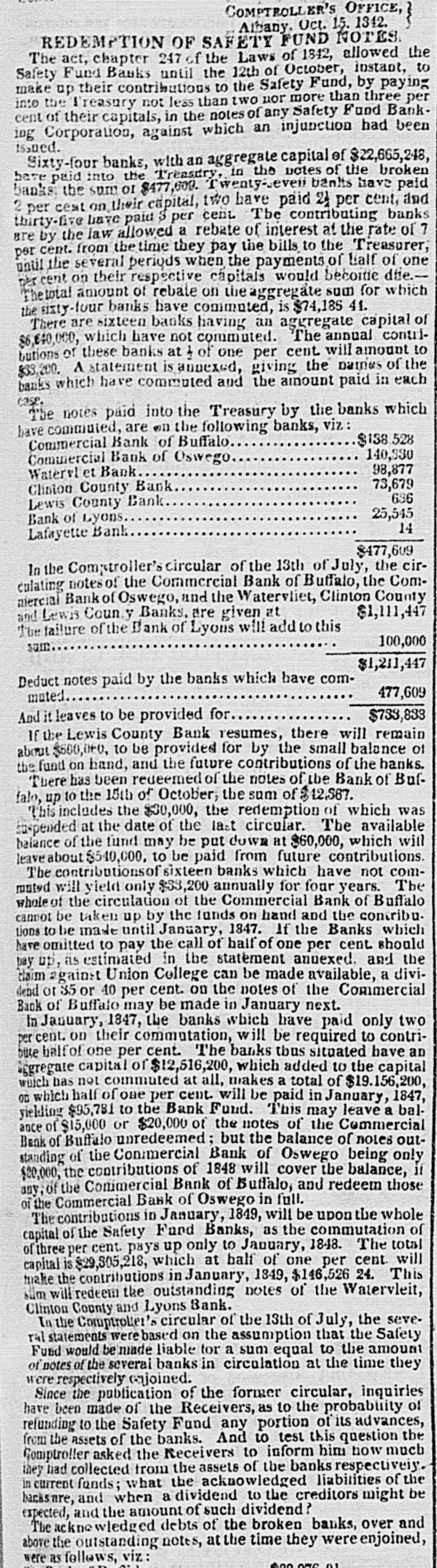

COMPTROLLER'S OFFICE, Albany. Oct. 15. 1342. REDEMPTION OF SAFETY FUND NOTES. The act, chapter 247 of the Laws of 1842, allowed the Safety Fund Banks until the 12th of October, instant, to make up their contributions to the Safety Fund, by paying into the Treasury not less than two nor more than three per cent of their capitals, in the notes of any Safety Fund Banking Corporation, against which an injunction had been issued. Sixty-four banks, with an aggregate capital of $22,665,248, have paid into the Treasdry, in the notes of the broken banks the sum of $477,600. Twenty-Jeveli banks have paid 2 per cest on their capital, two have paid 24 per cent, and thirty-five have paid per cent. The contributing banks are by the law allowed a rebate of interest at the rate of 7 per cent. from the time they pay the bills to the Treasurer, until the several periods when the payments of half of one cent on their respective capitals would becorile dtle.Theirtal amount of rebate on the aggregate sum for which the sixty-lour banks have commuted, is $74,185 41. There are sixteen banks having an aggregate capital of $6,£40,000, which have not commuted. The annual contributions of these banks at 4 of one per cent. will amount to $33,200. A statement is annexed, giving the names of the banks which have commuted and the amount paid in each case. The notes paid into the Treasury by the banks which have commuted, are will the following banks, viz: $138.528 Commercial Bank of Buffalo 140,530 Commercial Bank of Oswego 98,877 Watervl et Bank 73,679 Clinton County Bank 636 Lewis County Bank 25,545 Bank of Lyons 14 Lafayette Bank $477,609 In the Comptroller's circular of the 13th of July, the circulating notes of the Commercial Bank of Buffalo, the Commirrcrai Bank of Oswego, and the Watervliet, Clinton County $1,111,447 and Lewis County Banks. are given at The failure of the ank of Lyons will add to this 100,000 sum $1,211,447 Deduct notes paid by the banks which have com477,609 muted $733,833 And it leaves to be provided for If the Lewis County Bank resumes, there will remain about $600,000, to be provided for by the small balance of the fund on hand, and the future contributions of the banks. There has been redeemed of the notes of the Bank of Buffalo, up to the 15th of October, the sum of $12,587. This includes the $30,000, the redemption of which was suspended at the date of the last circular. The available balance of the fund may be put down at $60,000, which will leave about $540,000. to be paid from future contributions. The contributions of sixteen banks which have not comrouted will yield only $33,200 annually for four years. The whole of the circulation of the Commercial Bank of Buffalo cannot be taken up by the funds on hand and the contributions to be made until January, 1847. If the Banks which have omitted to pay the call of half of one per cent. should pay up, as estimated in the statement annexed. and the claim against Union College can be made available, a dividend or 35 or 40 per cent. on the notes of the Commercial Back of Buffalo may be made in January next. In January, 1847, the banks which have paid only two cent. on their commutation, will be required to contribute half of one per cent. The banks tbus situated have an Cggregate capital of $12,516,200, which added to the capital which has not commuted at all, makes a total of $19.156,200, 00 which half of one per cent. will be paid in January, 1847, yielding $95,781 to the Bank Fund. This may leave a balance of $15,000 or $20,000 of the notes of the Commercial Bank of Buffalo unredeemed; but the balance of notes outstanding of the Con:mercial Bank of Oswego being only $20,000, the contributions of 1848 will cover the balance, if any, of the Commercial Bank of Buffalo, and redeem those of the Commercial Bank of Oswego in full. The contributions in January, 1849, will be uponti whole capital of the Safety Fund Banks, as the commutation of of three per cent. pays up only to January, 1848. The total capital is $29,805,218, which at half of one per cent will make the contributions in January, 1849, $146,526 24. This stim will redeem the outstanding notes of the Watervleit, Clinton County and Lyons Bank. In the Comptrolier's circular of the 13th of July, the several statements were based on the assumption that the Safety Fund would be nade liable for a sum equal to the amount of notes of the several banks in circulation at the time they were respectively cojoined. Since the publication of the former circular, inquiries have been made of the Receivers, as to the probability of refunding to the Safety Fund any portion ot its advances, from the assets of the banks. And to test this question the Comptroller asked the Receivers to inform him how much they had collected from the assets of the banks respectively. in current funds; what the acknowledged liabilities of the backs are, and when a dividend to the creditors might be expected, and the amount of such dividend? The ackne wledged debts of the broken banks, over and above the outstanding notes, at the time they were enjoined, were as follows, viz: 000