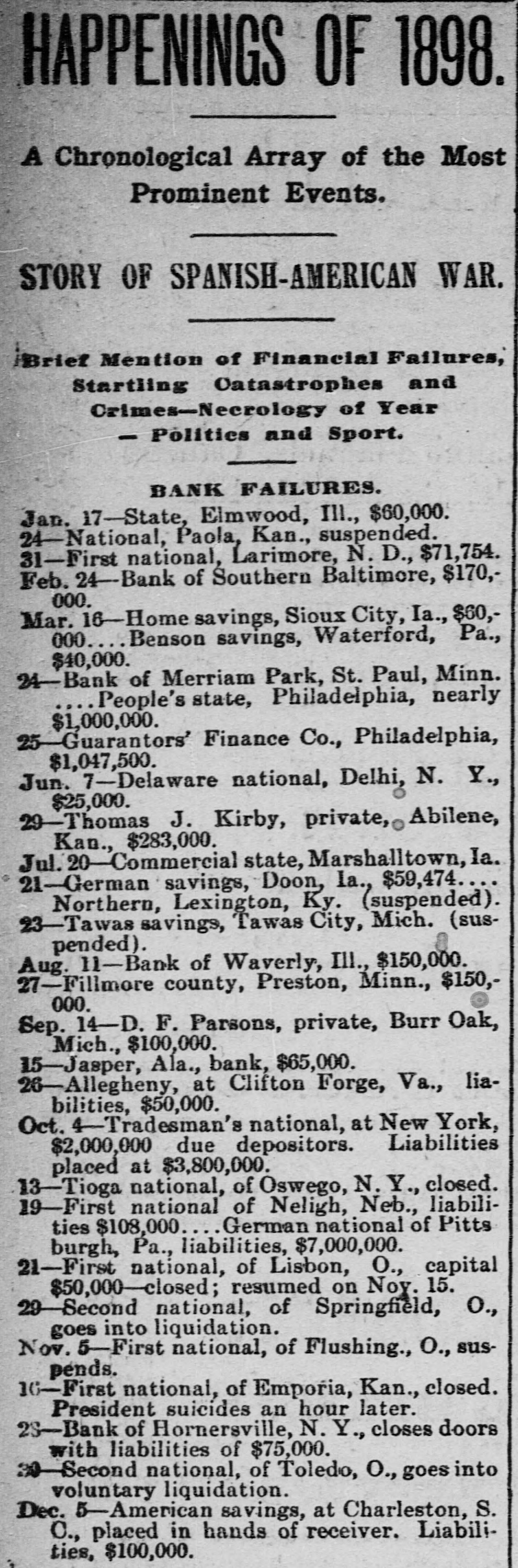

Article Text

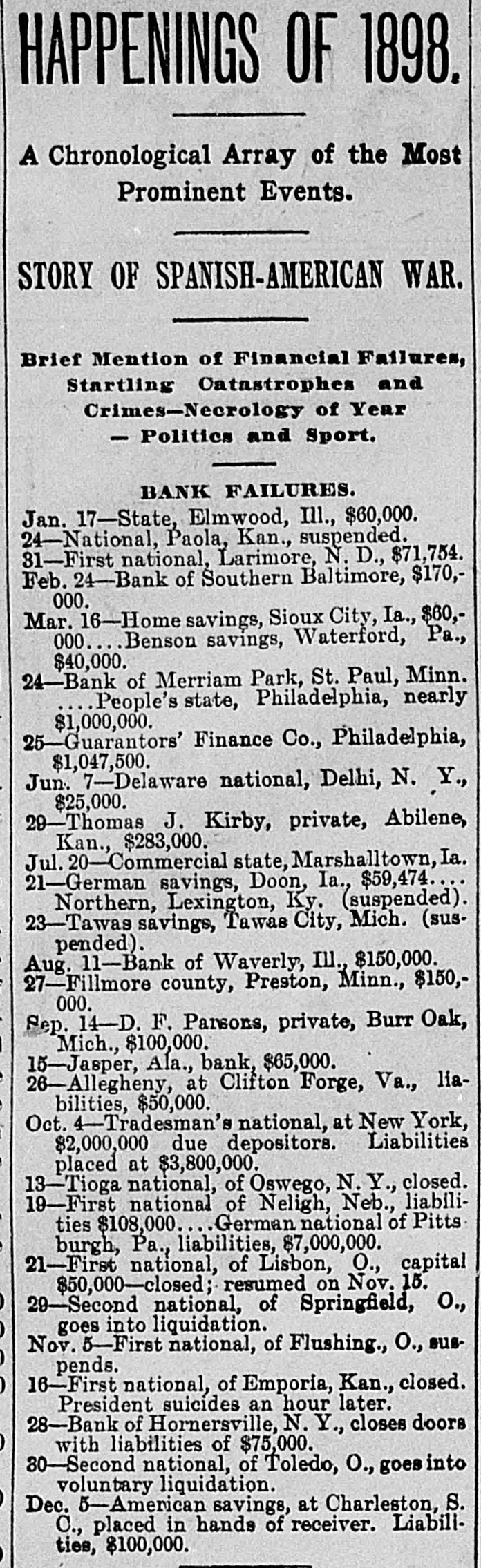

NATIONAL BANK CLOSED GERMAN, OF PITTSBURG, EMBARRASSED BY A FAILURE. Payment of Depositors Suspended on Account of the Assignment of a Tannery Company. PITTSBURG, Oct. 18.-"Upon examination of the books of the German National Bank the directors have decided not to open in the morning. If the depositors only give us time we believe that we will pay dollar for dollar." The foregoing frank statement was dictated by President Myers late to-night. No cause is assigned, but the reason for the failure at this time of what has for years been generally considered one of the strongest financial institutions in the State is conceded to be the assignment of the Allegheny tanning firm of A. Groetzinger & Sons. The directors of the bank have prepared this announcemente of the bank's failure: "At a meeting of the board of directors held at the bank this day at 6 p. m., the following resolution was adopted: "Resolved, That after a thorough examination by the bank examiner, clearing house committee and directors of the bank, all being unanimous in the opinion that the bank is solvent, that owing to the fact that a portion of the assets are not immediately available; that under the advice of all it seems best to close the bank for the equal protection of all the depositors and go into voluntary liquidation and the full assurance that at an early date we will be able to pay all its depositors in full, therefore the bank is closed and the directors hereby recommend as liquidation committee E. H. Myers, H. H. Niemann, A. Frauenheim." The connection between the Groetzingers and the German National Bank, of Pittsburg, was very close, the firm's paper not only being discounted at the bank, but Mr. Adolphus Groetzinger, having been a director in the bank for years and until recently its president. Several days ago he resigned as president and was succeeded by E. H. Myers, who was then vice president, the new vice president being Mr. A. Frauenheim.