Article Text

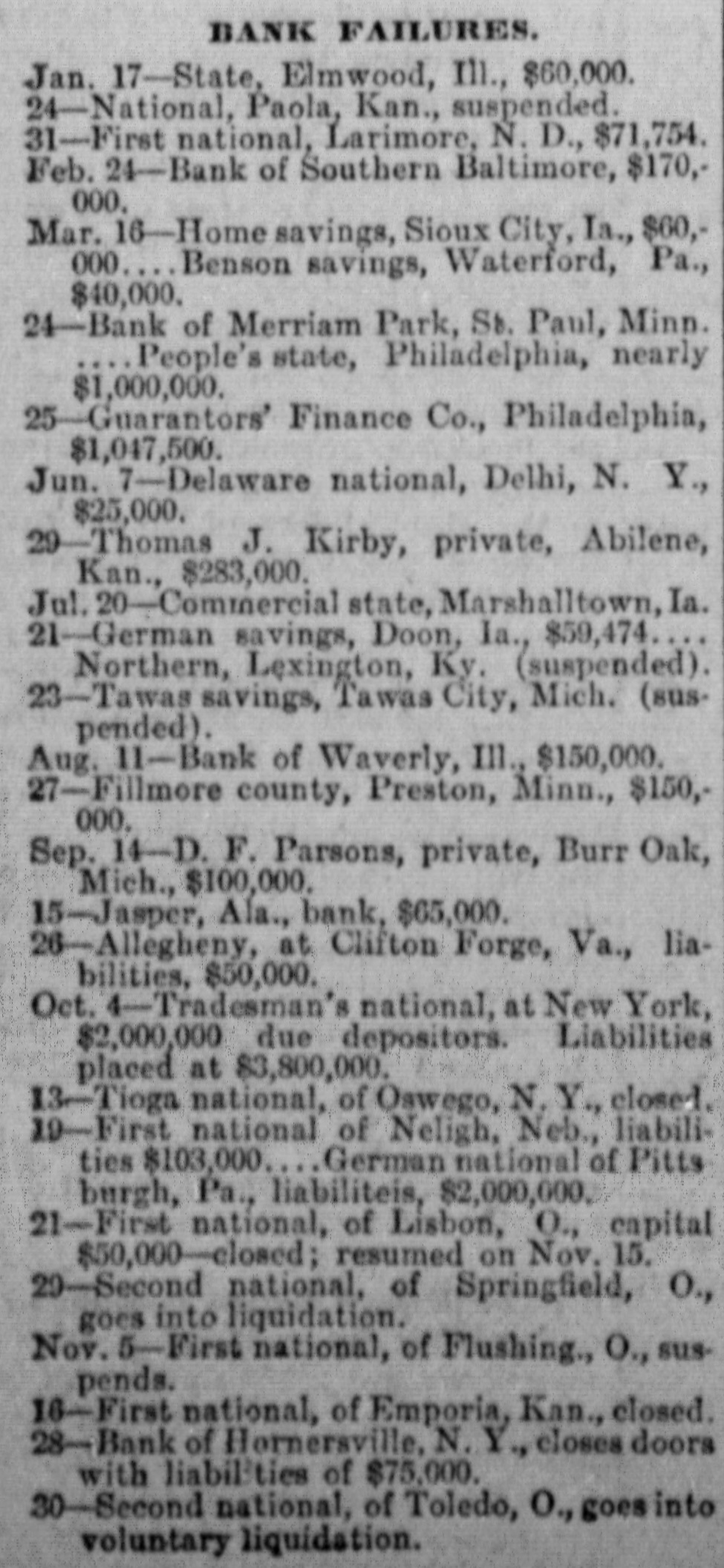

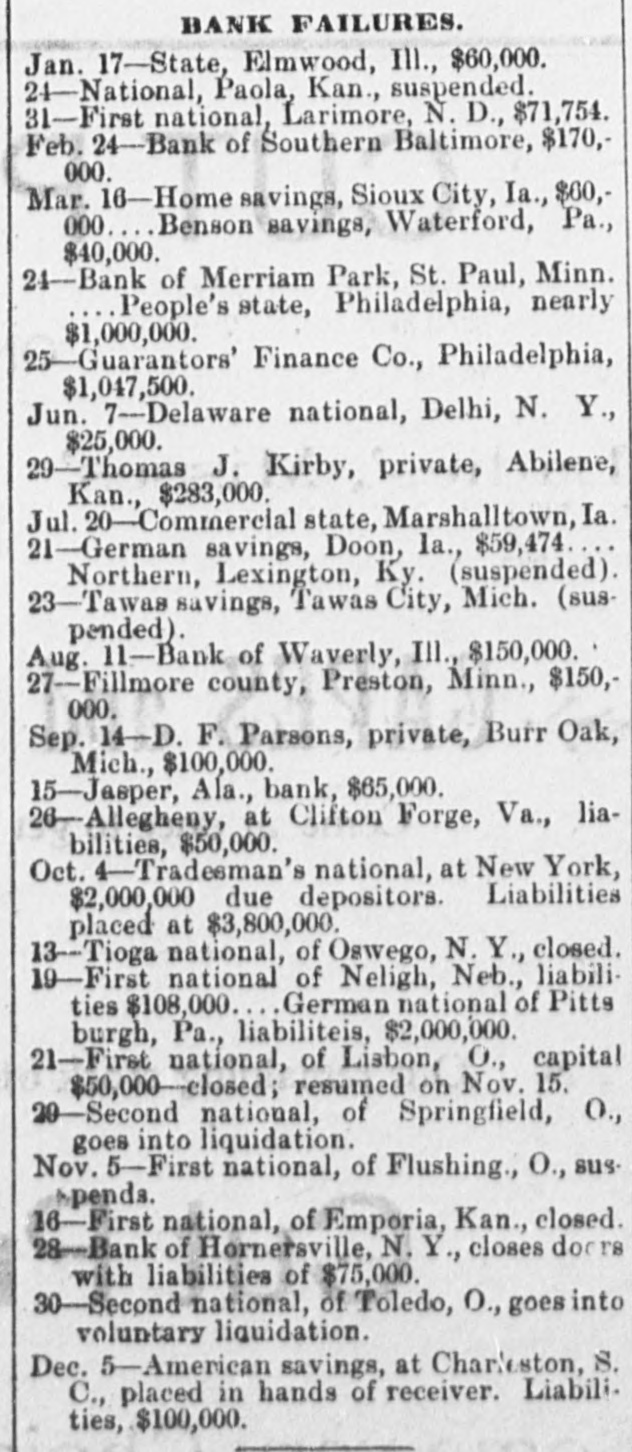

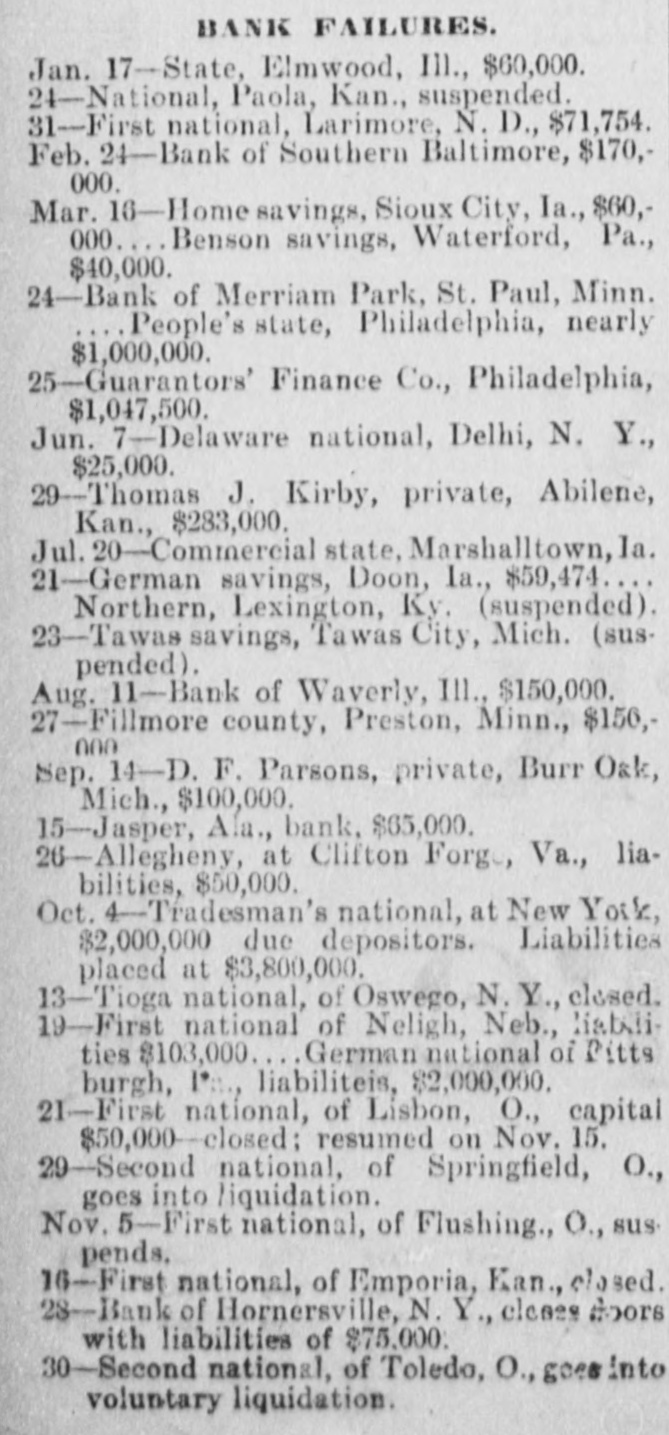

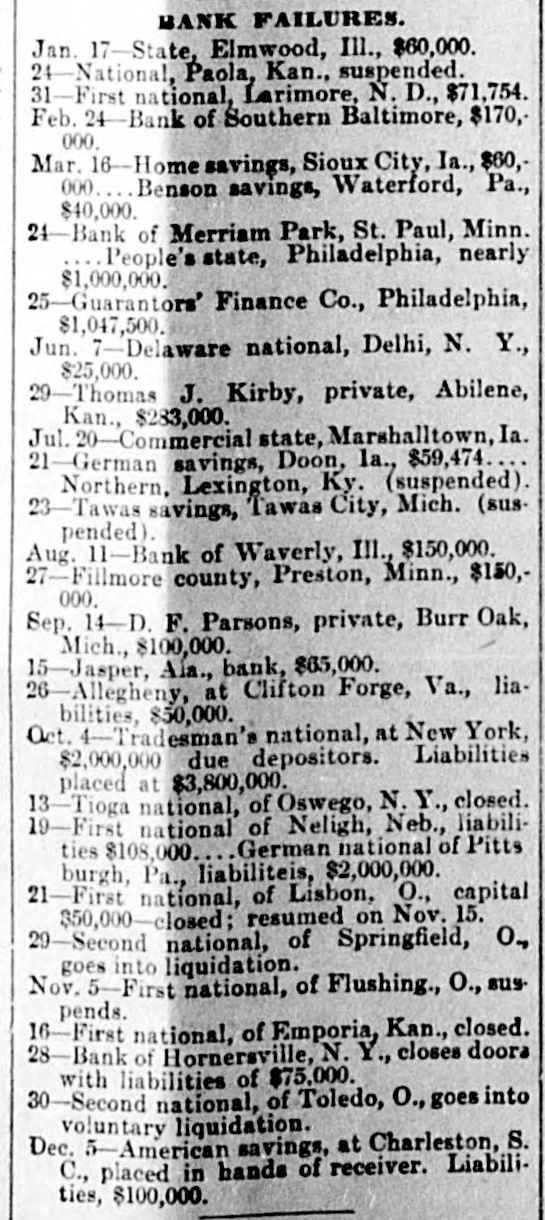

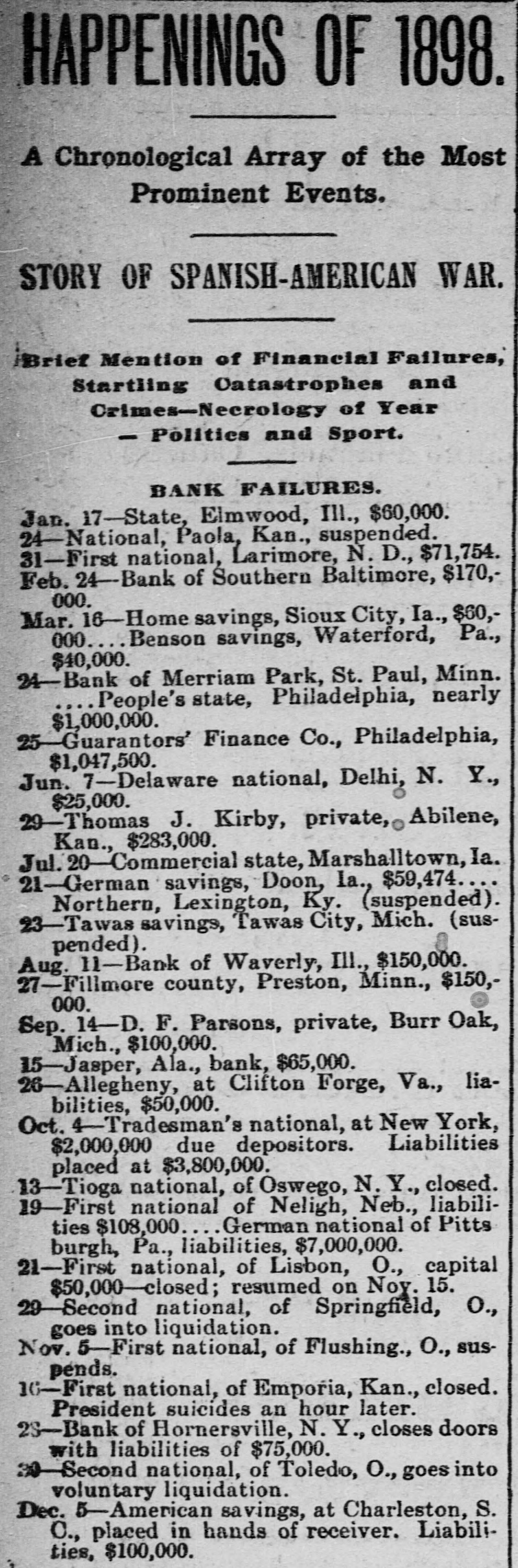

BROKEN BANKS Pittsburg Concern Is Solvent-A Nebraska House Is Not WASHINGTON, Oct. 19.-Bank Exam. iner Young has reported to the comptroller of the currency that in his judgment the German National bank of Pittsburg, which closed its doors yesterday, is solvent. The report states that the failures of A. Grotzinger, the president of the bank, resulted in a run and the directors closed the doors for the purpose of voluntary liquidation. The clearing house committee agreed with the directors that this was the best thing to do and the suspension followed. The capital of the bank is $250,000 and at the time of the last report, September 30th, the surplus amounted to $253,347; due individual depositors, $1,730,688; due national banks and bankers, $359,123; total resources, $2,637,708. Closed for Good WASHINGTON, Oct. 19.-The Bank Examiner, Whitmore, has telegraphed the Comptroller of the Currency that he has closed the doors of the First National Bank, Neligh, Nebraska. He says the condition of the bank makes resumption impossible. The bank has a capital of $50,000.