Click image to open full size in new tab

Article Text

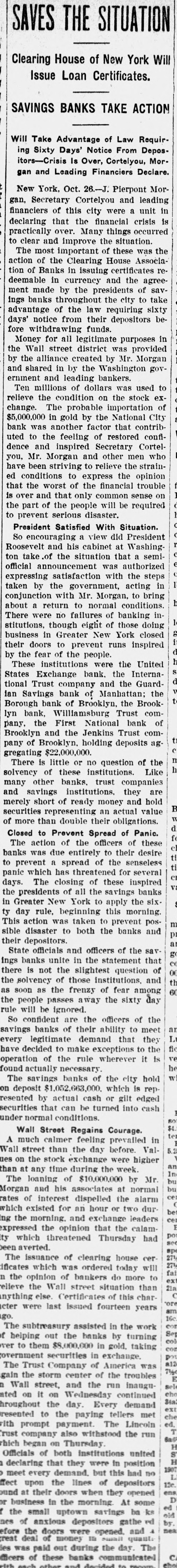

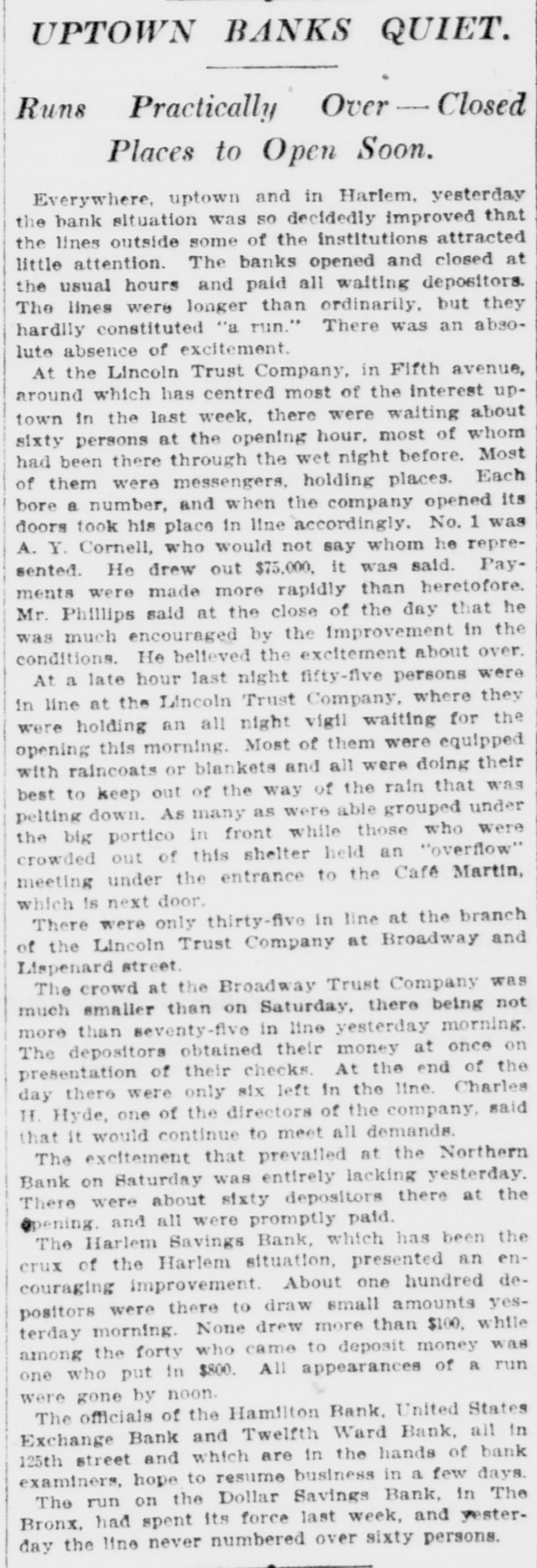

strongest hands in the financial world. Interests that have stood aside for many months watching the decline are now busy buying bargains. They do net hesitate to say that these stocks will be for sale should the market advance, because the purchasers are taking aboard an abnormal volume ot securities. But the fact that they are willing to take up this load even temporarily is reassuring. The banks of importance are finding themselves supplied with an abundance of cash. It will be no calamity in the Wall Street view if a few hundred small banks disappear from the horizon permanently, and the big people are shaning things so that depositors even in these smáll banks will get all of their money back. Standard Advanced. No particular stock distinguished itself today, but the standard issues were used to influence sentiment and they advanced from 1 to 3 points. Wheat was also advanced about 3 cents a bushel, and cotton was permitted to sink lower. Money was furnished freely and the responsible bankers said they looked for no further panic just now on that account. The United States Exchange Bank, Nos. 23 and 25 West 125th street, posted a notice before banking hours began, announcing its temporary suspension, A large crowd gathered in front of the bank, and the officers telephoned to police headquarters for protection, fearing a hostile demonstration. The Borough Bank, of Brooklyn, also printed a notice of suspension. The notice posted at the United States Exchange Bank was as follows: "NOTICE. "In consequence of the closing of other banks and the unusual demand for cash, we have decided to remain closed to-day. The bank is perfectly solvent, but these are extraordinary times, and we have to resort to extraordinary measures to protect ourselves and our depositors. "JAMES J. O'SHAUGHNESSEY, "Cashier." Nearly $1,000,000 Deposits. The United States Exchange Bank is capitalized at $100,000 and has a surplus and profits of $37,170. Individual deposits amount to $880,970. The Mercantile National Bank and the Bowling Green Trust Company, in this city, and the New York State National Bank of Albany are its principal correspondents. The president of the bank is John J. Gibbons. At the regular hour for opening this notice was pasted on one of the windows of the bank: "Pursuant to the authority conferred on me by section 619 of the laws of 1892, I have taken charge of the United States Exchange Bank. "CLARK WILLIAMSON, "State Bank Examiner. "A. P. Campbell, examiner in charge." Borough Bank Closes. The last report of the Borough Bank of Brooklyn, which also posted a notice of temporary suspension, gave It a capital of $200,000, with a surplus of $60,000. The loans were given at $2,650,000, with deposits of $3,250,000. The undivided profits were $85,000. Another Brooklyn Bank Closed. The third was the Brooklyn Bank, with a branch at 601 Fulton street, Brooklyn. Both Brooklyn banks are controlled by the International Trust Company of New York, which also holds the majority of stock of several other Brooklyn institutions. No statement has yet been given out in regard to the Brooklyn Bank, but an official of the Borough Bank announced that the public would be informed as to the details. The three banks which suspended yesterday remained closed today. They are the Hamilton, the Twelfth Ward, and the Empire Savings. All are declared to be perfectly solvent, and there is no probability of ultimate loss on depositors.