Article Text

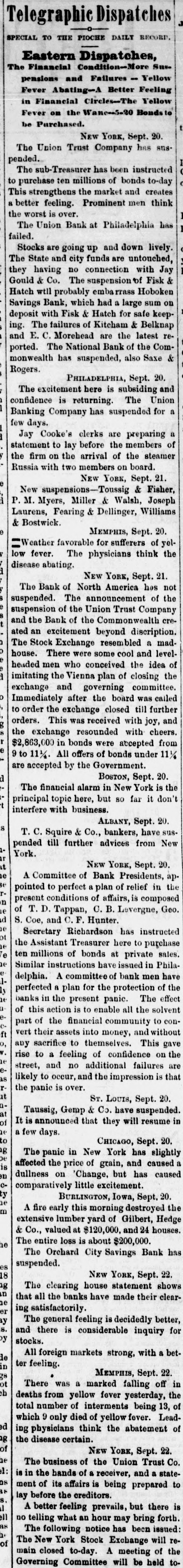

Telegraphic Dispatches SPECIAL TO THE PIOCHE DAILY RECORD Eastern Dispatches, The Financial Condition-More Suspensions and Failures - Yellow Fever Abating-A Better Feeling in Financial Circles-The Yellow Fever on the Wane-5020 Hondst be Purchased. NEW YORK, Sept. 20. The Union Trust Company has suspended. The sub-Treasurer has been instructed to purchase ten millions of bonds to-day This strengthens the market and creates better feeling. Prominent men think the worst is over. The Union Bank at Philadelphia has failed. Stocks are going up and down lively. The State and city funds are untouched, they having no connection with Jay Gould & Co. The suspension of Fisk Hatch will probably emba rrass Hoboken Savings Bank, which had a large sum deposit with Fisk & Hatch for safe keeping. The failures of Kitcham & Belknap and E. c. Morehead are the latest reported. The National Bank of the Commonwealth has suspended, also Saxe Rogers. PHILADELPHIA, Sept. 20. The excitement here is subsiding and confidence is returning. The Union Banking Company has suspended for a few days. Jay Cooke's clerks are preparing statement to lay before the members of the firm on the arrival of the steamer Russia with two members on board. NEW YORK, Sept. 21. New suspensions-Toussi & Fisher, P. M. Myers, Miller & Walsh, Joseph Laurens, Fearing & Dellinger, Williams & Bostwick. MEMPHIS, Sept. 20. Weather favorable for sufferers of yellow fever. The physicians think the disease abating. NEW YORK, Sept. 21. The Bank of North America has not suspended. The announcement of the suspension of the Union Trust Company and the Bank of the Commonwealth created an excitement beyond discription. The Stock Exchange resembled a madhouse. There were some cool and levelheaded men who conceived the idea of imitating the Vienna plan of closing the exchange and governing committee. Immediately after the board was called to order the exchange closed till further orders. This was received with joy, and the exchange resounded with cheers. $2,863,000 in bonds were accepted from 9 to 111/4. All offers of bonds under 11 1/4 are accepted by the Government. a BOSTON, Sept. 20. The financial alarm in New York is the principal topic here, but so far it don't interfere with business. ALBANY, Sept. 20. is T. C. Squire & Co., bankers, have s pended till further advices from New York. it NEW YORK, Sept. 20. e A Committee of Bank Presidents, apBe rpointed to perfect plan of relief in the n present conditions of affairs, is composed of T. D. Tappan, C. B. Levergne, Geo. d S. Coe, and C. F. Hunter. ot Secretary Richardson has instructed the Assistant Treasurer here to purchase e ten millions of bonds at private sales. e Similar instructions have issued in Phila1 delphia. A committee of bank men have ly perfected plan for the protection of the banks in the present panic. The effect of this action is to enable all the solvent part of the financial community to conft vert their assets into money, and without any sacrifice to themselves. This gave rise to a feeling of confidence on the street, and no additional failures are likely to occur, and the impression is that r the panic is over. it ST. LOUIS, Sept. 20. aat Taussig, Gemp & Co. have suspended. of It is announced that they will resume in he few days. to CHICAGO, Sept. g be The panic in New York has slightly is affected the price of grain, and caused en dullness on Change, but has caused ccomparatively little excitement. ty BURLINGTON, Iowa, Sept. 20. he m A fire early this morning destroyed the extensive lumber yard of Gilbert, Hedge & Co., valued at $120,000. and 24 houses. he The entire loss is about $200,000. The Orchard City Savings Bank has suspended. 18 NEW YORK, Sept. 22. hg The clearing house statement shows in he that all the banks have made their clearer ing satisfactorily. by The general feeling is decidedly better, s. and there is considerable inquiry for by stocks. de All foreign markets strong, with a better feeling. in MEMPHIS, Sept. 22. ot There was a marked falling off in eb deaths from yellow fever yesterday, the total number of interments being 13, which 9 only died of yellow fever. Leaded ing physicians think the abatement of ag the disease certain. of New YORK, Sept. 22. he The business of the Union Trust Co. 1: is in the bands of a receiver, and stateas ment of its affairs is being prepared to lay before the creditors. A better feeling prevails, but there is ll no telling what an hour may bring forth. The following notice has been issued: of The New York Stock Exchange will remain closed to-day. A meeting of the Governing Committee will be held to-