Article Text

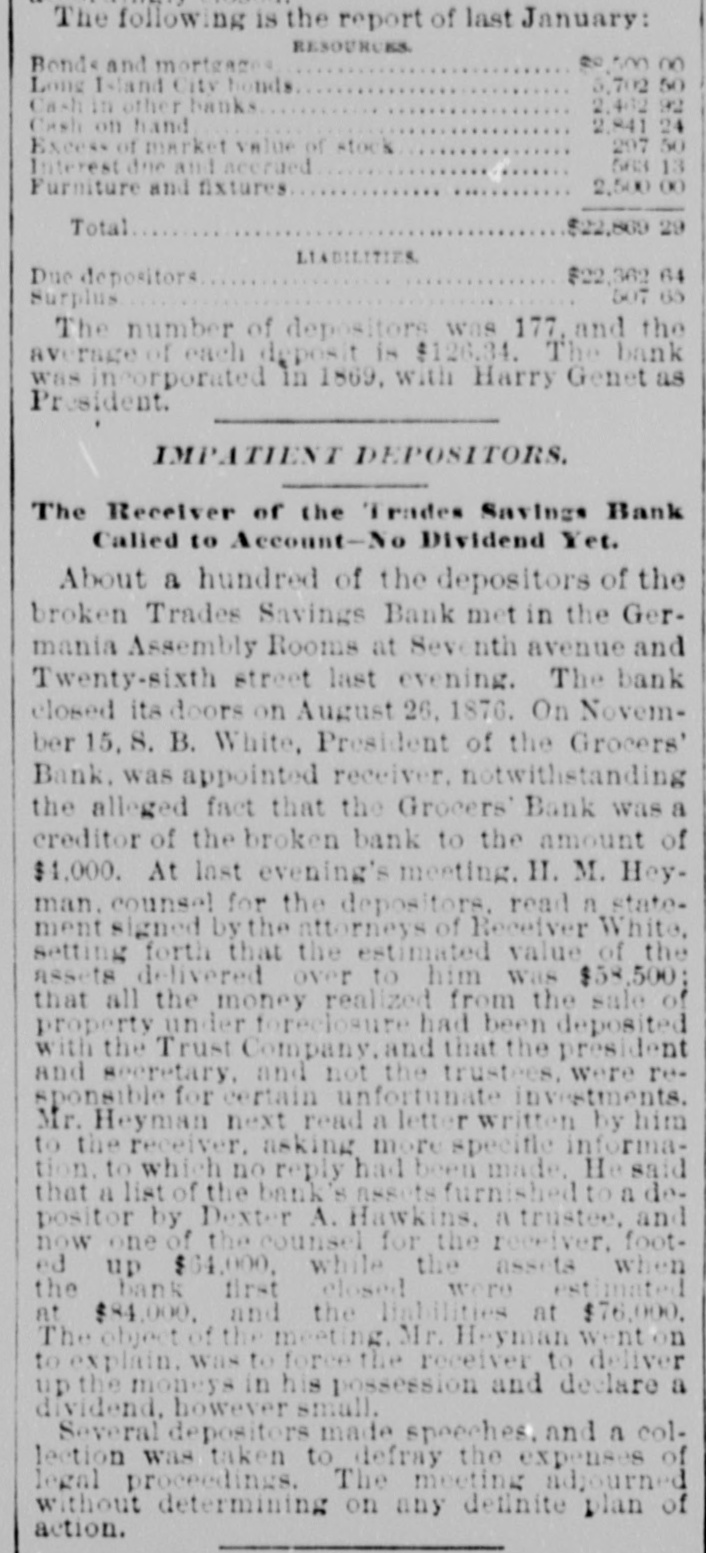

ANOTHER SAVINGS BANK GONE. The Trades' Savings Bank, No. 224 West Twenty. third street, was closed yesterday on an order of Judge Landon, of the Supreme Court, on the complaint of Deputy Superintendent Henry C. Lamb, of the Banking Department. The report of the bank for July stated that it held $97,209 03 of assets, with a surplus of $2,294 97, $94,913.06 being due depositors. Its resources are reported distributed as follows:-Bonds and mortgages, $55,375; bonds of cities in this State, $7,000; amount loaned on collaterals, $11,250; cash in other banks or trust companies, $10,061 95, and cash on hand, $8,229 13. All examination made by Mr. Roid, bank examiner in January last, did not show anyhing materially different from this statement, although the excess of income was shown to be only $643 49, and he suspected that untrue statements were made regarding matters of which be could take no proof by the officers. Upon the recommendation of the Superintendent he made frequent visits to the bank in consequence of this suspicion, and on August 9 last he made an official report of its condition to the department, of which the following is an abstract:--The resources as claimed were as follows:-Three bonds and mortgages on the property of C. Baker, in Eightythird street, quoted at $9,000, at $8,000 and at $5,000, which had been assigned by Mr. Lesley, the President, to T. W. Freese; two bonds and mortgages of Michael Grace, as Greenpoint, for $6,000; a bond and mortgage of William Atwater, for $6,000, upon the property No. 237 Bedford avenue, Brooklyn, which was claimed by the bank, but to which no title could be shown. and two bonds and mortgages of A. M. Lesley, the President of the bank, to a property in Beach street for $15,000, which were not recorded, and to which no title was shown: call loans on United States bonds, $250; F. Kingman's receipt for J. R. Friese, bond and mortgage, $10,000; loan to E. B. Newburn, $5,000; an overdraft, said 10 be good. of $868 14, and other assets, which made a total of $88,439 34. The liabilities showed $88,178 67 due depositors and $200 due for interest, which would leave a surplus of $60 67. But Mr. Reid could not credit the bonds and mortgages to which no title was shown, and he deducts $21,000 from the assets on this account, leaving the bank deficient in assets to the amount of $20,939 Mr. Reid needed no further proof of the insufficiency of the bonds and mortgages claimed than these facts, but he had been in receipt of additional proof for some time in the persistent refusal of the Secretary, Mr. Freese, to give him full liberty of examination, and on one occasion so rude was Mr. Freese's opposition that a regular commission, requiring and empowering Mr. Reid to make the examination. was deemed necessary to be issued by the Banking Department Ugly st ries have been current for some time about the management of the bank, and one of the most suspicious circumstances connected with its failure is the fact that a brother of the secretary has very recently applied to be relieved as a bondsman of the officers. The number of depositors was $42. and 11 is doubtful if they will get more than day cents on the dollar. The order of the Supreme Court requires the bank to show cause before Judge Landon, at Saratoga, September 1. why there should not be a receiver appointed. It IS the opinion of Mr. Lamb that no general distrust of saving institu. tions is likely to proceed from this failure, as people generally looked upon It as "shaky."