Article Text

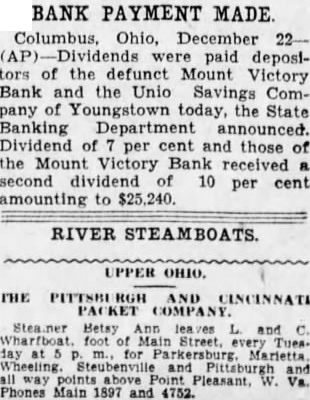

BANK PAYMENT MADE. Columbus, Ohio, December 22(AP) Dividends were depositors of the defunct Mount Victory Bank and the Unio Savings Comof Youngstown today, the State Banking Department announced. Dividend of per and those of the Mount Victory Bank received second dividend 10 per cent amounting RIVER STEAMBOATS UPPER OHIO. THE PITTSBURGH CINCINNATI PACKET Stea.ner and foot Main Street, every all Va. Phones Main 1897 and 4752.