Article Text

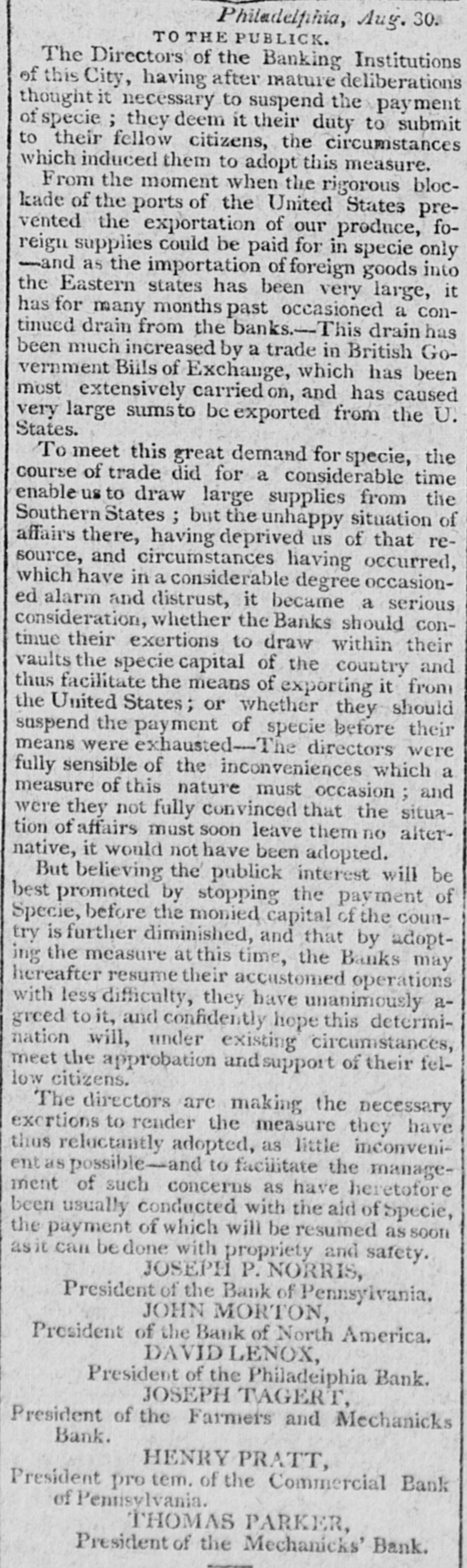

Philadelphia, Aug. 30. TO THEPUBLICK. The Directors of the Banking Institutions of this City, having after mature deliberations thought it necessary to suspend the payment of specie ; they deem it their duty to submit to their fellow citizens, the circumstances which induced them to adopt this measure. From the moment when the rigorous blocleade of the ports of the United States prevented the exportation of our produce, foreign supplies could be paid for in specie only -and as the importation of foreign goods into the Eastern states has been very large, it has for many months past occasioned a continued drain from the banks.--This drain has been much increased by a trade in British Government Bills of Exchange, which has been most extensively carried on, and has caused very large sumsto be exported from the U. States. To meet this great demand for specie, the course of trade did for a considerable time enable us to draw large supplies from the Southern States ; but the unhappy situation of affairs us rea occasionsource, which have there, and in circumstances having considerable deprived having degree of occurred, that ed alarm and distrust, it became a serious consideration, whether the Banks should continue their exertions to draw within their vaults the specie capital of the country and thus facilitate the means of exporting it from the United States; or whether they should suspend the payment of specie before their means were exhausted-The directors were fully sensible of the inconveniences which a measure of this nature must occasion and were they not fully convinced that the situation of affairs must soon leave them no alternative, it would not have been adopted. But believing the publick interest will be best promoted by stopping the payment of Specie, before the monied capital of the country is further diminished, and that by adopting the measure at this time, the Banks may hereafter resume their accustomed operations with less difficulty, they have unanimously agreed to it, and confidently hope this determination will, under existing circumstances, meet the approbation and support of their fellow citizens. The directors are making the necessary exertions to render the measure they have thus reluctantly adopted, as little inconvenient as possible-and to faciitate the management of such concerns as have heretofore been usually conducted with the aid of Specie, the payment of which will be resumed as soon can be done with propriety and safety. JOSEPH P. NORRIS, President of the Bank of Pennsylvania. JOHN MORTON, President of the Bank of North America. DAVID LENOX, President of the Philadeiphia Bank. JOSEPH TAGERT, President of the Farmers and Mechanicks Bank. HENRY PRATT, President pro tem. of the Commercial Bank of Pennsylvania. THOMAS PARKER, President of the Mechanicks' Bank.