Click image to open full size in new tab

Article Text

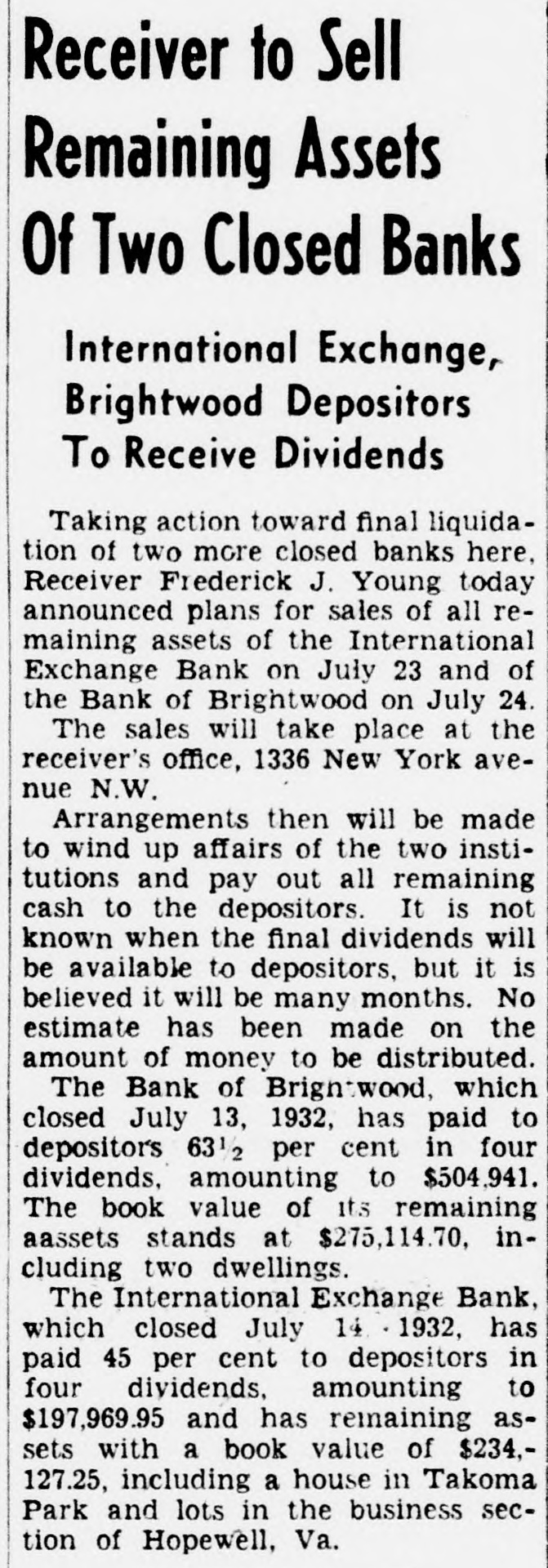

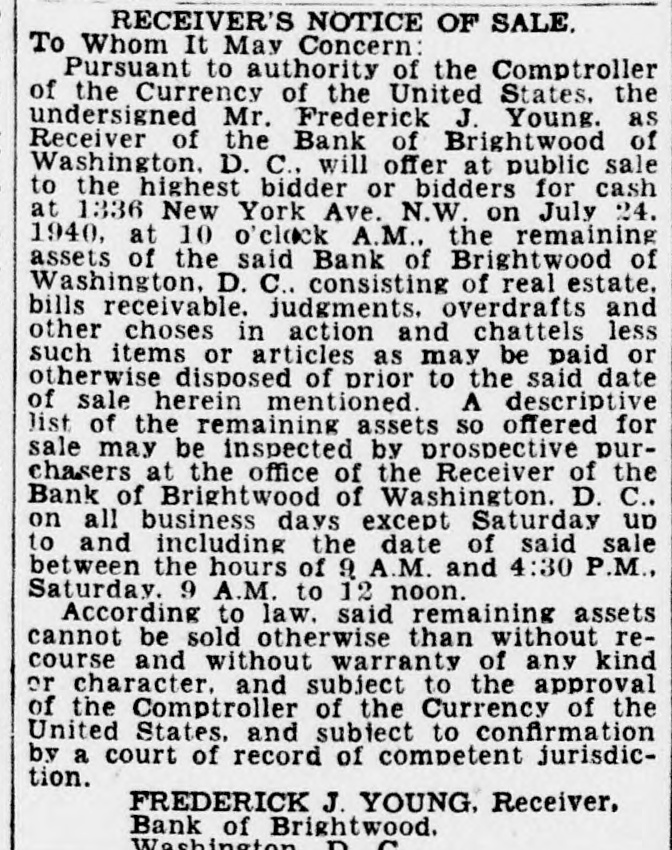

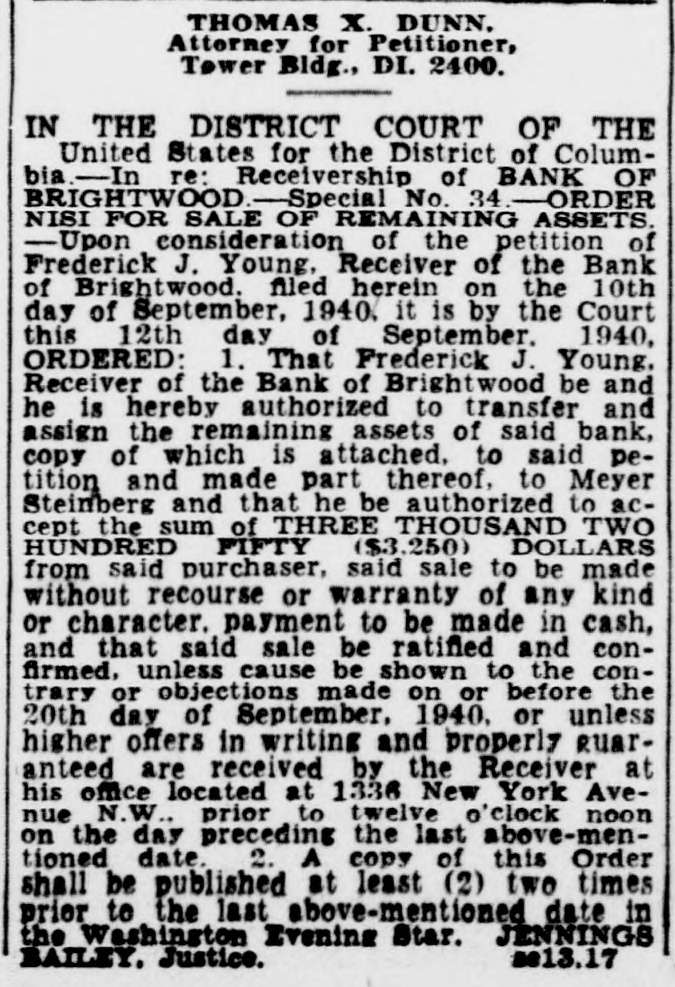

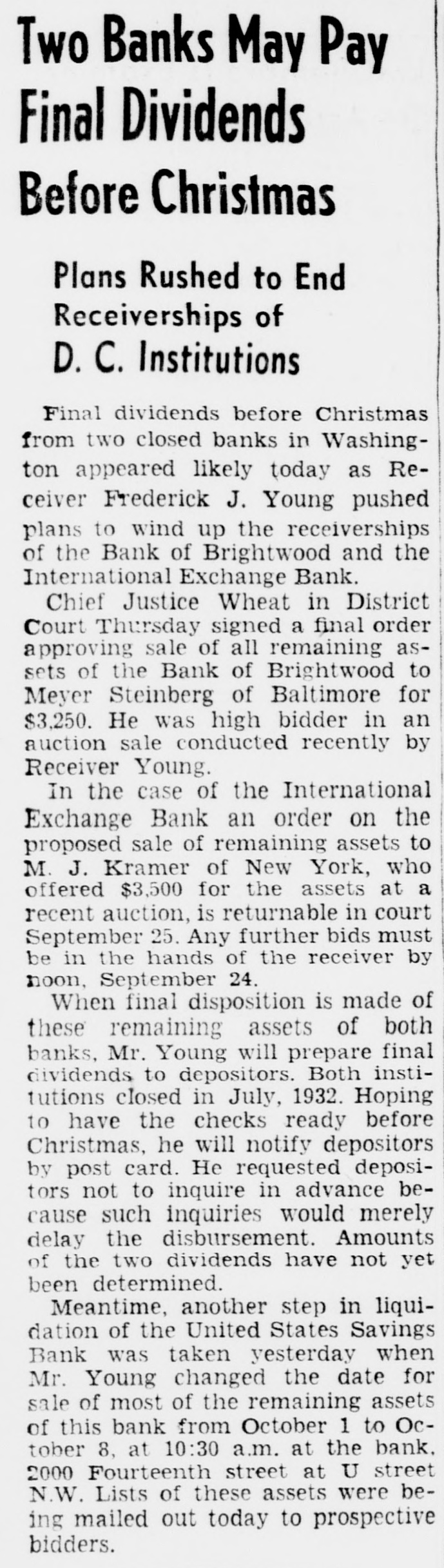

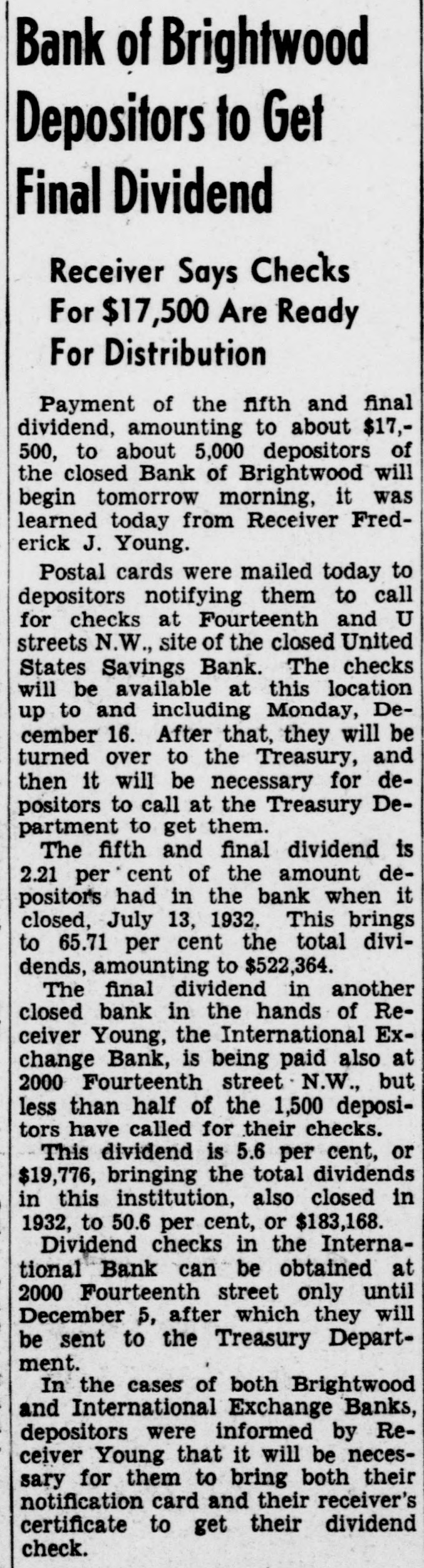

July August September 89,203,505 88,017,063 102.799.707 90.915.380 October 101.236.048 99,665,488 101.263.187 November Officials Bank Interested of the today Bank In confirmed of Branch. Commerce interested the and Savings they had been for merly fact in the that purchase occupied of by the the building Bank Bank of Brightwood - nounced was Savings that the had neIt and receiver. Fred- an with had of gotiated Commerce J. Young. the and of made the real erick for the purchase vault equipoffer estate. furniture together and with fixtures. made HOW- an ment. an opposing bidder the property was in amount ever. offer in court which for the bank unwilling an to meet stated tha+ a Con- perthe Officials further issued by the bank troller mit had of been the Currency branch to in this re- vicinity. to establish No future statement a plans concerning branch was made the there garding establishment Bank of of Brightwood this 1932 and disconThe business in since. albeen no have been the though institution has tinued efforts bank there through made to start sale of a stock new known The as institution the Northwest tions would for have been Subscripti of National the stock. Bank. however. fell shore Building the required of amount the Brightwood statement Bank replans Purchaser has made no The next will garding future to former because depositors of the increased dividend be slightly payment larger for the property. Receiver C. & Young P. Phone says. the Net Chesapeake Higher. & income of Co. in October a was Potomac Net slightly Telephone better than with a $155,176 year to ago, the of just $157.643, compared according with Commission gain financial statement $2,467. filed net the Public Utilities showed total statement months of this income The in the first in 10 comparison year. with year as $1.424.433. like period last of $149,913. $1,574,346 a decrease in the revenues for October amounted Operating $976.449. an increase $950.265 to in October were held 1937. under Oper- last over with $691.$681.271. $1.800 year, ating 119. Taxes expenses were comparing and about non-operating more sum than a year ago to the small against income amounted $8.016. Interest were year vs. $39,782. of deductions $4,696. in $27,515 October in the this same 1937 period. the first 10 months of amount- the year In & P operating revenues comparison gain, with C. $9.398.351. in This a year than offset by was expenses however, $9,232,758 ed to operating more ago. and in- inin operating creases a net $1,747,533 taxes. of $1.722.5 933. of 1937 Income first leaving 10 months against $339,825. in the deductions required ago against terest $210,227 236.643 a year telephones was an in service There were which increase on of October 2.038 telephones Telephone 31. over users calls the in month. 27.435.000 during Washington previous the month. made October. or an increase 1937. Im- the of 1,697,000 business over conditions a total in of Capital proved were indicated calls by in the 10- a month year 259,036,000 period. telephone against 247.304.000 ago. Given Special Honors. just Baltz who has retired Edward as president C. Baltz. and of Loan the League. United by States Building yesterday signally and loan was Washington building honored national leadconstructive his ers the during G. program term for of office. he carried Chairman the out city in Arthur general Bishop said that organizations in parloan honors acand the were proud of the the past 12 ticular him during marine radio, corded months. A handsome inscribed. was presentBaltz ed Mr. appropriately at the close of the for the plans meeting. stated that being preIt was annual banquet Cook. are secretary pared 1939 with Martin Building. A. acting as Enterprise present the chariman. be the of the affair will From league largest indications in deleof the the official Willson history The to report the recent of Chicago by. F. conven- of gates was submitted of the District Columbia tion Camp. secretary Building Camp. and C Loan E. Kefauver League. repBesides Mr. official resentatives. and R. W. Santelman-aningtonians 17 in went to Chicago Trading stock on Exchange. figured a on Capital 25-share Today's Transit sale and the another Washington of two eighth shares Exchange at today. A single off an share of from Stock yesterday. Power 5 1/2 per cent Potomac Electric moved at 115. James preferred M. stock Johnston. Stock president Exchange, of the Washington his guest at today's connected session. with had as Lally, who is of Hayden, & Co., New Home Loan Bank report Edward Stone the The trading Federal department York its latest of Winston-Salem that as of October in loan 31. associations 18 Washington members of the saws building and fourth district