Article Text

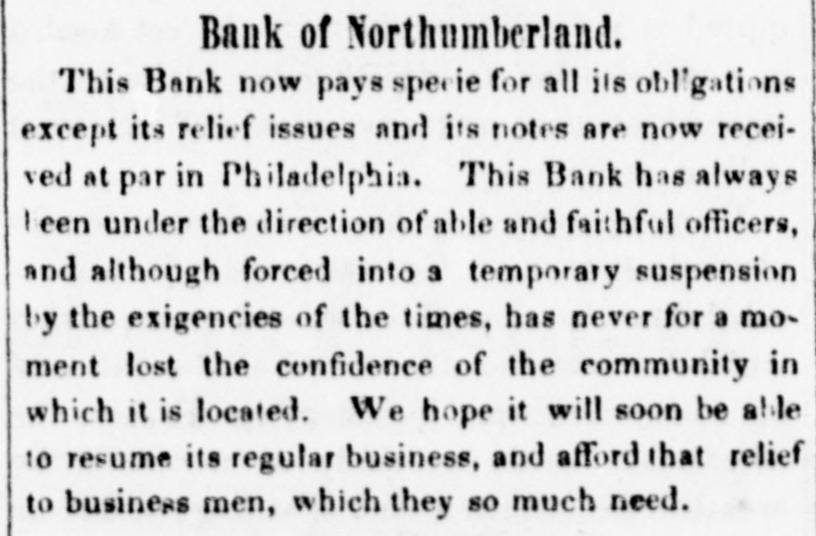

Bank of Northumberland. This Bank now pays specie for all its obligations except its relief issues and its notes are now received at par in Philadelphia. This Bank has always I een under the direction of able and faithful officers, and although forced into a temporary suspension by the exigencies of the times, has never for a moment lost the confidence of the community in which it is located. We hope it will soon be able 10 resume its regular business, and afford that relief to business men, which they so much need.