Article Text

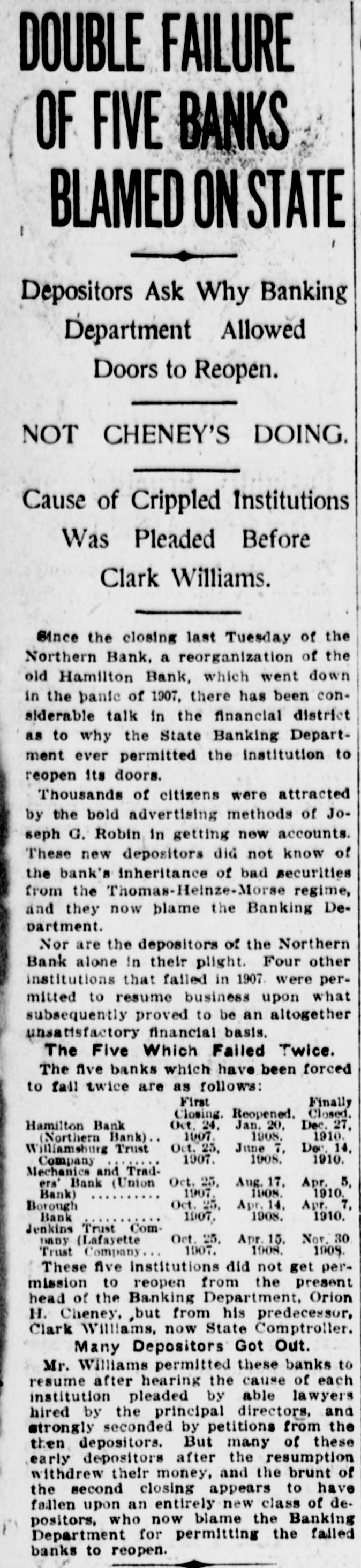

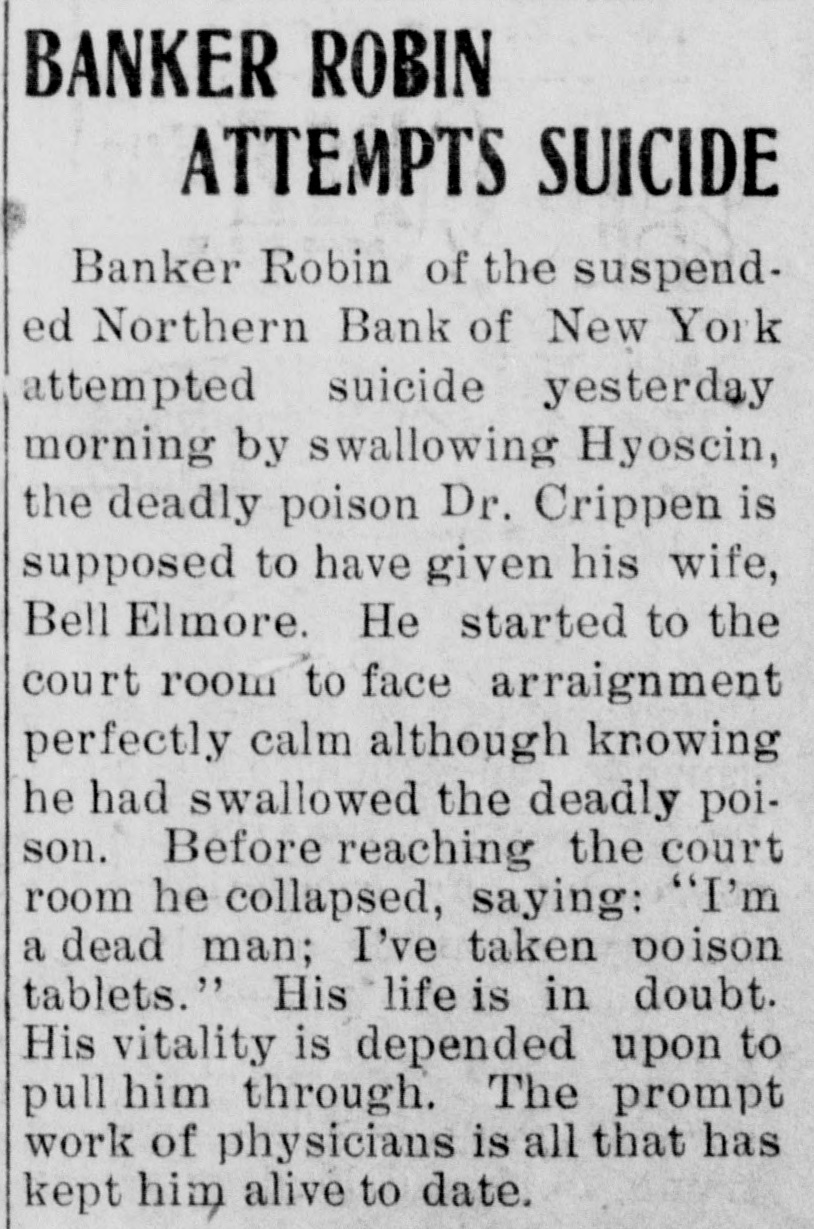

Bankers Arrange to Issue Clearing House Certificates to All Banks ARRIVAL OF GOLD IMPORTS GIVES SUBSTANTIAL AID Banks and Trust Companies Ride the Storm of Runs Without Impairment, and the Situation Is Now Well In Hand. New York, October 26.-(Special.)-With the unanimous decision of the New York Clearing House association to issue clearing house certificates, leading financiers believe that the final steps have been taken to restore conditions in financial circles to their usual state. Of scarcely less importance as tending to restore confidence was the introduction of a resolution in the meeting of the Clearing House association applying for the readmission of trust companies to membership in the association. The announcement of the early arrival of gold imports from Europe further improved the situation today. There is a balance of $60,000,000 in our favor in the trading between Europe and the United States, and an influx of the yellow metal from Europe at this time will serve to hasten the return to normal conditions. With all these things operating to restore confidence the reaction which seu in on Friday continued unabated today. The suspension of the Terminal bank in Brooklyn, a small institution, had no effect on the situation. The Trust Company of America, the Lincoln Trust company and the other institutions which were imperiled by runs rode the storm, and their officials announced at the close of the day that tneir concerns would resume business Monday in good shape. It is understod that for the reason that Europe might get the idea that the cone ditions in New York are worse than they really are, J. P. Morgan and bankers in friendly association with them, opposed the issuance of the clearing house cer tificates, but gave way to the minority after the matter had been thoroughly threshed out Arranging Details. A committee, headed by Vice President Cannon of the Fourth National bank. was appointed to arrange the details for the issue. The final act of the meeting of the Clearing House association was the adoption of a resolution thanking Secretary Cortelyou and J. P. Morgan for their services during the time of the crisis, The regular weekly bank statement is sued today showed that the surplus which the banks had at the close of last week was entirely wiped out by the panic and that a deficit of $1,233,300 was created instead. A surprising feature of the statement was an increase of loans of $10,864,700. 11 had been expected that the enormous liquidation during the week would have resulted in a considerable decrease in this item. Frightened depositors in the Mechanics' and Traders bank. with 12 branches in Manhattan and Brooklyn, and the Broadway Trust company made a run upon these banks. All demands were met by these concerns, however. In a run on the Northern bank of New York there was so much disorder that the police had to be called. The Broadway Trust company adopted a rule that those who were withdrawing funds to pay off employes should have the first call today. General approval was given to the action of the presidents of the saving3 banks, all of which today put into effect the rule which compels the filing of 60 days notice of an intention to withdraw funds. Cortelyou's Statement. Secretary of the Treasury Cortelyou caused the following statement to be given out tonight: "On the occasion of a call on him this morning by representatives of the New York clearing house, Secretary Cortelyou asked that they convey to the clearing house his deep appreciation on behalf of the government of the courageous and high-minded manner in which they had upheld the interests, not only of the people of this city but in a sense the people of the whole country.' " Later the secretary called upon J. P. Morgan and expressed in similar terms his appreciation of the services rendered by Mr. Morgan and all who had cooperated with him in meeting the emergency. The sub-committee of the directors of the Knickerbocker Trust company, which is hoping to bring about a resumption of business of the company, met in executive session today. After the meeting Mr. Davies, the counsel for the company, said: "The committee met and after a discussion decided upon a plan of reorganization, with the end in view of resumption of business. This plan will be advertised in detail as a paid advertisement in the Monday morning newspapers. This to insure its accuracy and also its authenticity."