Click image to open full size in new tab

Article Text

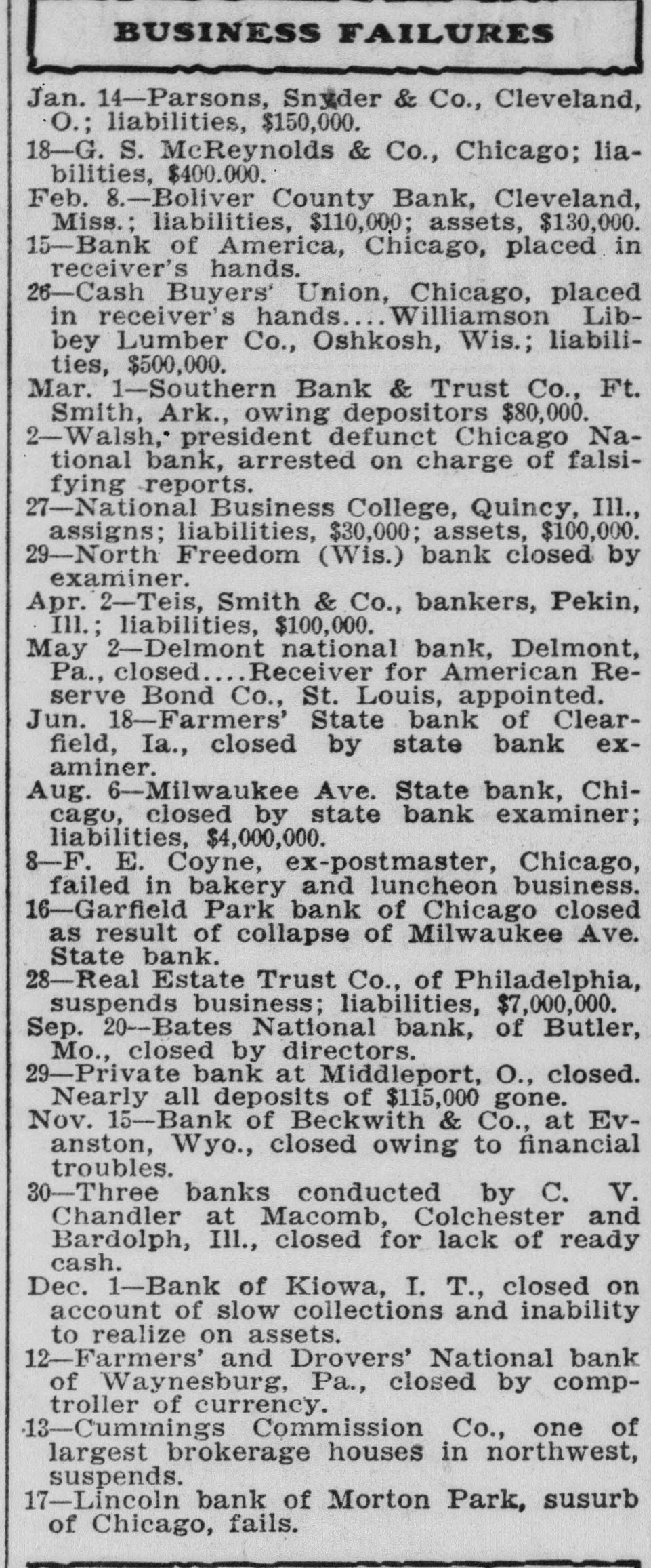

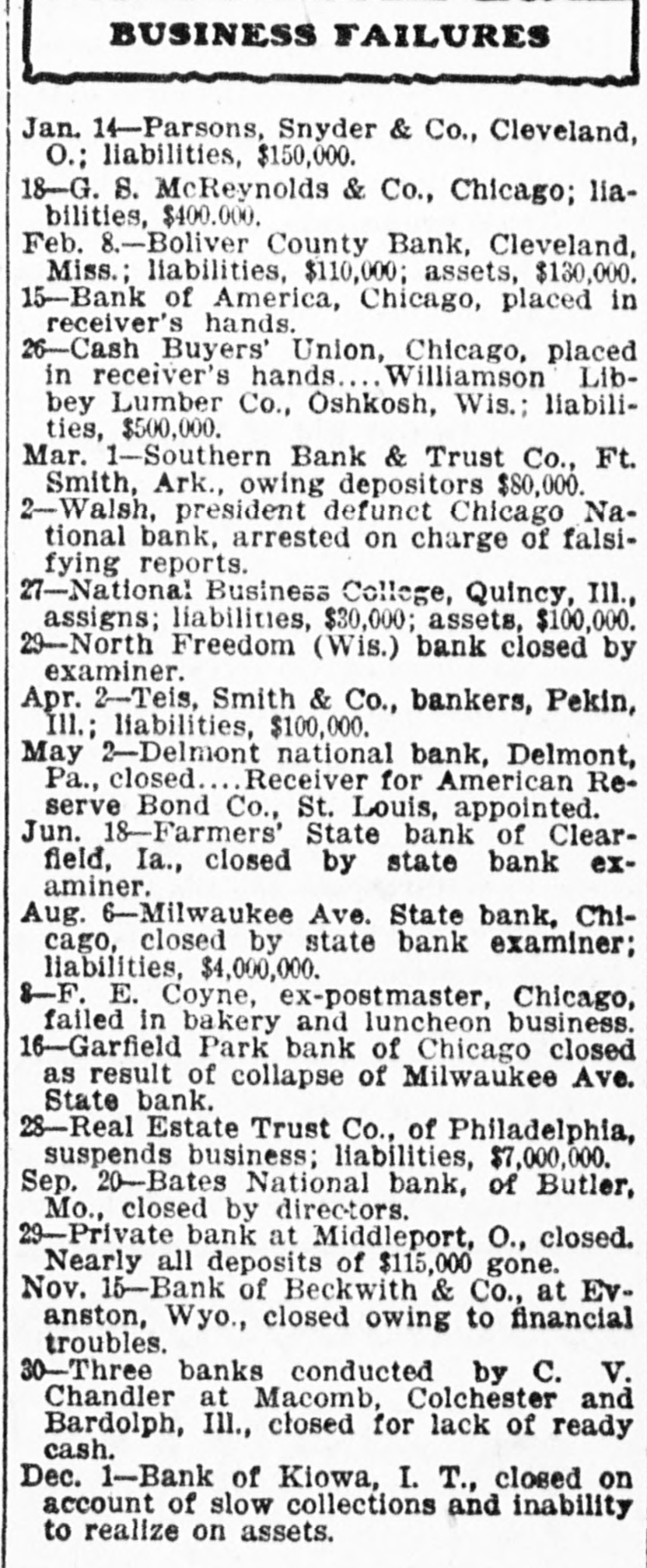

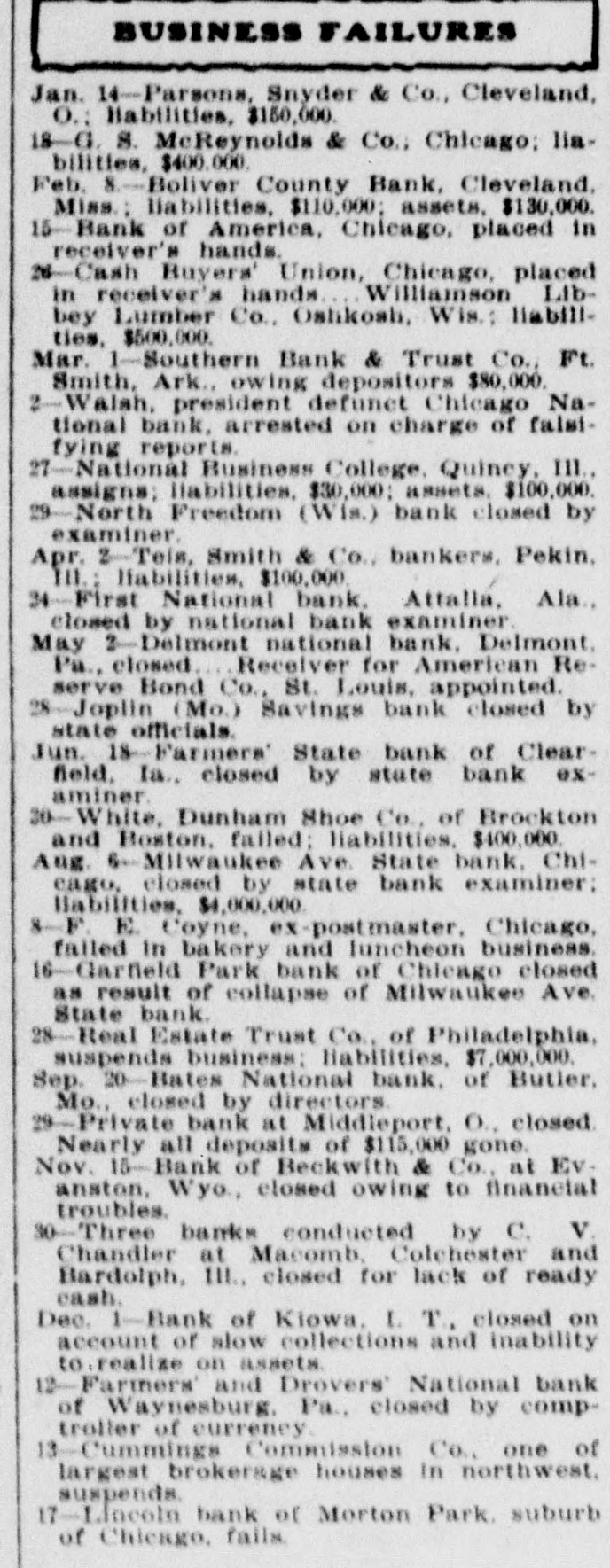

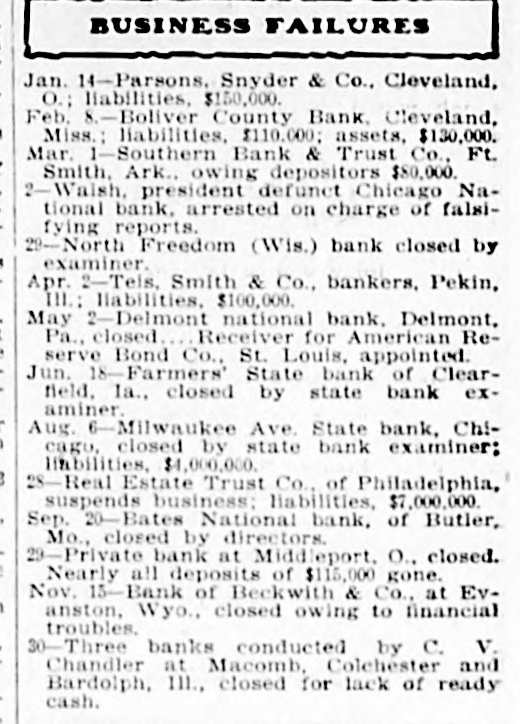

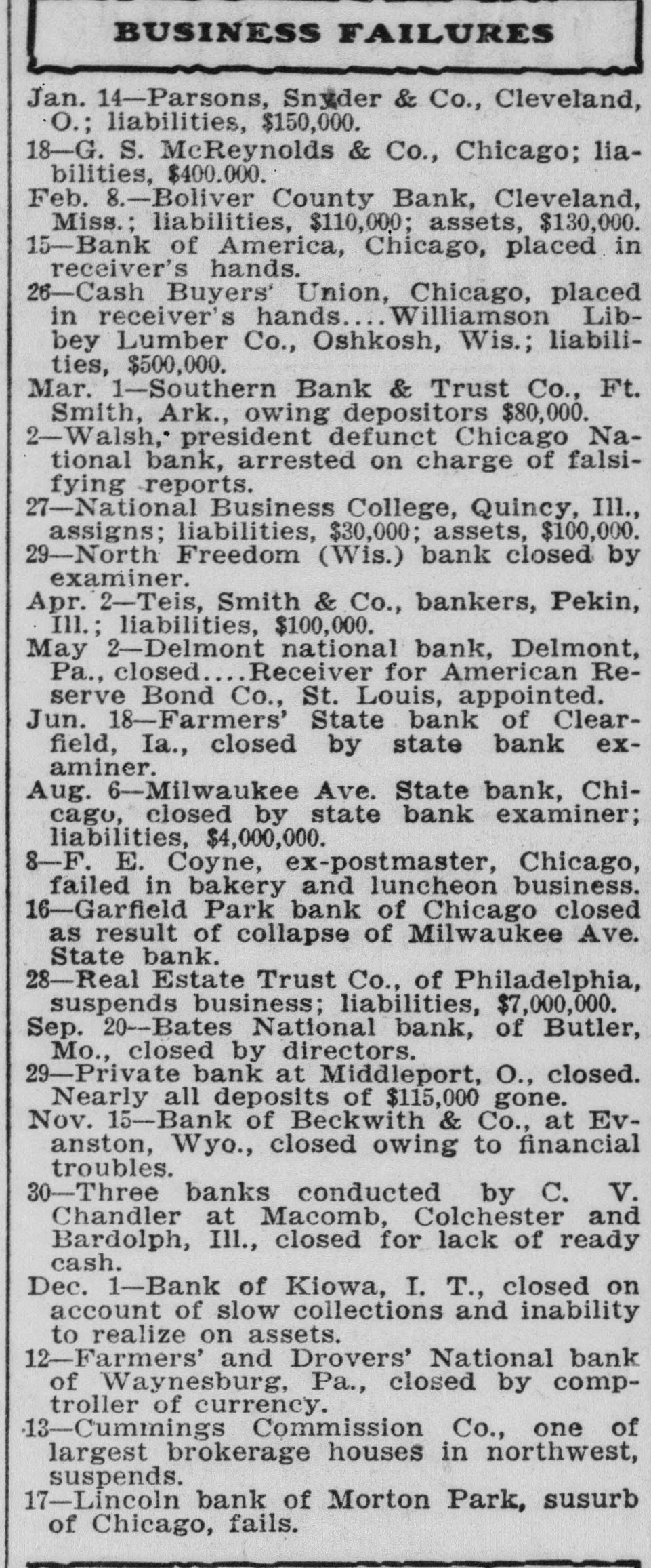

BUSINESS FAILURES Jan. 14-Parsons, Snyder & Co., Cleveland, O.; liabilities, $150,000. 18-G. S. McReynolds & Co., Chicago; liabilities, $400.000. Feb. 8.-Boliver County Bank, Cleveland, Miss.; liabilities, $110,000; assets, $130,000. 15-Bank of America, Chicago, placed in receiver's hands. 26-Cash Buyers' Union, Chicago, placed in receiver's hands Williamson Libbey Lumber Co., Oshkosh, Wis.; liabilities, $500,000. Mar. 1-Southern Bank & Trust Co., Ft. Smith, Ark., owing depositors $80,000. 2-Walsh,* president defunct Chicago National bank, arrested on charge of falsifying reports. 27-National Business College, Quincy, Ill., assigns; liabilities, $30,000; assets, $100,000. 29-North Freedom (Wis.) bank closed by examiner. Apr. 2-Teis, Smith & Co., bankers, Pekin, Ill.; liabilities, $100,000. May 2-Delmont national bank, Delmont, Pa., closed Receiver for American Reserve Bond Co., St. Louis, appointed. Jun. 18-Farmers' State bank of Clearfield, Ia., closed by state bank examiner. Aug. 6-Milwaukee Ave. State bank, Chicago, closed by state bank examiner; liabilities, $4,000,000. 8-F. E. Coyne, ex-postmaster, Chicago, failed in bakery and luncheon business. 16-Garfield Park bank of Chicago closed as result of collapse of Milwaukee Ave. State bank. 28-Real Estate Trust Co., of Philadelphia, suspends business; liabilities, $7,000,000. Sep. 20--Bates National bank, of Butler, Mo., closed by directors. 29-Private bank at Middleport, O., closed. Nearly all deposits of $115,000 gone. Nov. 15-Bank of Beckwith & Co., at Evanston, Wyo., closed owing to financial troubles. 30-Three banks conducted by C. V. Chandler at Macomb, Colchester and Bardolph, Ill., closed for lack of ready cash. Dec. 1-Bank of Kiowa, I. T., closed on account of slow collections and inability to realize on assets. 12-Farmers' and Drovers' National bank of Waynesburg, Pa., closed by comptroller of currency. 13-Cummings Commission Co., one of largest brokerage houses in northwest, suspends. 17-Lincoln bank of Morton Park, susurb of Chicago, fails.