Article Text

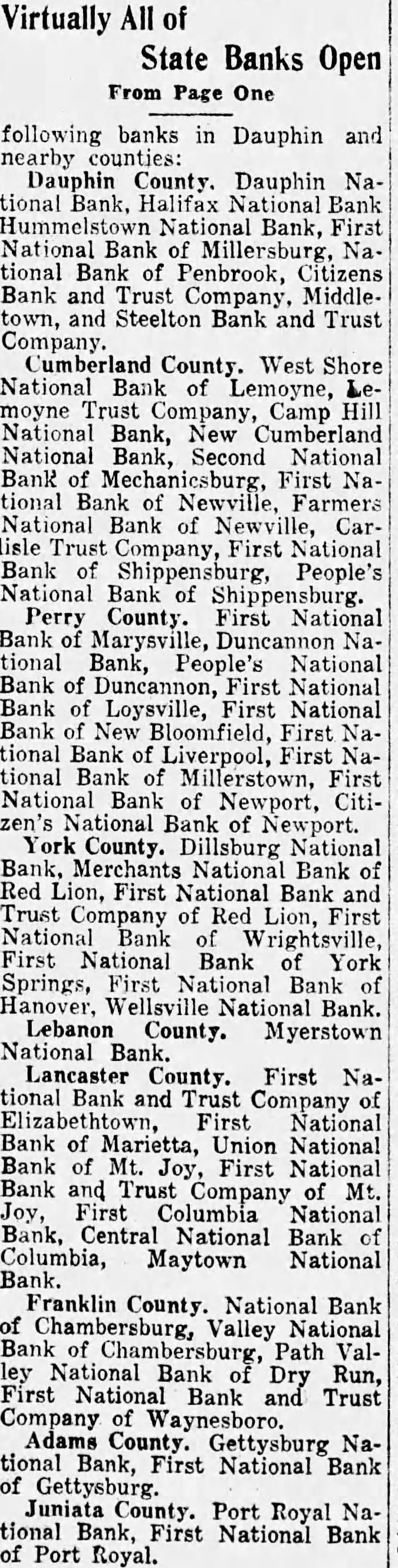

Virtually All of State Banks Open From Page One following banks in Dauphin and nearby counties: Dauphin County. Dauphin National Bank, Halifax National Bank National Bank, First National Bank of Millersburg, tional Bank Penbrook, Citizens Bank Trust Company, Middletown. and Steelton Bank and Trust Company. Cumberland County. West Shore National of Lemoyne, moyne Trust Camp Hill National Bank, Cumberland National Bank, Second National Bank Mechanicsburg, First tional Bank Newville Farmers Bank of Newville, Carlisle Trust Company, National Bank People's National Bank of Shippensburg. Perry County. First National Bank Marysville, Duncannon tional Bank, People's National Bank of Duncannon, First National Bank of Loysville, First National Bank New Bloomfield, First tional Bank of Liverpool, First tional Bank of Millerstown, First National Bank Newport, Citizen's National Bank of Newport. York County. Dillsburg National Bank, National Bank Red Lion, First National Bank Trust of Red Lion, First National Bank First National Bank York Springs, First Bank Hanover, National Bank. Lebanon County. Myerstown National Lancaster County. First tional Bank and Trust Company Elizabethtown, First National Bank Marietta, Union National Bank Joy, First National Bank and Trust Company Mt. First National Bank, Central National Bank Columbia, Maytown National County. National Bank Chambersburg, Valley Bank Path ValNational Bank Run, Dry National Bank and Trust Company Adams County. Gettysburg National Bank, First National Bank of Gettysburg. Juniata County. Port Royal tional Bank, First National Bank of Port Royal.